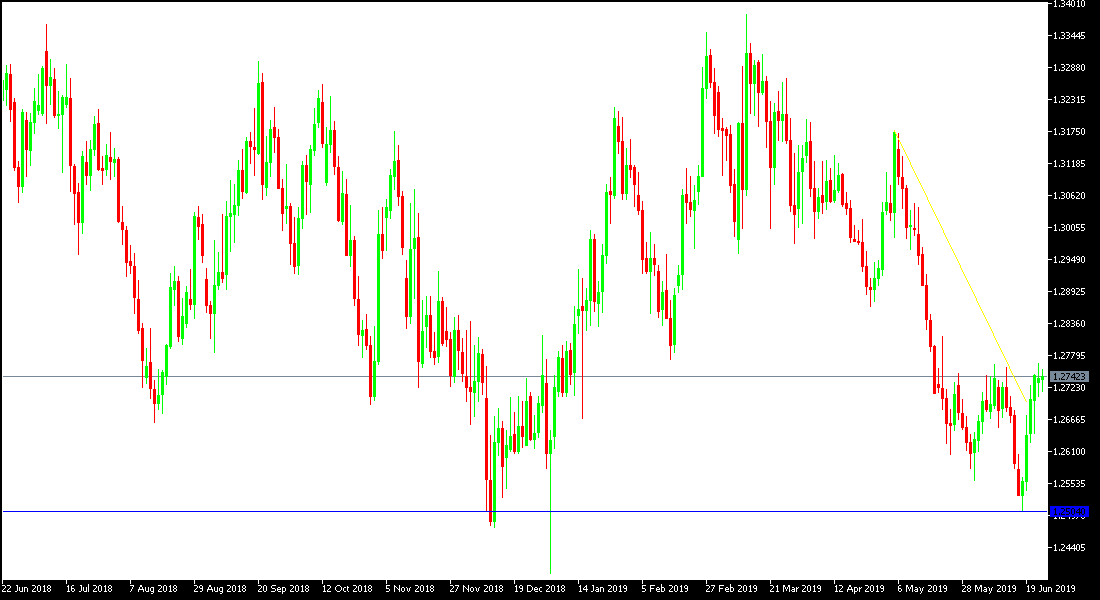

Despite six consecutive trading sessions where the GBP/USD managed to achieve bullish correction reaching the resistance level of 1.2765. These gains will remain under the threat of Brexit developments as indicators increase for the victory of the former foreign minister in taking over the task after Teresa May, a well-known figure of hostility in dealing with Europe and things may develop with him to a no-deal Brexit. The pair's recent losses have reached the 1.2505 support level, the lowest level since more than five months. The latest rebound has been supported by continued pressure on the dollar since the Federal Reserve confirmed the possibility of a US rate cut as soon as possible if the US economy continues to slow down. The results of recent economic data already confirm the weakness of the economy. The Pound lacks only a positive development regarding Brexit.

The Bank of England is a major economy central bank and the only one that is looking to raise the interest rate at the moment, but the uncertainty of Brexit future is preventing them from doing that. The bank has kept the interest rate and asset purchase plans unchanged, stressing that the rate hike will depend on Brexit.

The pair's performance confirms what we always recommend; to sell from every bullish level. Brexit fears will remain a negative factor for any pair gains. The dollar is facing a setback supported by hinting that the US interest rate could be cut soon. Since the UK vote to exit the EU, we have always recommended selling the Pound against other major currencies as Brexit will not end overnight, and not easily, as some believe, so as not to spread the infection among the rest of the EU. Pound gains will remain good opportunities to sell.

Brexit developments from time to time will continue to contribute to the volatility of the pair's performance.

Technically: GBP / USD settling again below the 1.3000 level still support the bearish correction for the pair despite the recent rebound, and support levels are still at 1.2665, 1.2580 and 1.2445 respectively, closer to the pair's performance while confirming the strength of the bearish trend. On the upside, the bullish correction opportunity will not be stronger without settling above the 1.3000 resistance. I still prefer selling the pair from every ascending level. Its gains may be in the wind for any negative Brexit development.

On the economic data front, the economic calendar today will focus on US consumer confidence and new home sales data, and later on comments by Federal Reserve Governor Jerome Powell.