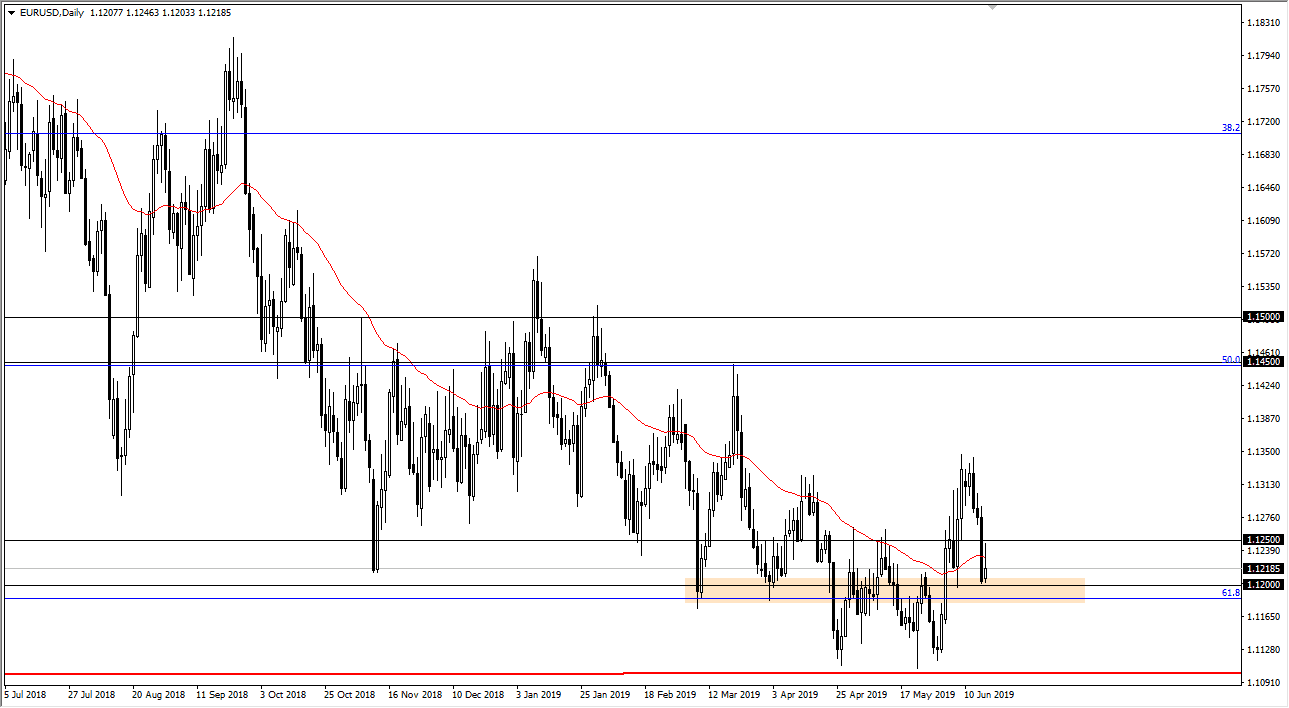

EUR/USD

The Euro rallied a bit during the trading session on Monday as we go back to work, reaching towards the 1.1250 level. That is an area that is the top of major support, and an area that has been important. However, the fact that we pulled back from there is a very negative sign. That being said, I suspect that it’s only a matter of time before buyers come back, especially if the Federal Reserve is very dovish during its Wednesday statement. Looking at the charts, I believe that there is massive support at the 1.11 handle underneath, and that we will not break down below there. This of course would change if the Federal Reserve remained somewhat hawkish and disappointed the markets. However, it seems very unlikely and therefore I suspect that a rally in this pair is coming. However, it may not be until after the announcement on Wednesday.

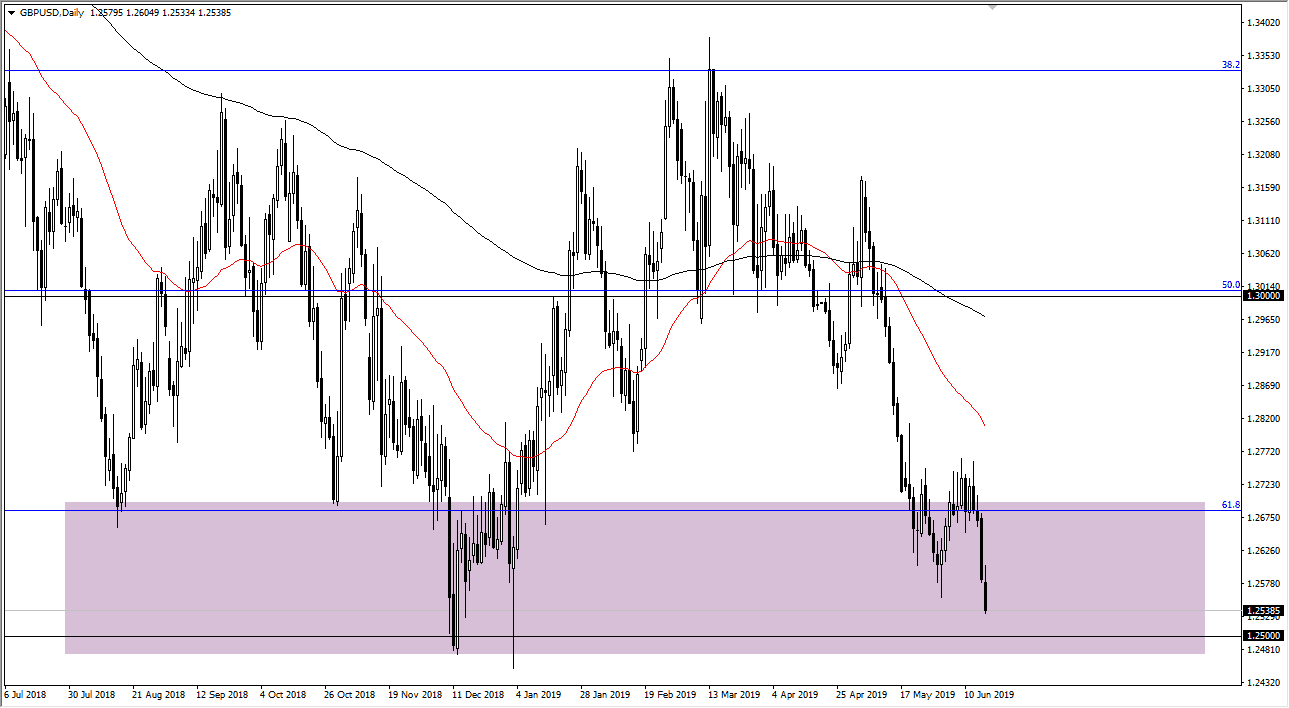

GBP/USD

The British pound broke down rather significantly during the trading session as well, and it now looks as if we are in fact going to test the 1.25 level, an area that I have mentioned previously. If we can find buyers just above there, it’s very likely that we will continue to rally to find massive support at this large, round, psychologically significant level. However, if the Federal Reserve isn’t dovish enough, we could see this market break down below the 1.25 handle, opening up the possibility of a move down to the 1.2250 level. After that, we could be looking at the 1.20 level after that. All things being equal, it’s very likely that we find buyers sooner than sellers, but it may not be until after the Wednesday Fed meeting.