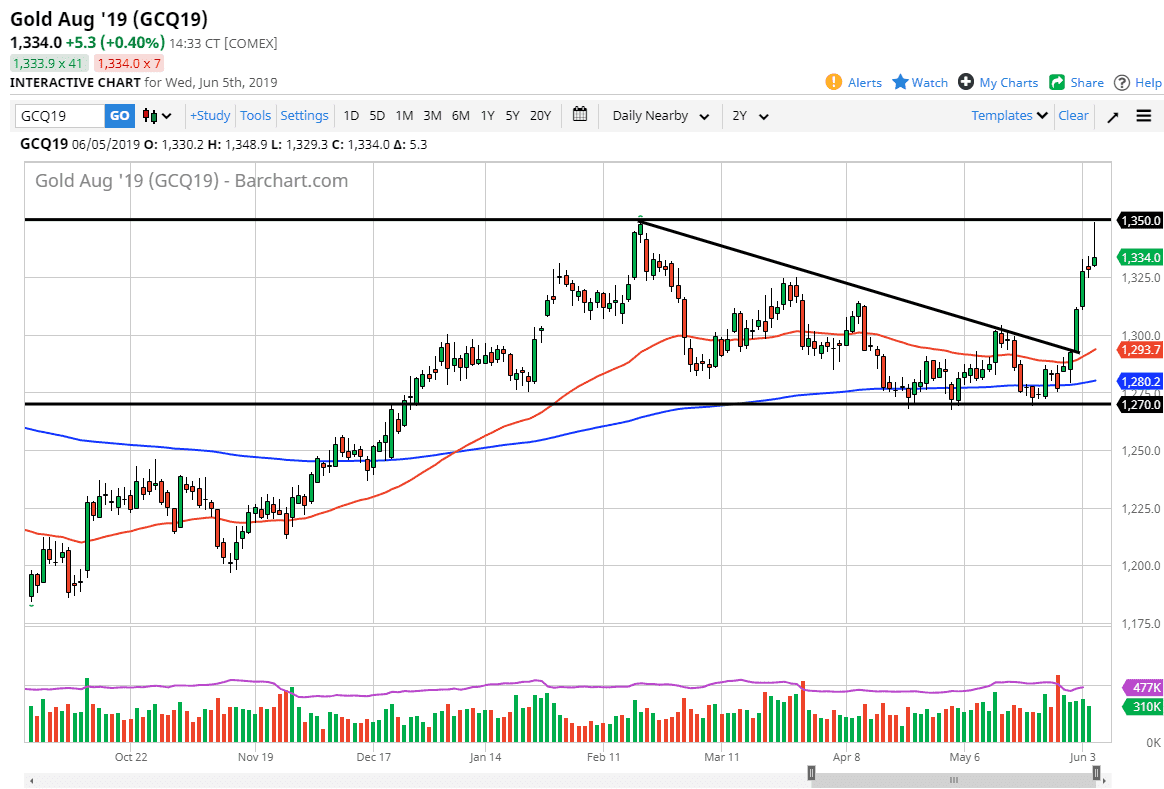

Gold markets rallied significantly during the trading session on Wednesday, slamming into the crucial $1350 level. That’s an area that of course is massive resistance because it has proven itself to be so in the past, and now that we have turned around the show signs of exhaustion at this point it’s very likely that we could pull back. I have no interest in trying to get cute with this market, and if we were to break above there it would be a very bullish sign.

However, this is a market that show signs of being overbought, and at this point it makes no sense to think that the market can continue with this type of ferocity. It would take something rather negative as far as risk appetite is concerned to keep Gold going higher right away. A pullback from here could make quite a bit of sense though, perhaps down to the $1300 level. That is an area that will attract the lot of attention due to the fact that the area is such a large number, and of course it is where the 50 day EMA is currently trading just below.

The breakout above the downtrend line that I have marked on the chart was rather significant, but I think most people understand just how overdone it is. Now that we have hit that massive resistance barrier, I think a lot of profit taking occurred. The question now is whether or not we can break above there? I think it’s very likely that we are going to see is a lot of back and forth in a relatively tight range, basically $80 from 1350 down to the $1270 level.