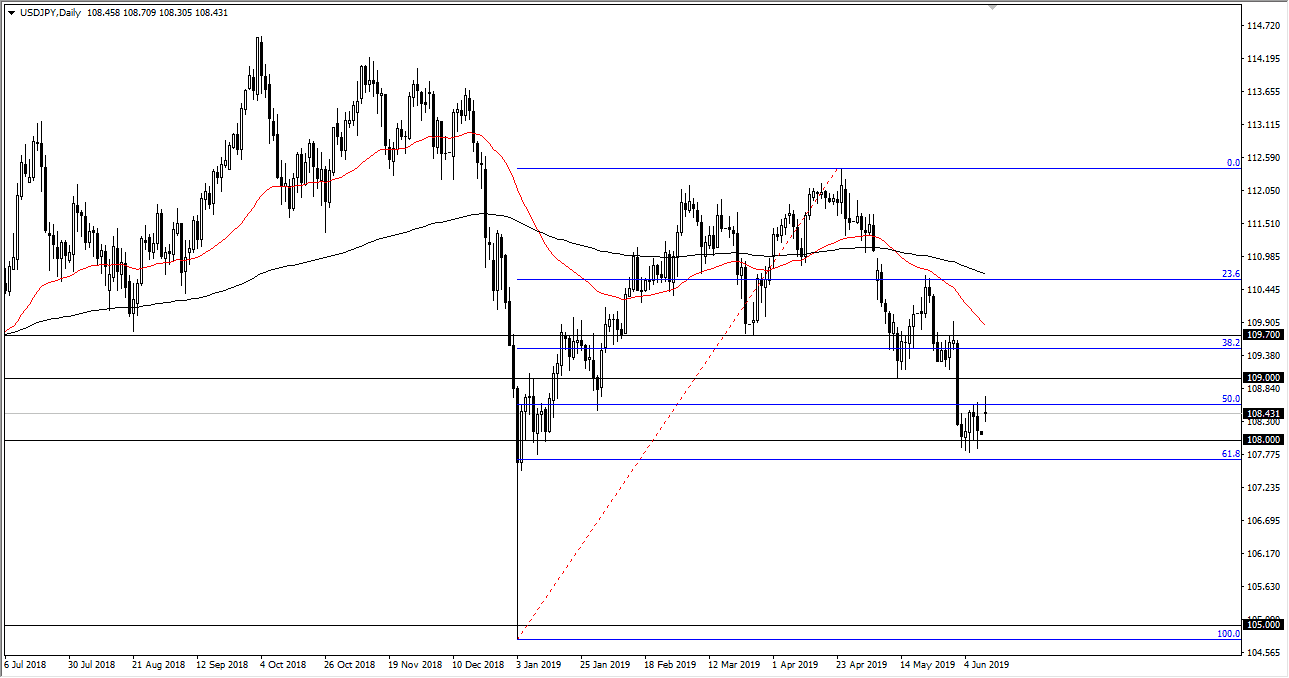

USD/JPY

The US dollar initially gapped higher against the Japanese yen on Monday, and then spiked a bit before pulling back. By doing so, we have formed a bit of a shooting star, but we still have the gap underneath that could offer plenty of support. If we pull back from here, it’s likely that we should find plenty of support underneath and therefore I think that any downside is probably somewhat limited.

I think that the ¥108 level should offer support due to previous action, and then of course the 61.8% Fibonacci retracement level underneath will as well. Any break down below that level will be extraordinarily negative, so until we do I suspect that we will probably continue to see buyers on dips, perhaps trying to push this pair towards the ¥109 level.

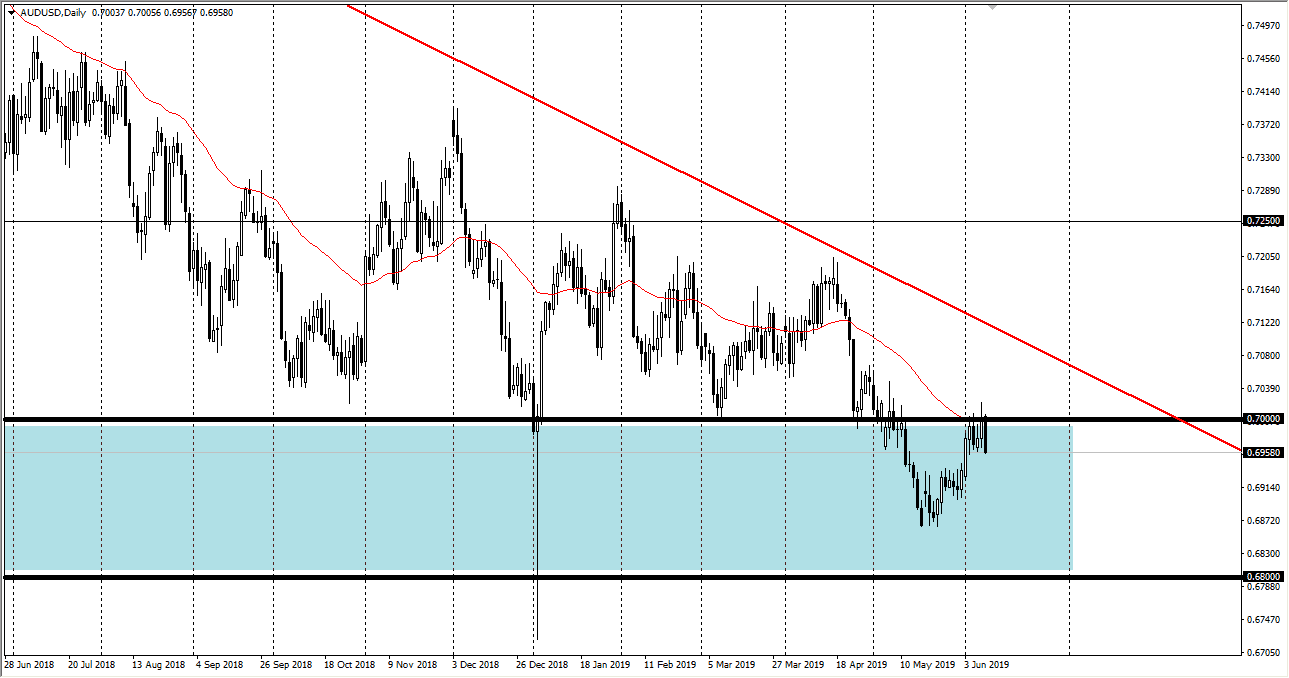

AUD/USD

The Australian dollar broke down during the trading session on Monday, showing the 0.70 level as massive resistance, extending to the 0.7060 handle above. That is a massive amount of resistance just waiting to happen, and the fact that we sold off as hard as we did during the trading session on Monday suggests that we do have further downside to go. I think at this point we are very likely to go down towards the 0.69 level and could even break down below there. After all, the Aussie dollar is very sensitive to the Chinese trade negotiations, which quite frankly are going nowhere right now.

The one thing that is possibly offering a bit of support is the fact that the Federal Reserve has become a bit more dovish as of late, so therefore the greenback has suffered a bit and could very well continue to lose a bit of its luster.