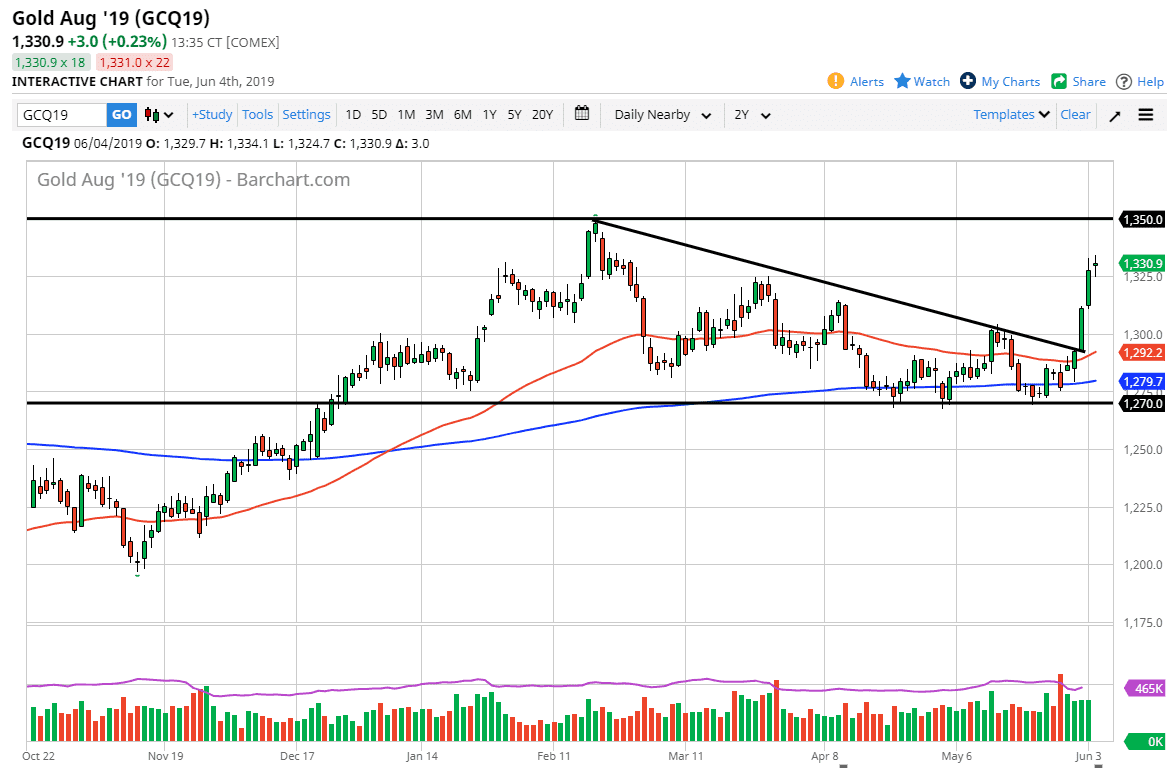

The Gold markets went back and forth during the trading session on Tuesday as we have entered an overbought range. At this point, it looks as if the $1330 level is going to be a bit difficult to continue to go through, and quite frankly a pullback would make quite a bit of sense. In fact, even if you are bullish of gold at this point you should probably welcome a pullback as it gives you an opportunity to pick up gold “on the cheap.” However, keep in mind that gold is very erratic at times, and therefore you should pay attention to what the overall attitude of markets are.

There has been a sudden “risk off” attitude in the markets again, and that of course sent gold markets higher. At this point in time, it does look as if we are going to continue to struggle so I think a break down below the $1325 level opens this market up for buying at lower levels. I think the $1300 level of course is an area that will attract a lot of attention as it is a psychologically and even more structurally important support. To the upside, the $1350 level above is major resistance. If we can break above there, then of course gold can really start to take off.

Regardless, I think we are going to see a couple of days of softness, especially if we can get a little bit more positivity in the stock markets as it will calm down some of the fears that we have seen as of late. However, if stock markets continue to show erratic and negative behavior, that could send Gold right back up. I anticipate some softness, but there is more than likely going to be a lot of value hunting underneath as well.