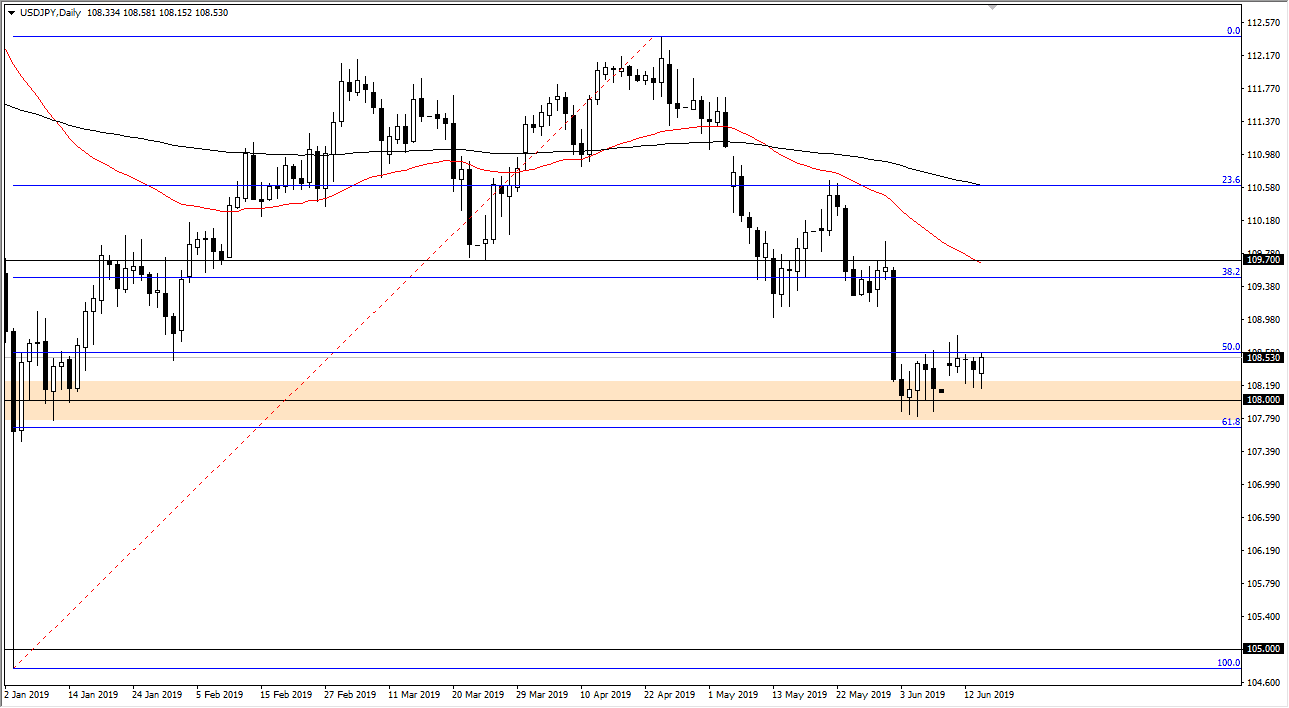

USD/JPY

The US dollar initially pulled back during the trading session on Friday as we have seen over the last three days, but also as we have seen over the past three days, the buyers came in and push the market towards the ¥108.50 level. Looking at this chart, I think it shows that there is a lot of resilience in this pair, and eventually we will break above the Tuesday shooting star, sending the market towards the ¥109.70 region.

The alternate scenario of course is that we get a lot of a “risk off” scenario, and therefore we could drop down to the ¥180 level, filling the gap again. Underneath there, we have the 61.8% Fibonacci retracement level at the ¥107.70 level. Breaking that could open up rather significant losses to the market, perhaps sending them down as low as the ¥105 level.

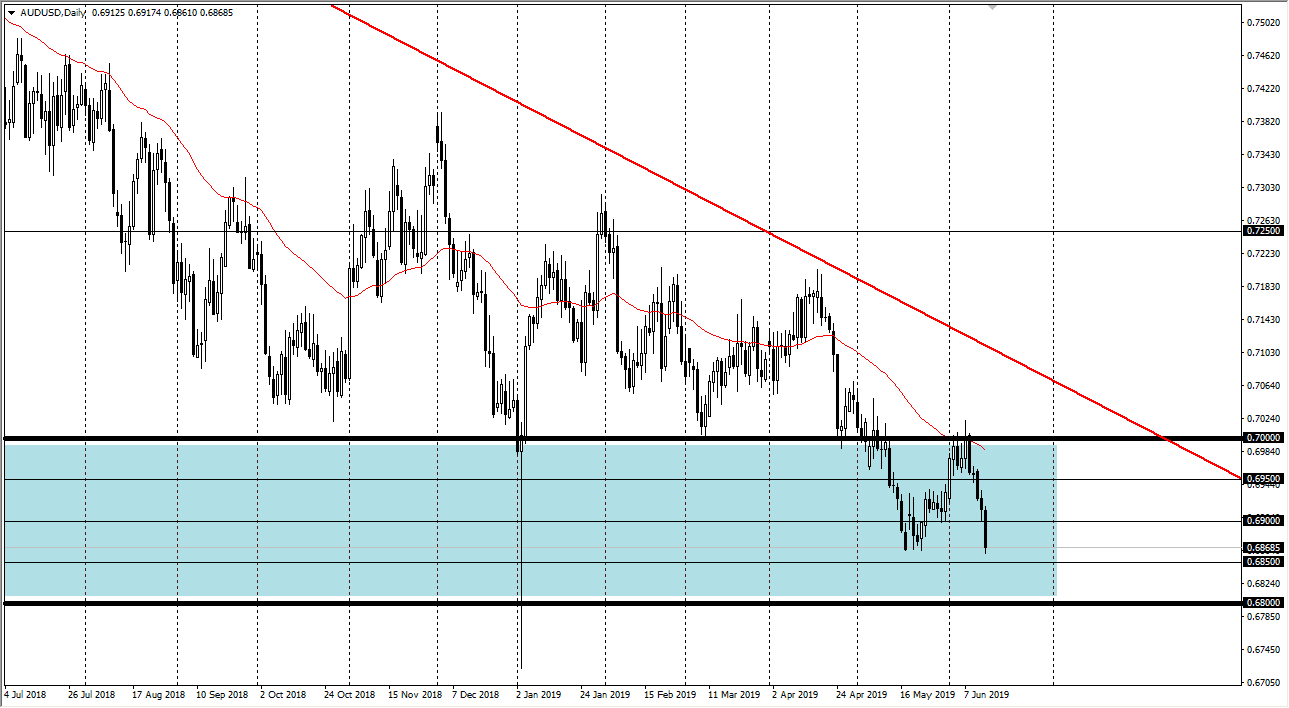

AUD/USD

The Aussie has had a very rough trading session on Friday, continuing the negativity that we have seen over the course of the week. At this point, the market still is dancing around between the 0.68 level and the 0.70 level, using 50 pips increments to guide the market on shorter-term charts. That being said, the Australian dollar is highly sensitive to the US/China mess that we have going on right now, but at the same time we also have the Federal Reserve looking to step away from a hawkish tone, and if that’s going to be the case then we start to perhaps see a little bit of support underneath. All things being equal I think it’s probably easier to simply look at this as a market that is going to continue to go back and forth, with a lot of choppiness. I look at short-term charts to guide myself between these 50 pip lines.