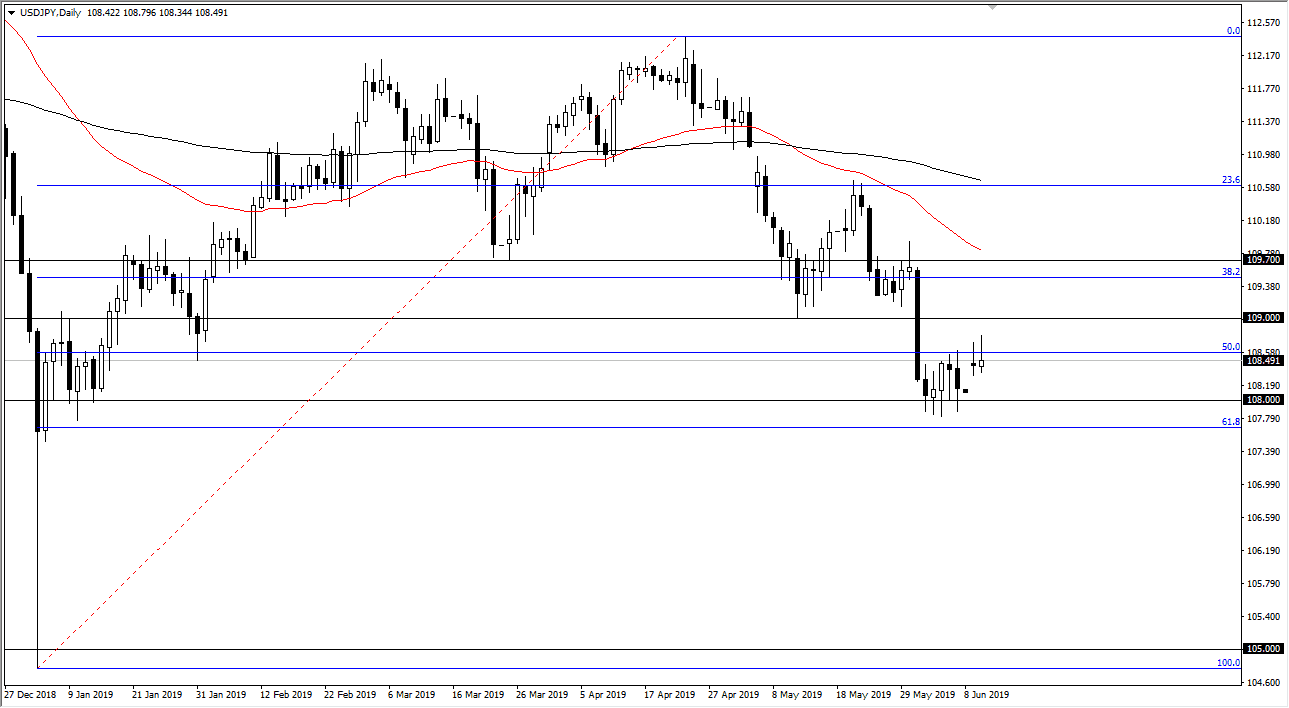

USD/JPY

The US dollar has rallied a bit during the trading session on Tuesday, breaking above the highs of the Monday shooting star, but has sold off later in the day. This mirrors what I am seeing in the S&P 500 so it makes sense that perhaps people started to sell off this pair as it is risk sensitive. There is a gap underneath so I think that still needs to be filled. With that in mind, I anticipate that we break down below the lows of the trading session on Tuesday, we will probably fill that gap down to ¥108 or so. If we can break down below there, then the ¥107.70 level which is also the 61.8% Fibonacci retracement level. To the upside, if we were to break above the top of the session again during Wednesday trading, that would be a bullish sign as well.

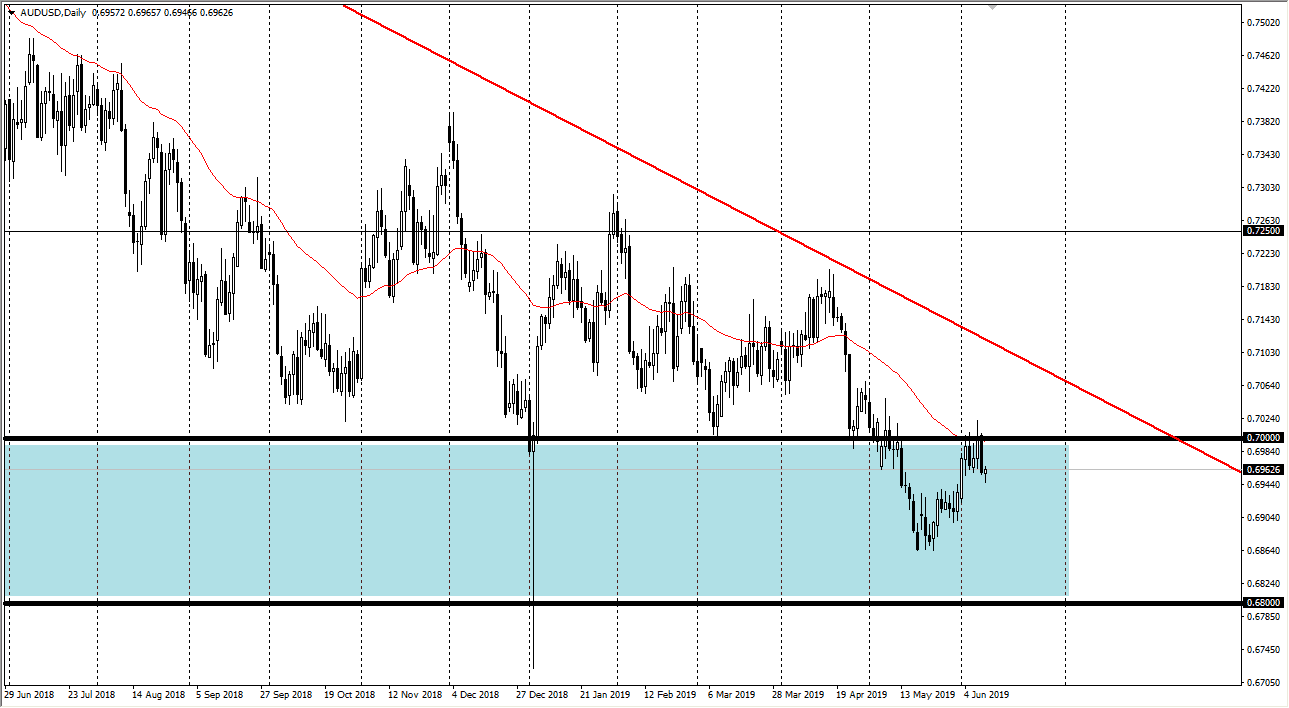

AUD/USD

The Australian dollar initially fell during the trading session on Tuesday but turned around to show signs of life again. That’s a good sign, because the Australian dollar is trying to form some type of base. I think that we continue to bounce around between the 0.6950 level and the 0.70 level and should look at this market in the prism of having supported and resistance every 50 pips or so. I think that the Aussie isn’t ready to take off to the upside for a larger move though yet, because the US/China trade situation hasn’t changed much, it’s still rather dire.

That being said, the Federal Reserve has softened its stance so there is a little bit of a floor underneath the Australian dollar, only because of the potential selling of the US dollar, but I think this market continues to be something that day traders will scout back and forth.