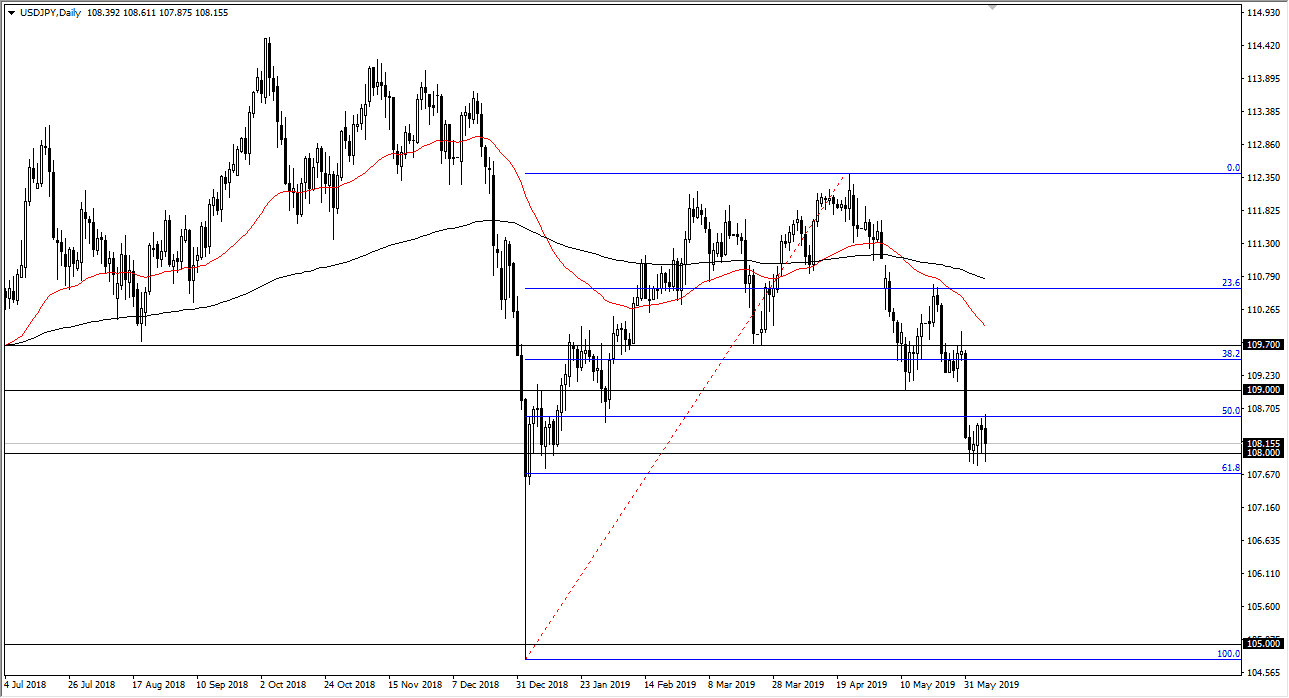

USD/JPY

The US dollar initially tried to rally during the Friday session but then pulled back significantly to reach below the ¥180 level. The 61.8% Fibonacci retracement level underneath will be supportive, so I think as long as we can stay above there we are very likely to see buyers come in on value propositions, which is how you should look at this market. If we can break above the highs of the trading session on Thursday, then I think the market probably start heading towards the ¥109 level, and then possibly even as high as the ¥109.70 level.

While the Federal Reserve looks very likely to ease its monetary policy, the reality is that this pair tends to move right along with risk appetite. With the stock markets rallying, this pair will probably go right along with it. However, if we were to turn around and break below the ¥107.70 level which is also the 61.8% Fibonacci retracement level, then the market probably unwinds down to the ¥105 level.

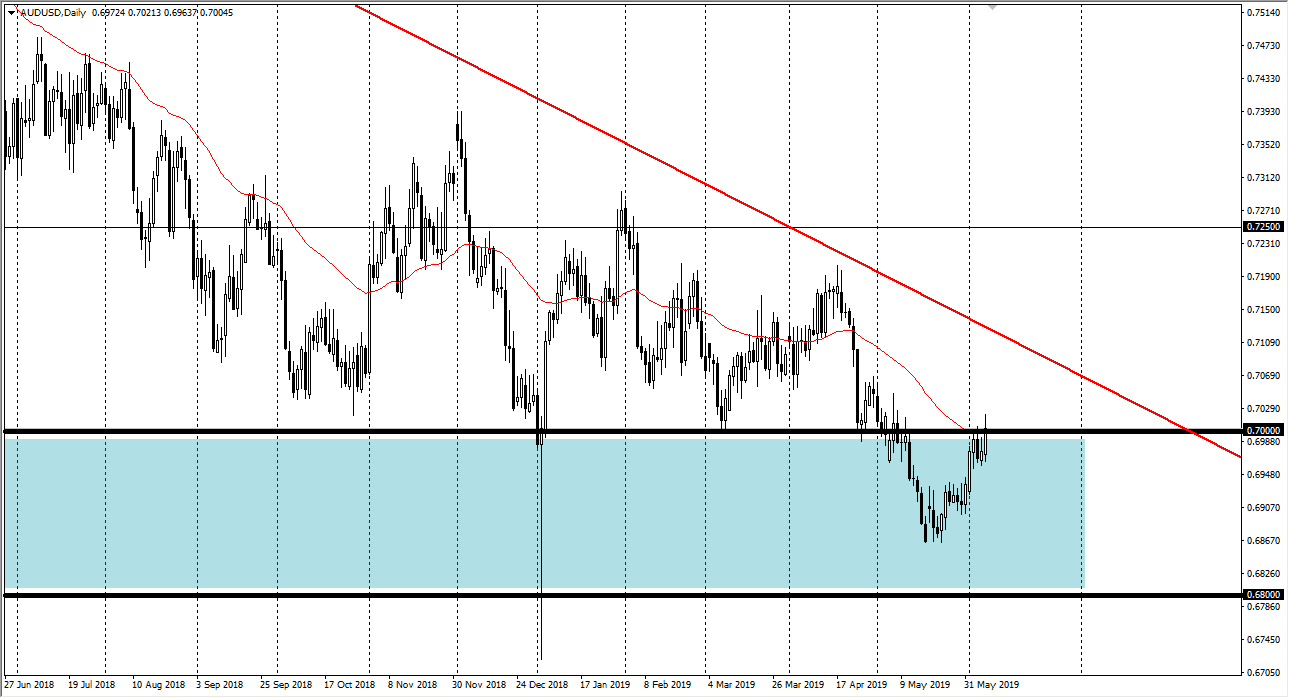

AUD/USD

The Australian dollar has rallied a bit during the trading session on Friday, reaching towards the 0.70 level above. That’s an area that was previous support, and now should offer resistance. However, it’s a zone of resistance that extends all the way to the 0.7050 level. At this point, any signs of exhaustion should be selling opportunities. Overall, this is a market that is perhaps moving against the idea of the Federal Reserve e-zine monetary policy, but the Australian dollar also has the added twist of being highly sensitive to the US/China trade relations, which of course are going very well. All things being equal, look for exhaustive and start selling. However, if we get a daily close above the 0.7050 level, then we could go as high as the 0.72 level.