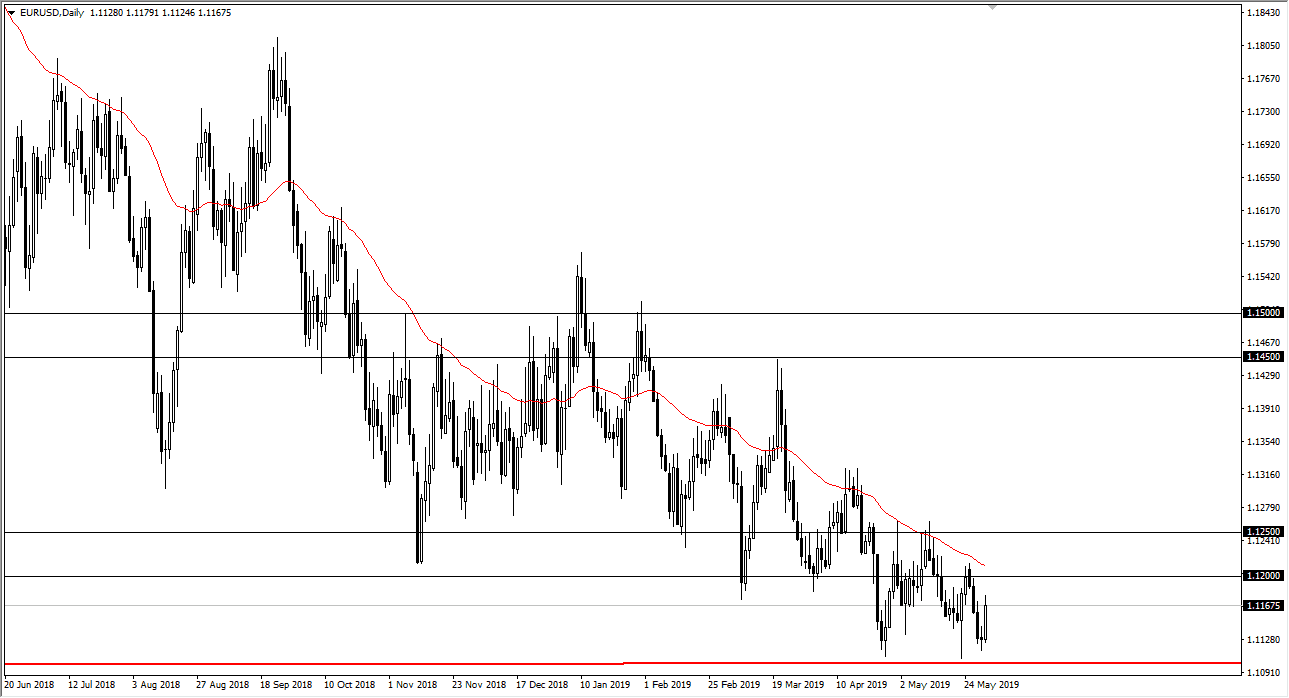

EUR/USD

The Euro rallied significantly during the trading session on Friday, reaching towards the 1.1165 handle. To the upside is the 1.12 level, which is the beginning of significant resistance that extends to the 1.1250 level. As the market reaches towards that area, I suspect that an exhaustive candle could be a nice selling opportunity. Underneath, I anticipate that there is a lot of support at the 1.11 handle. While the Euro looks as if it is trying to find some type of base here, I think that we will probably simply go back and forth over the next several weeks. If we were to break out of this range, I believe a move to the downside would probably open up a move down to the 1.10 level. Ultimately, a break above the 1.1250 level opens the door to the 1.14 handle.

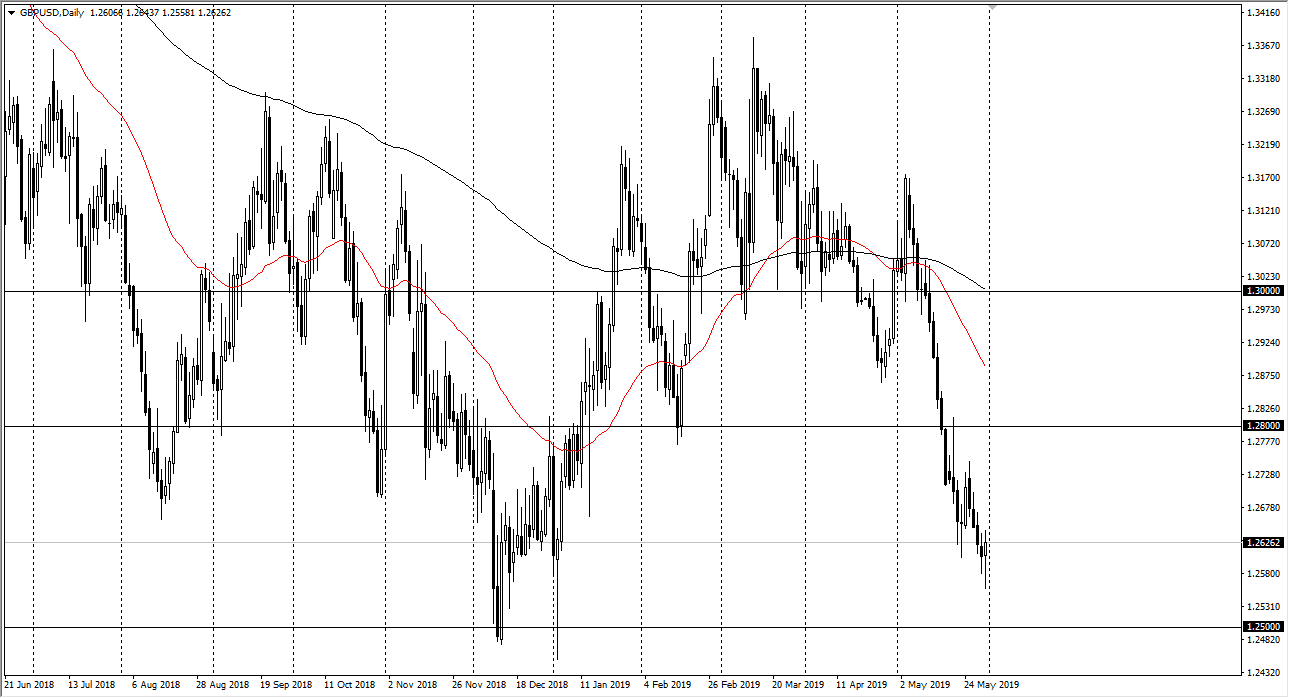

GBP/USD

The British pound went back and forth during the trading session on Friday but settled on a hammer. That of course is a bullish sign, but I think this is a short-term bounce more than anything else. I don’t think this is a change of the overall attitude of the market, as there are plenty of moving pieces out there that could weigh upon the British pound. At the very least, it we have the Brexit to worry about. Beyond that, we also have the global growth concerns, and that has been picking up the value of the US dollar. That’s a bit of a double whammy for this market, so I think that rallies at this point are probably going to be sold into, especially near the 1.27 and the 1.28 handles. If you can break above the 1.28 level, the market then goes to the 1.30 level. To the downside, the 1.25 level is massive support.