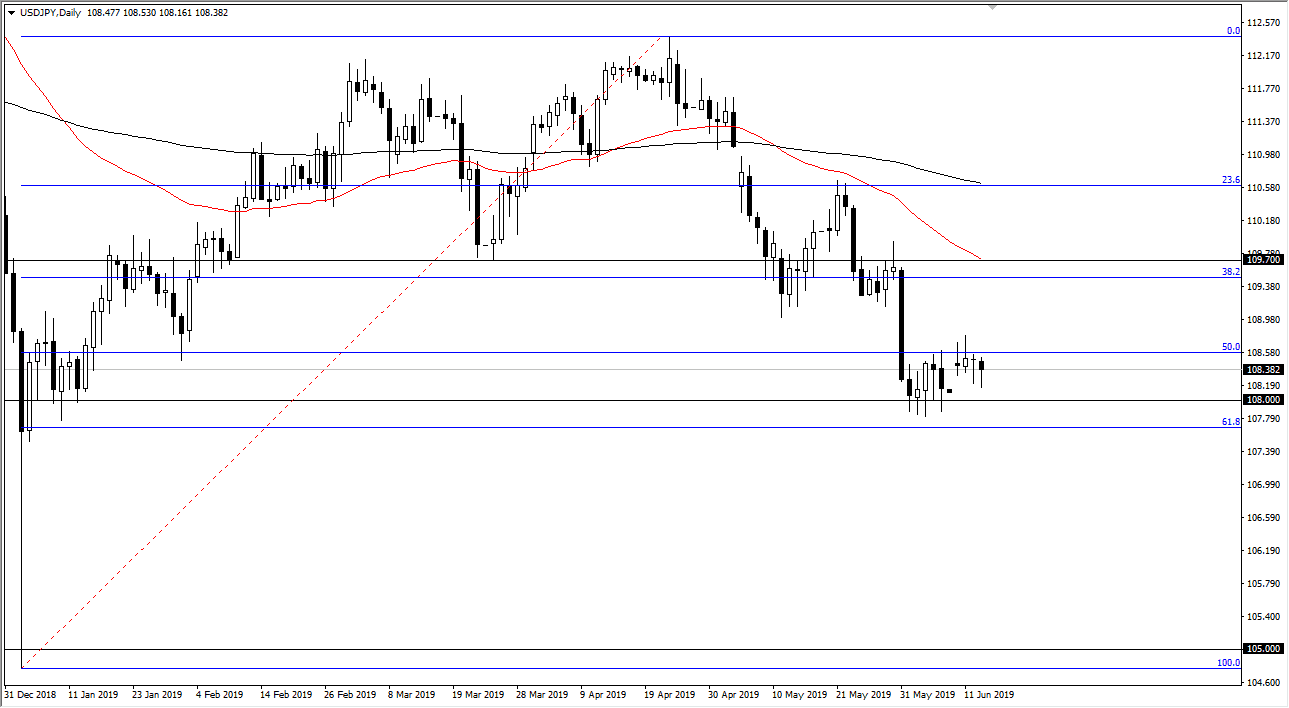

USD/JPY

The US dollar fell during most of the trading session on Thursday against the Japanese yen, filling the gap from the beginning of the week. Interestingly enough, the question now is going to be whether or not this holds as support. While it typically would be a great buying opportunity, the biggest problem is that the shooting star on both Monday and Tuesday provide a significant amount of resistance. If we can break above the Tuesday candle stick, then it’s very likely we probably go looking towards the ¥109.70 level.

However, if we break down below the bottom of the candle stick it’s likely that we could go down to the ¥180 level which would offer support, and then after that the 61.8% Fibonacci retracement level. If we were to clear that to the downside, that would be very negative for this market and send the ¥105 level into focus.

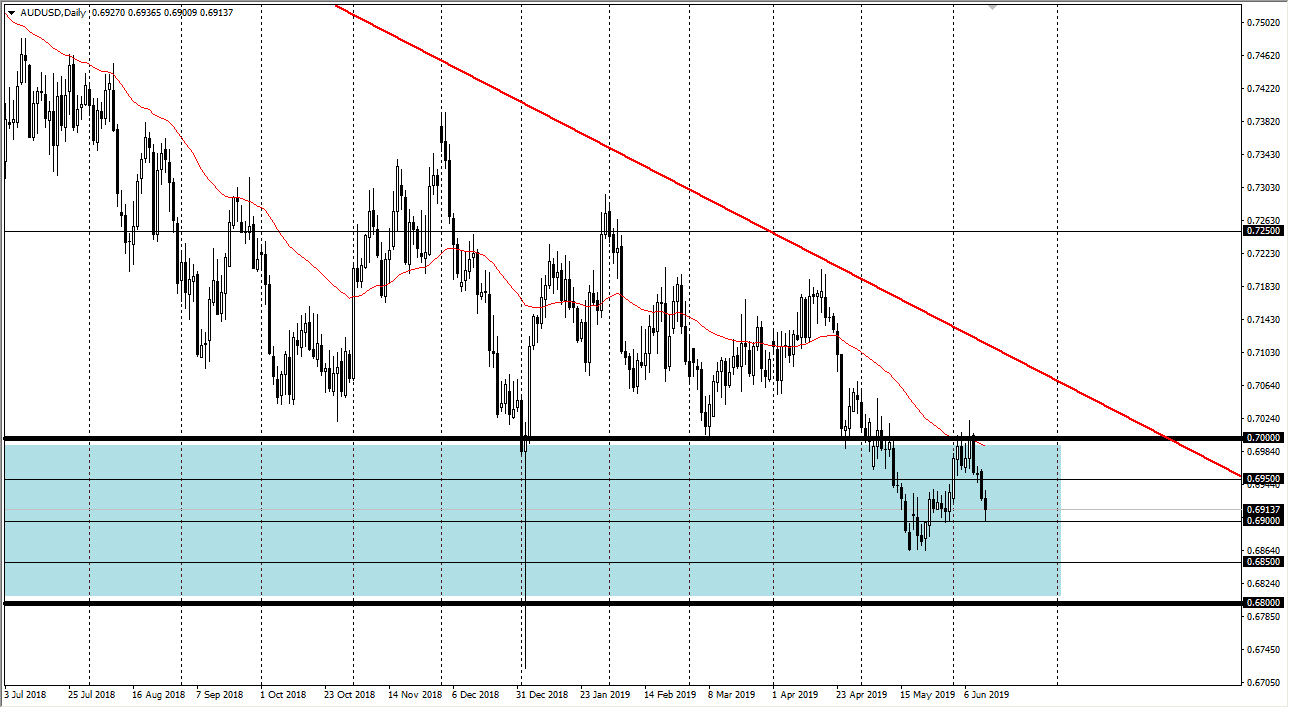

AUD/USD

The Australian dollar went back and forth during the trading session showing signs of support at the crucial 0.69 handle. Ultimately, that is a large, round, psychologically significant figure, but at this point I think this market simply bounces around in 50 pips increments, and of course due to trade concerns between the United States and China. This is a market that we are looking at as dead money right now, as the Aussie is obviously very sensitive to China. What’s particularly interesting is that the Federal Reserve has stepped away from a hawkish stance, so that could give us a little bit of support but beyond that I don’t see any reason to get excited about this pair. Short-term back and forth 50 pip moves continues to be how I expect this market to behave.