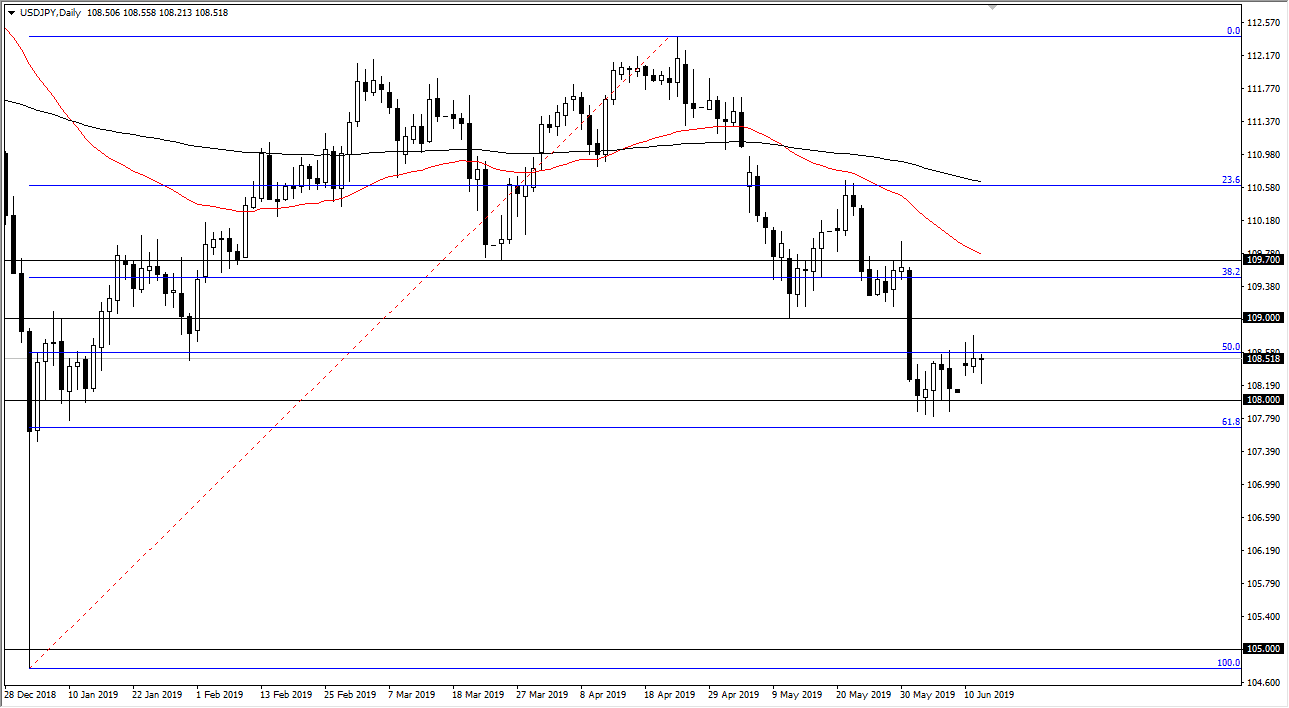

USD/JPY

The US dollar fell significantly during the trading session on Wednesday but filled the gap and then found buyers. The fact that we turned around of form a bit of a hammer suggests that we will find buyers now, exactly where you would expect to do to the gap. However, we had formed a couple of shooting stars during the previous two sessions this week, so I think what we are about to see is a consolidation area that eventually breaks in one direction or the other.

With that in mind, we have to pay attention to the ¥108 level and of course the 61.8% Fibonacci retracement level just underneath there as massive support. If we were to break down below there then the action over the last couple of weeks will have become a “bearish flag.” On the other hand, if we break above the highs from the Tuesday session, that means we will probably try to take out the “breakdown candle” that fell from just below ¥109.70 above.

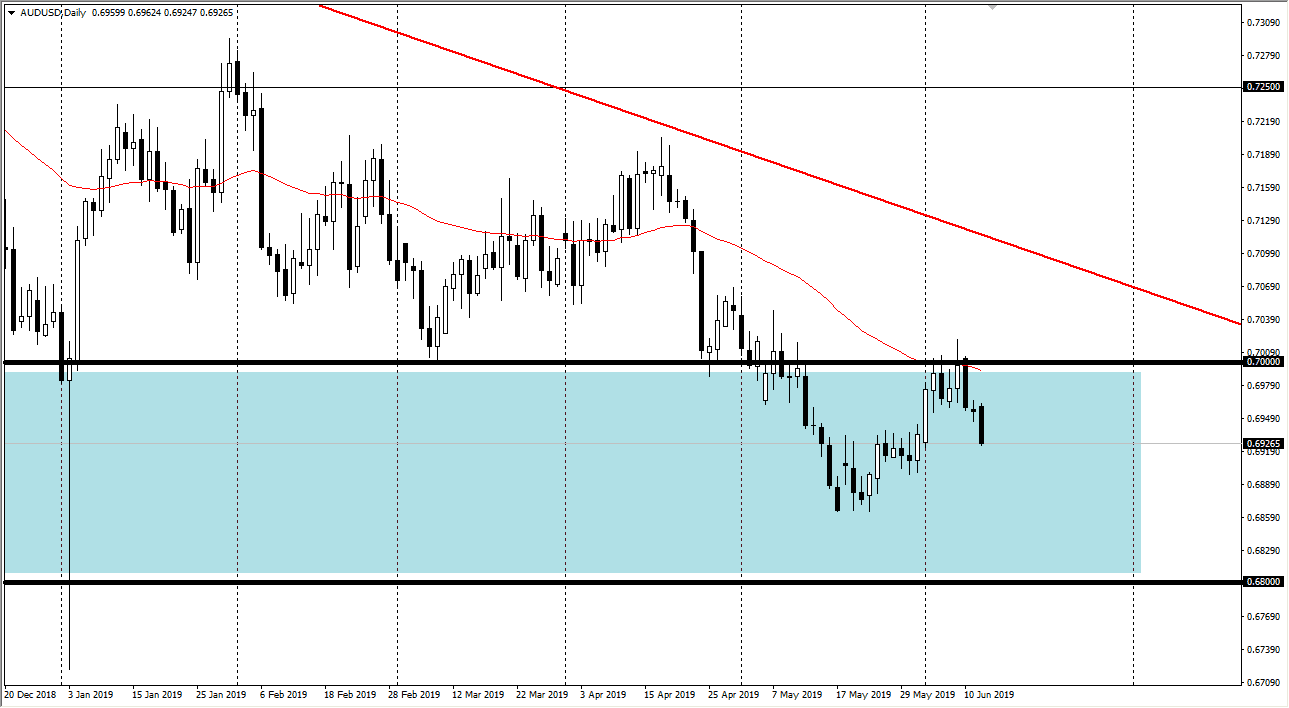

AUD/USD

The Australian dollar broke down significantly during the trading session on Wednesday, showing signs of weakness again. We are approaching the 0.69 handle underneath which should attract a lot of attention. However, I think at this point the market continues to go back and forth as this is a currency pair that is highly sensitive to the US/China trade situation, and of course global growth and risk appetite in general. I think at this point the market is going to continue to bang around in 50 pips increments, meaning that the 0.69 level should be supportive, but if we were to break down below there we probably drop another 50 pips. Unless you are short-term trader, this is probably not the market you need to be trading.