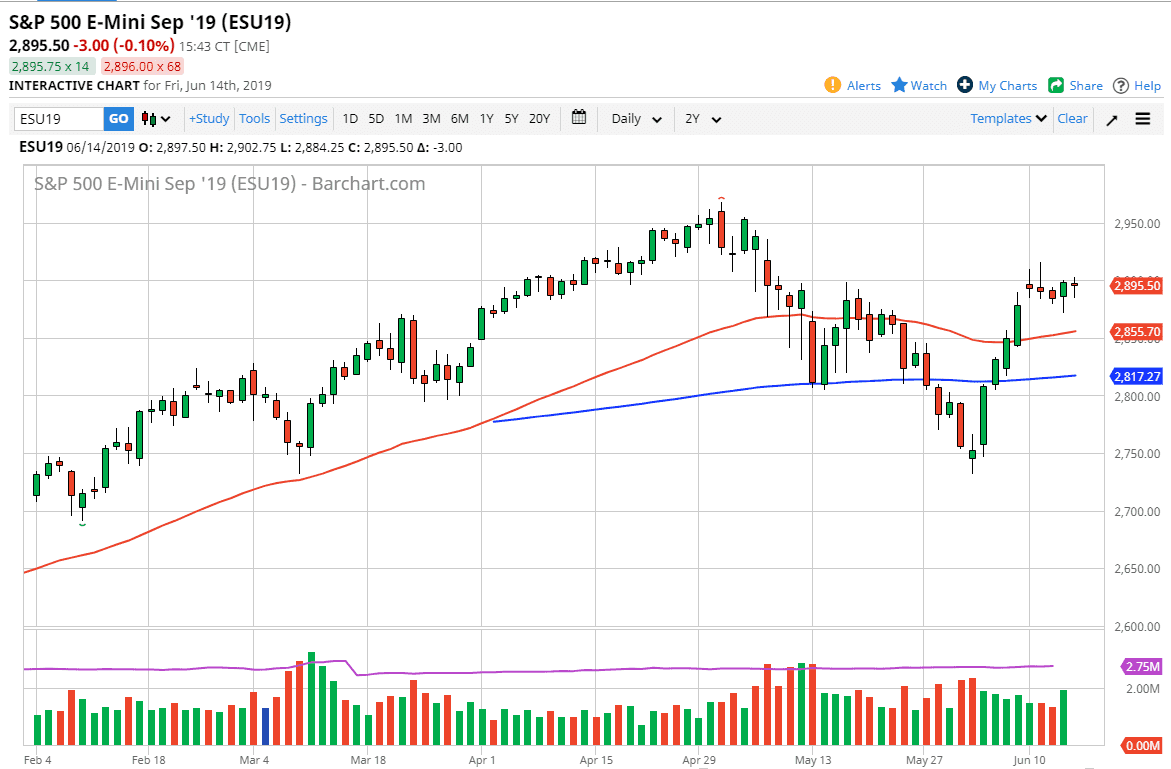

S&P 500

The S&P 500 initially fell at the open but found enough support underneath the turn around and rally again. The market was very choppy and as we roll over into the September contract, we are going to get a lot of poor trading. That being said though, we are obviously forming some type of support underneath so I think that looking at short-term pullbacks are buying opportunities. The market looks as if it is ready to go higher, perhaps based upon the Federal Reserve stepping away from its tightening attitude. If that’s going to be the case, it’s very likely that we could go looking towards the 2950 level. If we can break above the shooting star on Tuesday, then I think the market goes looking towards 2950.

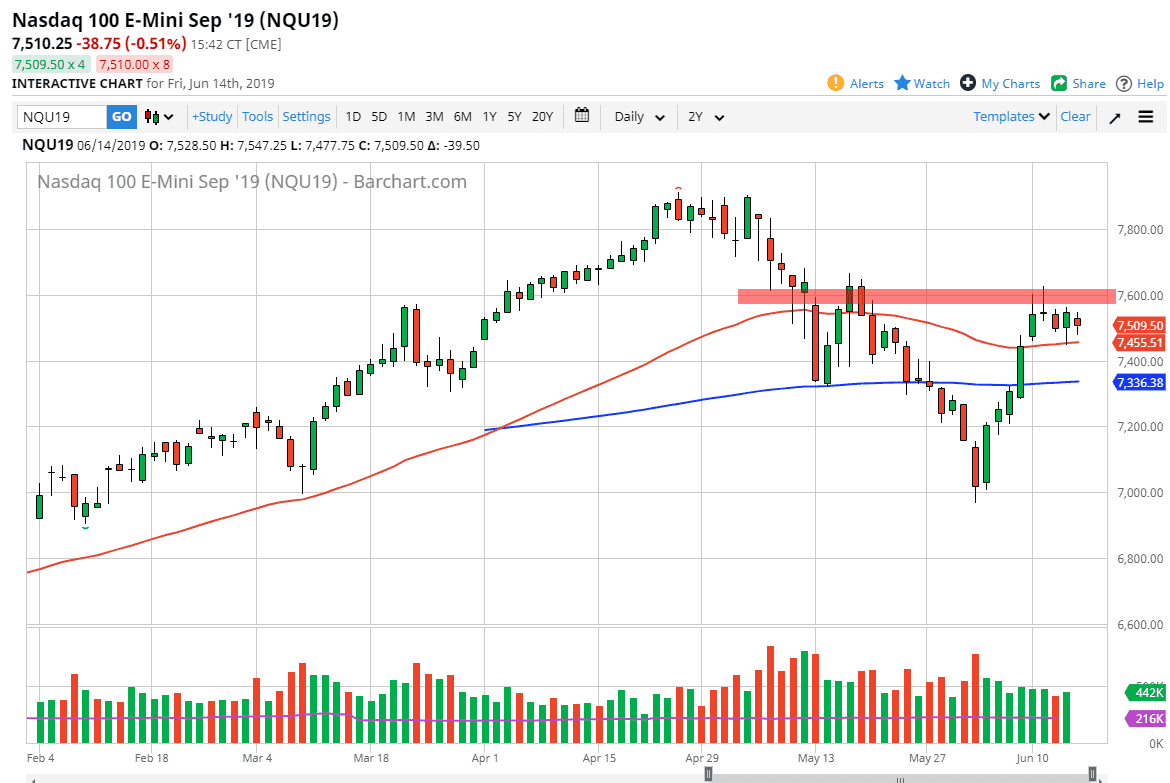

NASDAQ 100

The NASDAQ 100 also fell initially but did recover a bit during the trading session on Friday as we got close to the 50 day EMA. By doing so, it looks as if the NASDAQ 100 also wants to go higher but it is a little bit of a laggard and it certainly has some work to do to break out. We would need to wipeout quite a bit more to make the same type of breakout, wiping out the Tuesday candle stick. However, the two will more than likely move in tandem given enough time, so one should lead the other.

The NASDAQ 100 unfortunately has much more sensitivity to the US China situation, which of course is not very good looking. Ultimately, I do think that the buyers probably come back but it’s going to take quite a bit of work. If we break down below the 7400 level though, that could roll over completely and send this market much lower.