The British pound against the Japanese yen pair is a barometer for risk appetite more than anything else under normal circumstances. Add in the fact that we have the Brexit to deal with, there isn’t much hope for this pair right now. We have been selling off drastically, and the fact that the weekly candle stick closed at the bottom of the range tells me that the market still has negative momentum to deal with.

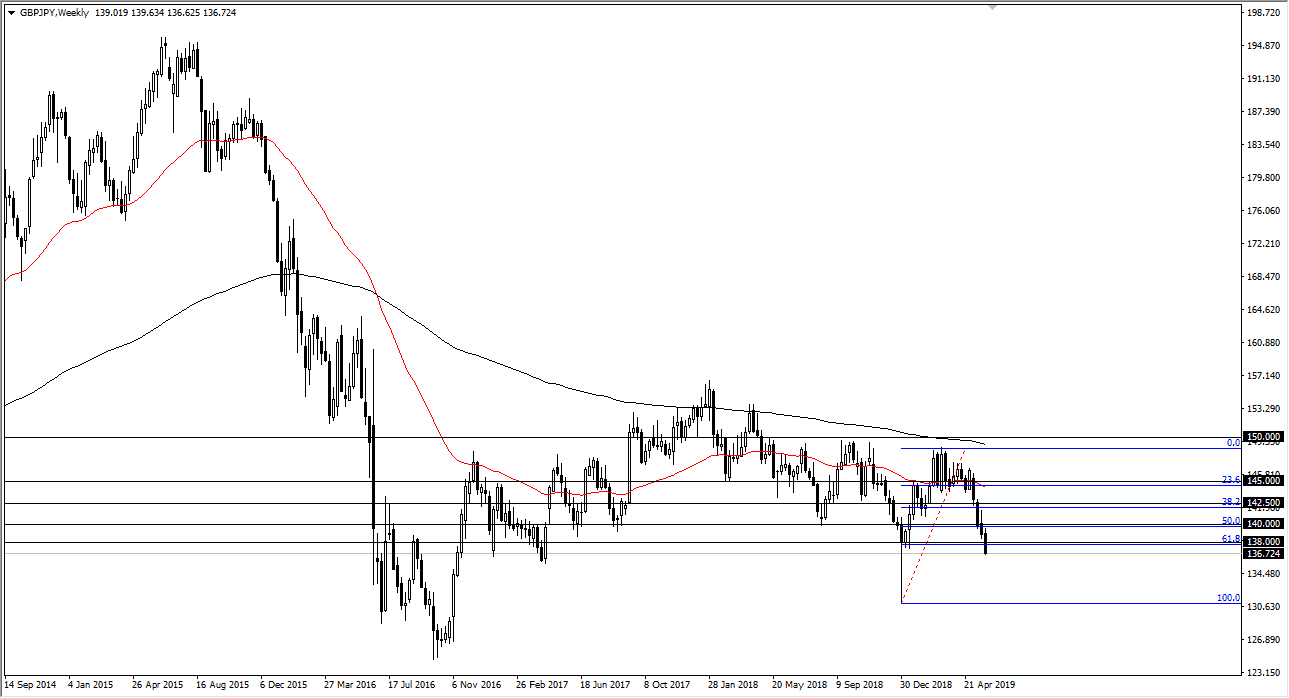

The ¥138 level has been broken, and that was an area that was so supportive in the past and of course was the 61.8% Fibonacci retracement level. That being the case, it now looks like we will probably fall rather significantly, and in my experience it’s quite common to see that a break down below the 61.8% level opens up the door to the 100% Fibonacci retracement level, wiping out the entire move higher.

At that point, we would be looking towards the ¥131 level. Obviously, as long as we continue to have a lot of negative economic headlines around the world, this pair will favor the Japanese yen. I believe that the month of June is going to be horrible for risk appetite, and the last day of the month of May really opened up the door to a lot of panic.

However, if we can break above the ¥138 level and stay above there for a couple of days, the market will probably try to go higher, reaching towards the ¥140 level. I don’t have a scenario in my mind right now that allows that to happen, but it’s possible that some good news could come back into the marketplace. Right now, I fully anticipate that this pair will be lower during the month.