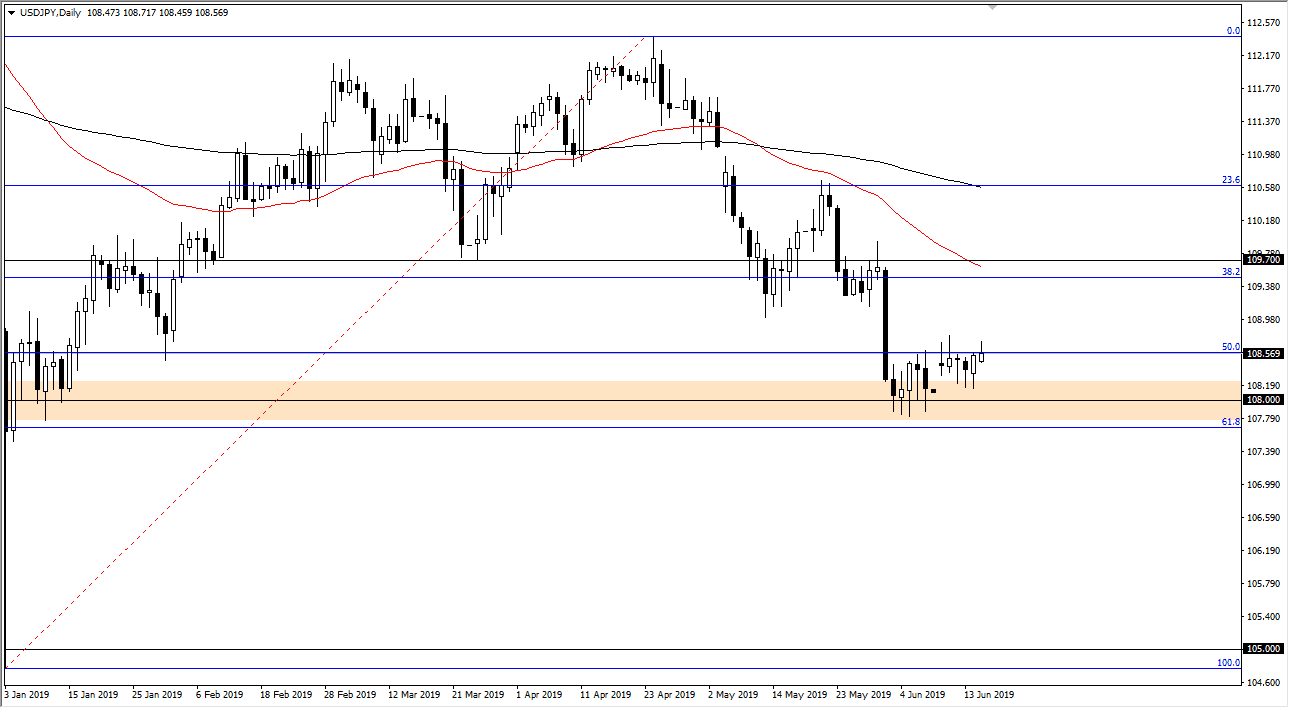

USD/JPY

The US dollar has rallied a bit during the trading session on Monday but continues to struggle to hold gains above the 100 a ¥0.50 level. By doing so, it shows just how congested the market is, as we simply cannot continue with any type of momentum. That being said, if we can break above the Tuesday highs, it’s very likely that this pair continues to go higher. It’s moving in lockstep with the S&P 500, so pay attention to that market as a potential secondary indicator.

If we pull back from here, it’s very likely that the ¥108 level offer support, extending down to the 61.8% Fibonacci retracement level. With that, a break down below there would be extraordinarily negative. All things being equal though, I would anticipate more of a range bound market until we can break out. The market which is the fence continue to look at risk appetite more than anything else when it comes to this pair.

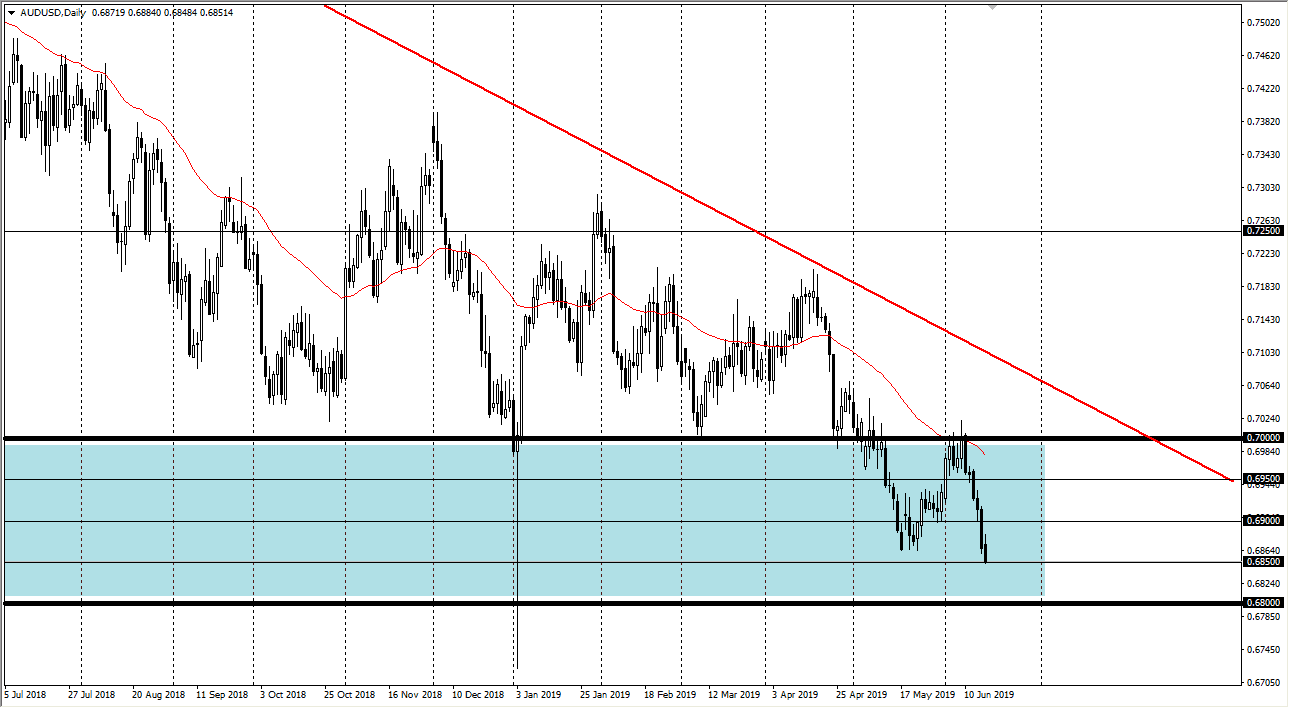

AUD/USD

The Australian dollar has fallen again during the trading session on Monday, slamming into the 0.6850 level. That’s an area that should be somewhat supportive, extending down to the 0.68 handle. However, there’s nothing on this chart that suggests a bounce quite yet, so I would be cautious about trying to buy it here. As far as selling is concerned though, it’s definitely gotten a bit oversold so it’s going to be difficult to do so at these extraordinarily low levels. That being said, it is most certainly in a downtrend so that can’t be denied.

If we were breaking down below the 0.68 level, then the market will unwind quite drastically. The Australian dollar is obviously tied to the US/China trade relations, something that simply isn’t going very well right now. Until then, it’s hard to believe that this pair is going to be overly bullish. I think in the meantime we simply bounce around between 50 pip increments.