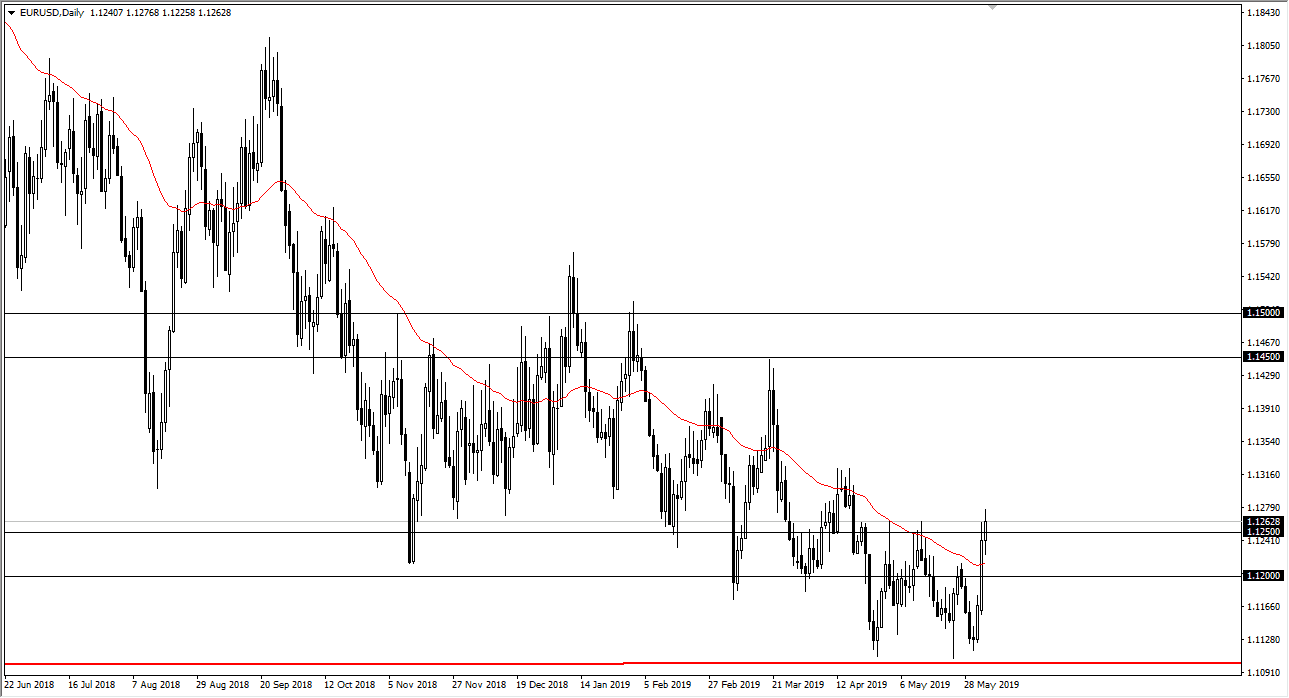

EUR/USD

The Euro went back and forth during the trading session on Tuesday, breaking above the crucial 1.1250 level. This is a market that sees a lot of resistance at this region, so the fact that we gave back quite a bit of gains is in a huge surprise. However, it looks as if we are at least sticking around this area. I think there is a lot of confusion right now, and Jerome Powell suggesting that perhaps the Federal Reserve may be willing to cut rates if necessary threw even more of a mess into the market. At this point, if we break down below the bottom of the candle stick for the trading session, then I think the market rolls over and goes back into the consolidation area. However, if we break above the highs of the day it’s a sign that we are probably going to try to grind to the upside.

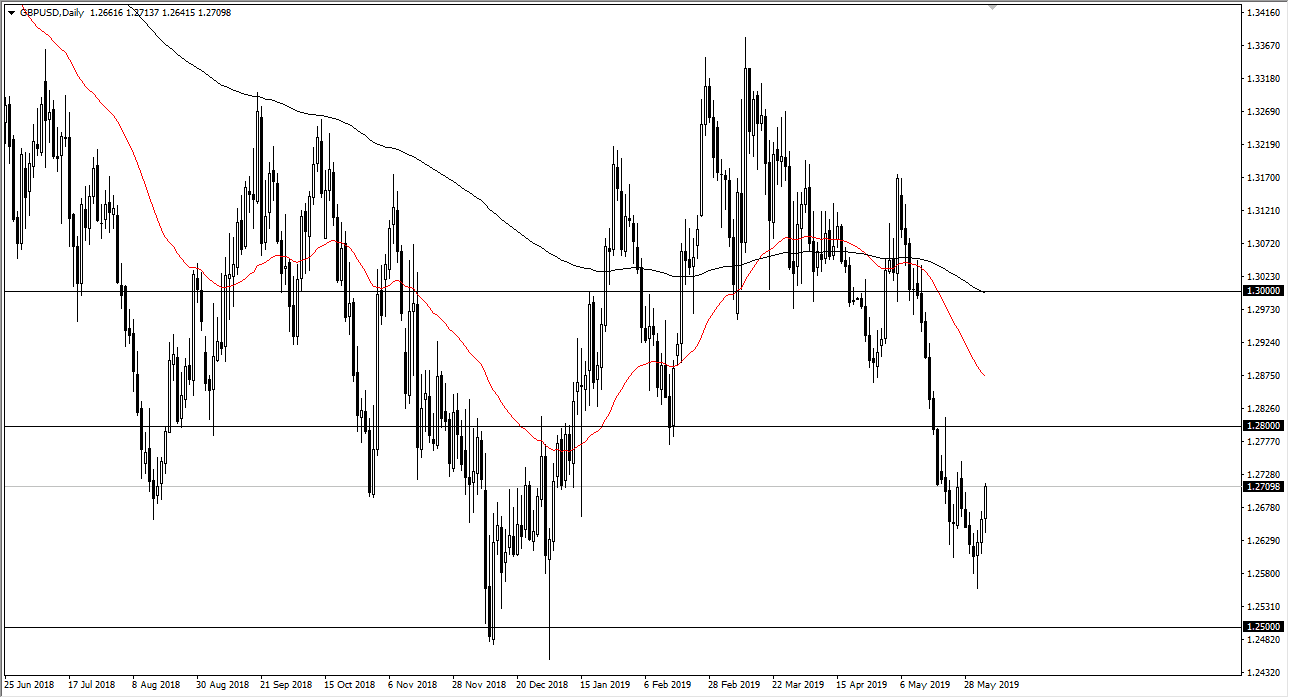

GBP/USD

The British pound rallied a bit during the trading session on Tuesday as well, but this may have been more or less an anti-US dollar move than anything else. I think there is significant resistance just above at the 1.2725 region, and most certainly there is resistance at the 1.28 handle. I still believe that selling short-term rallies that show signs of exhaustion might be a way to go going forward, and I also believe that we are going to go looking towards 1.25 handle underneath, which is a large, round, psychologically significant figure. It’s an area that we have also seen a bounce from recently. However, if we were to break above the 1.28 handle, then it’s possible that we could go all the way to the 1.30 level. I feel that it’s very unlikely to happen, but it is what the charts tell me.