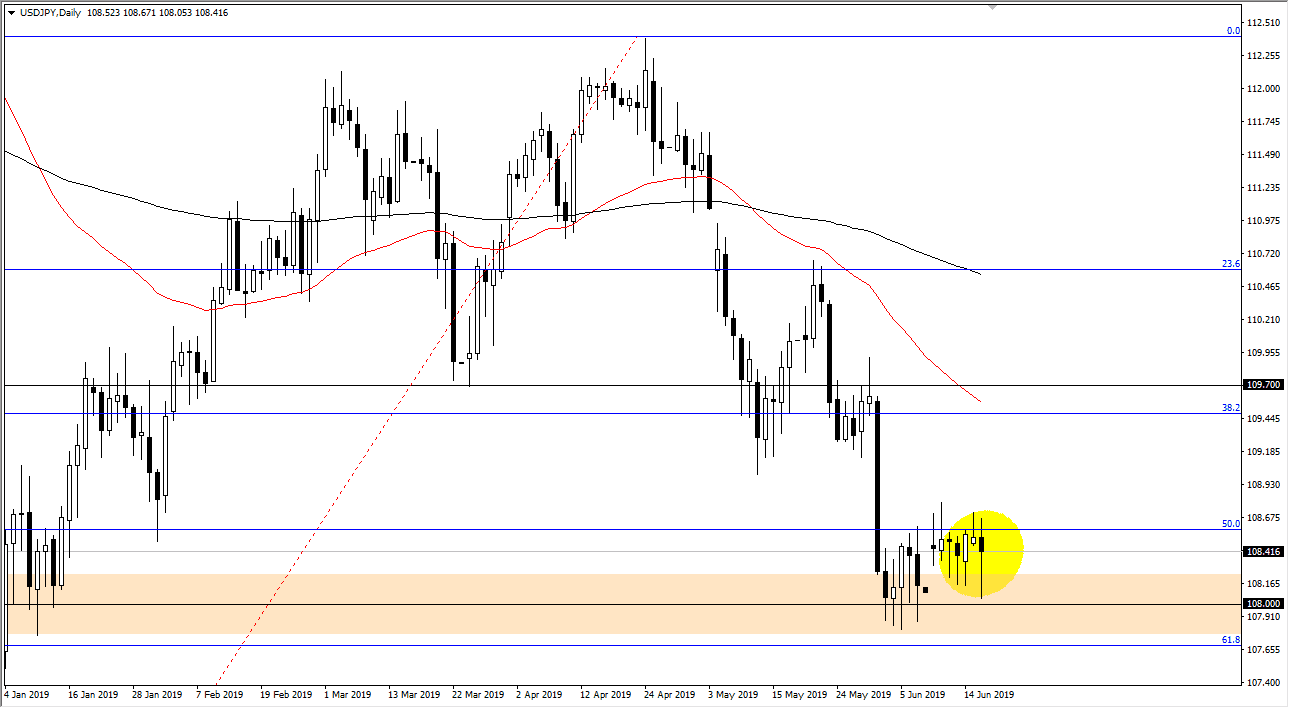

USD/JPY

The US dollar fell rather hard against the Japanese yen initially during the trading session on Tuesday, testing the ¥180 level. That being the case, the market then bounced from there to form a massive hammer. Ultimately, if we can break above the highs of the Tuesday candle stick of last week, we could go higher. Beyond that, we have the FOMC Statement coming out later in the day, and therefore it’s likely that the market will be rather noisy. If the S&P 500 takes out to the upside, that could compel this pair to go looking towards the ¥109.60 level. On the other hand, if we break down below the 61.8% Fibonacci retracement level while the S&P 500 breaks down, this market could go as low as the ¥105 level. All things being equal, we are winding up the market to build up enough inertia to get going higher or lower.

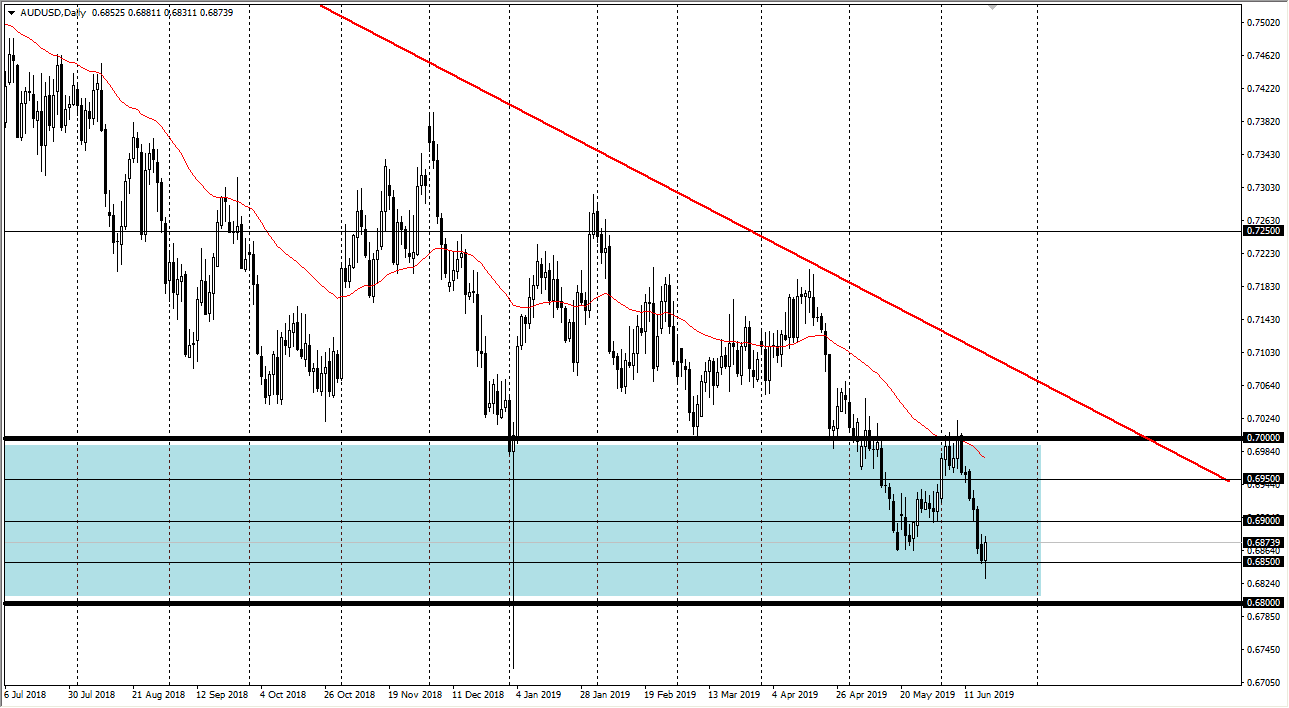

AUD/USD

The Australian dollar broke down significantly during the trading session to go below the 0.6850 level, finding support underneath. We turned around to break above that level and now it looks like the Aussie is somewhat supportive. I think this is the market trying to get ahead of the FOMC statement, so therefore it wouldn’t be surprising at all to see this market bounce a bit. That being said, we still have a lot of influence with the US/China trade war, but you can also suggests that the tweet from Donald Trump suggesting he was going to meet with the Chinese president after all of the G 20 has also offered a bit of a boost to the Aussie. We are oversold, so at this point a bounce makes sense. That being said, if we were to break down below the 0.68 level, the market would break down drastically.