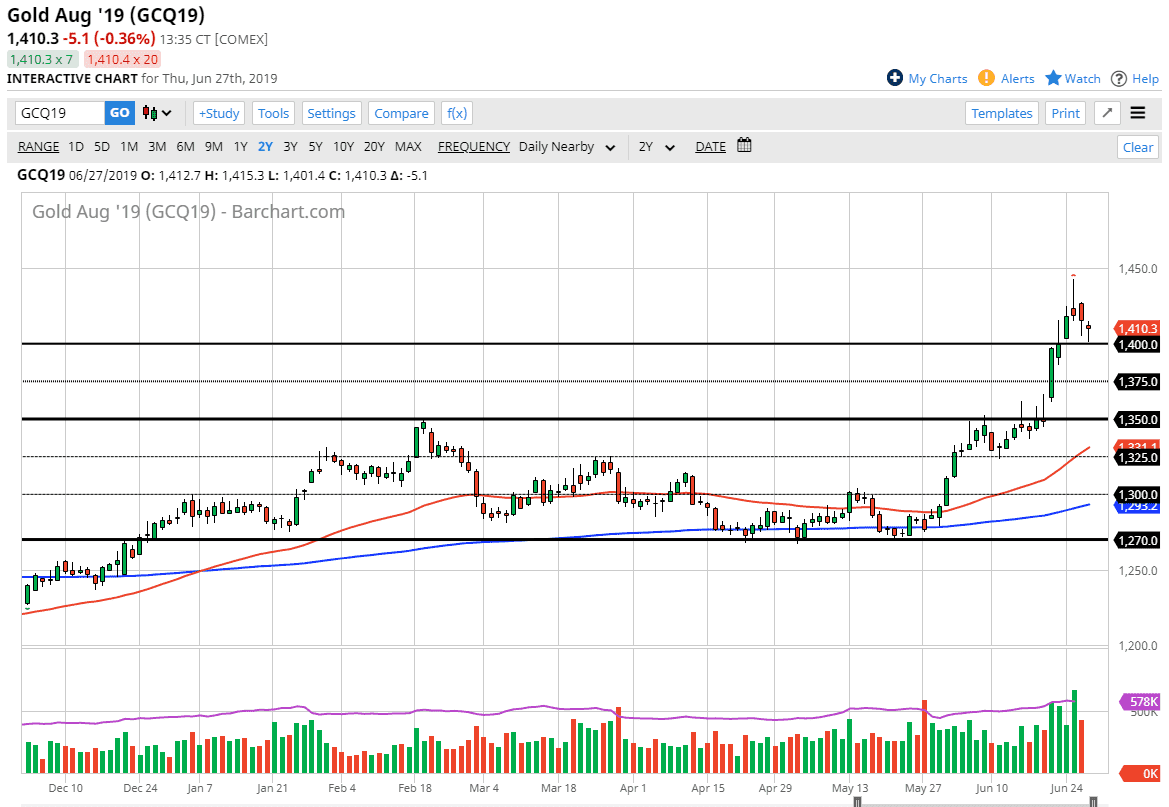

Gold markets pulled back a bit during the day on Thursday, testing the crucial $1400 level for support. We did in fact find it down there so that’s a good sign. In fact, the daily candle stick looks a lot like a hammer and that does suggest that perhaps we could rally from here, perhaps heading into the G 20 session might be that reason. After all, it’s very likely that we are going to see absolutely no advance in the US/China trade wars, and that could have people looking for a bit of safety.

We do know that central banks around the world are looking very likely to continue to cut interest rates, and now the Federal Reserve has jumped into the fray as well. With that in mind, the gold market should do quite well over the longer-term. Another thing that I like about this market is that it seems to be very driven by $25 increments, so I am paying attention to the $1400 level, the $1375 level, and the $1350 level prospectively. After all, there is a gap at the $1350 level, and it is roughly the 50% Fibonacci retracement level from the recent surge higher. If we can get down there, we should find plenty of buying opportunities.

Alternately, if we break above the high of the trading session on Thursday, we will probably go looking towards the $1440 level. That would be the top of the shooting star from a couple of days ago, I think we are a bit expensive here so I like the idea of finding value on pullbacks, with the goal of reaching the highs again, and then possibly even the $1500 level. In this environment, I have no interest in selling Gold.