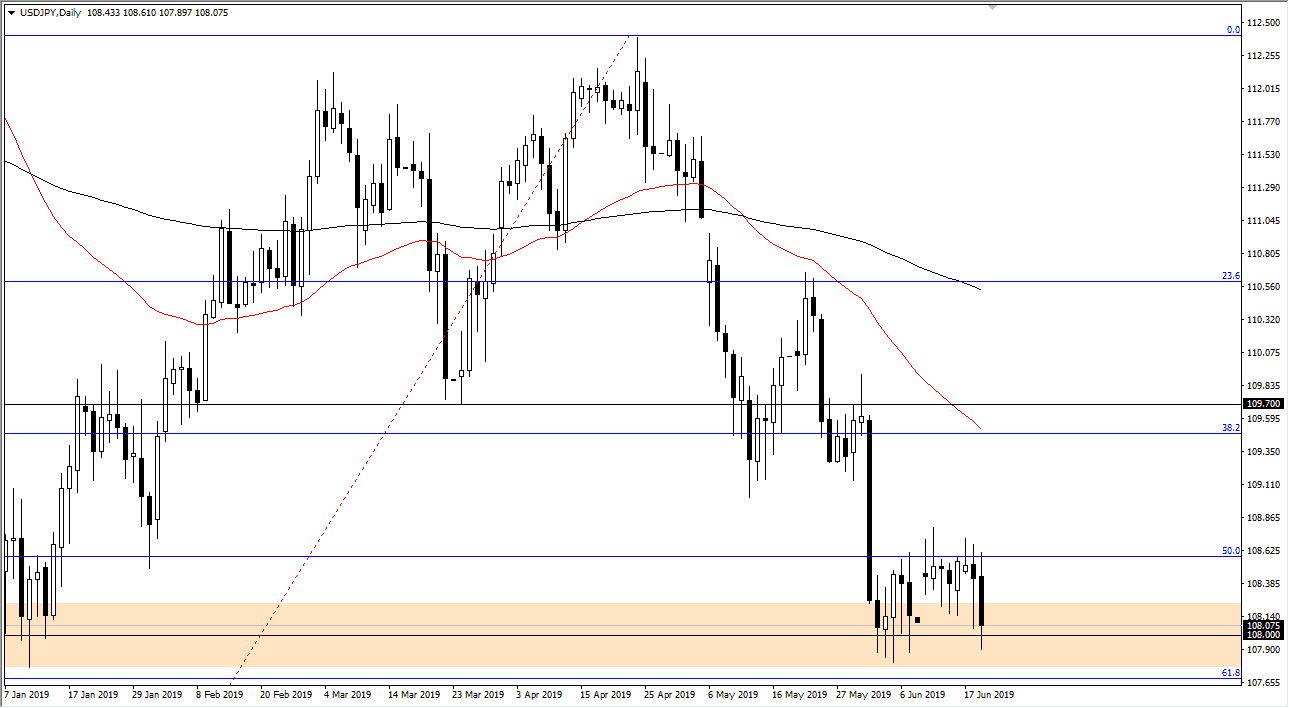

USD/JPY

The US dollar initially rallied against the Japanese yen during the trading session on Wednesday but found quite a bit of bearish pressure as we reached towards the Federal Reserve statement. At this point in time, we reached towards the lows again as it looks like the ¥108 level is continuing to offer support. With that in mind, the 61.8% Fibonacci retracement level underneath should also offer support, so I suspect we are probably going to stay in the same range that we have been in for some time. That means that we could rally towards the ¥108.75 level, where we could find sellers again. If we do break out of this range, a move below the ¥108 level and then the 61.8% Fibonacci retracement level sets up the pair to go down towards the ¥105 level.

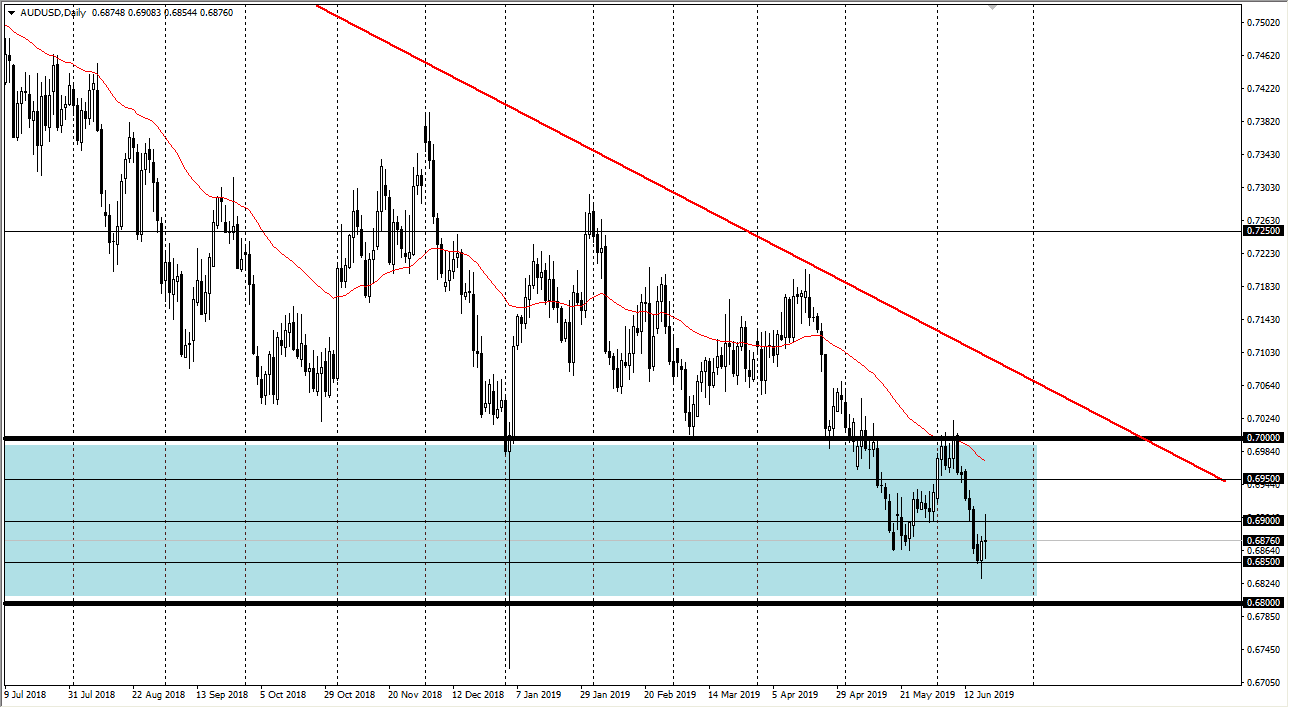

AUD/USD

The Australian dollar has been all over the place during the trading session as the Federal Reserve of course knocked the US dollar around. At this point, it looks as if we are trying to form some type of support, but now it’s almost a given that we will start focusing on the US/China trade relations. At this point, we still have a lot of headwinds so I think that it’s only a matter time before rallies get sold, but at this point I still think that the 0.68 level will hold as support. The market now should go back to what it had been doing previously, trading in 50 pip ranges, offering itself a nice opportunity for short-term traders to prosper if they have range bound systems that the employee. As we are towards the bottom of the larger blue section that I have marked on the chart, I suspect that we probably have a little bit of upside potential.