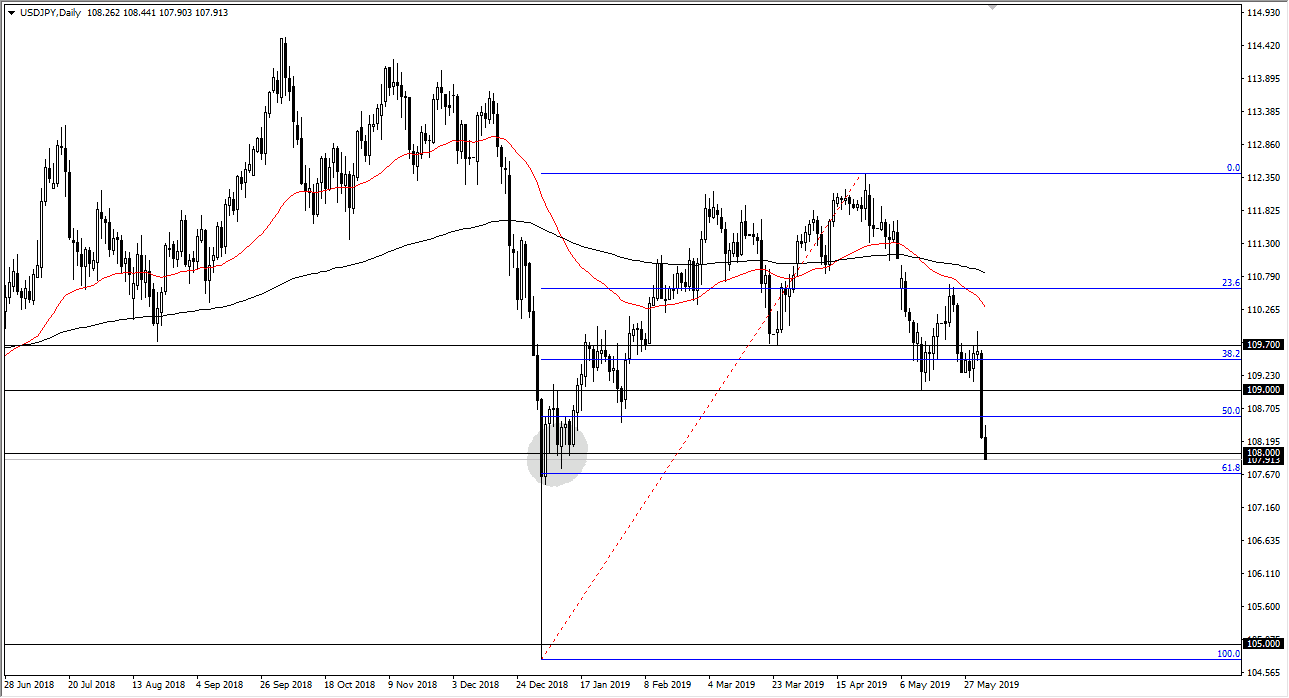

USD/JPY

The US dollar initially tried to rally during the trading session on Monday but turned around to fall rather significantly. The ¥108 level is offering support, as it has in the past. The market is very risk sensitive, as the Japanese yen is considered to be a safety asset. If we do break down below the ¥108 level, we also have the 61.8% Fibonacci retracement level just below there. A breakdown below that level opens up the door down to the ¥105 level underneath, wiping out the entirety of the push higher. The alternate scenario is that if we can break above the top of the candle stick for the Friday session, we could go looking towards the ¥109 level. All things being equal, I think there are a lot of concerns out there and therefore it makes sense that we continue to freak out. However, we are at significant support levels, so if there’s going to be a bounce, it’s going to be soon.

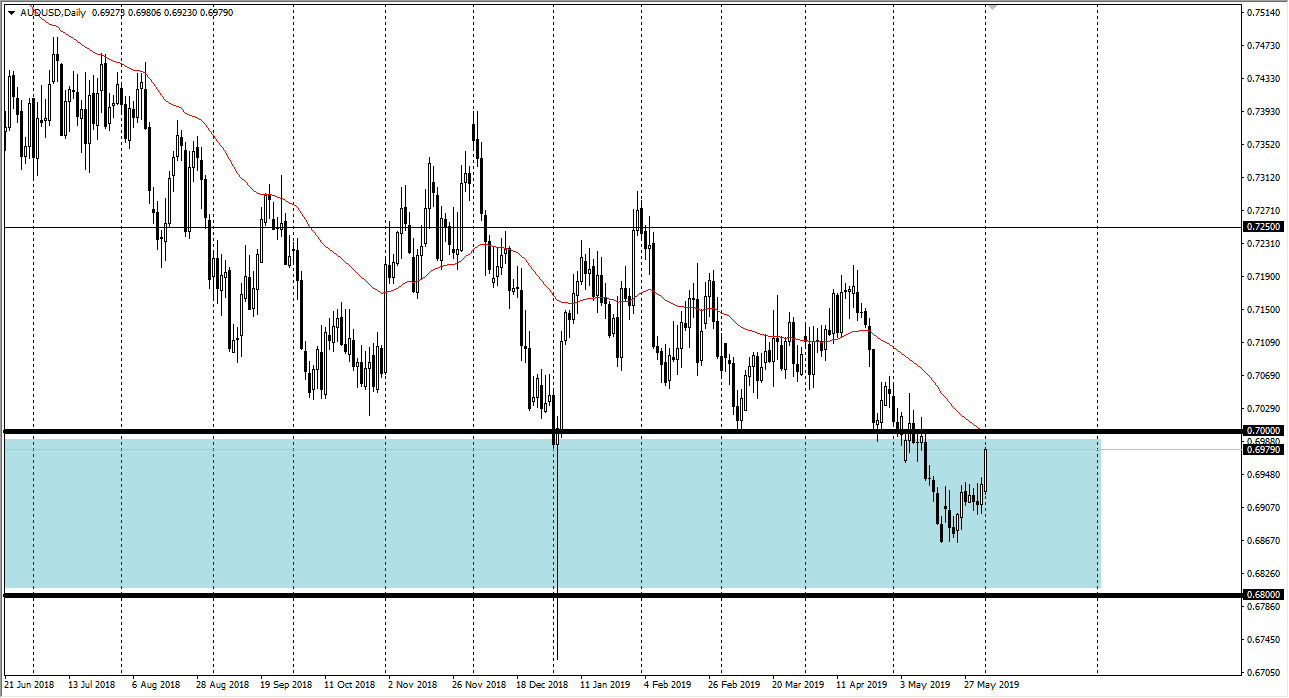

AUD/USD

The Australian dollar rallied significantly on Monday, finishing what had been started on Friday. The 0.70 level above is massive resistance, so I think that will be where we start to see a lot of sellers come in and push this market lower. I believe that the resistance extends about 25 pips above there, so signs of exhaustion should be a nice selling opportunity as well. Keep in mind that this pair is highly sensitive to the US/China trade relations, as Australia’s a major supplier of commodities to the Chinese economy. With that in mind, as long as we have trade tensions, I suspect that the upward mobility of the Aussie dollar is somewhat limited. To the downside, I expect the 0.68 level to be massive support.