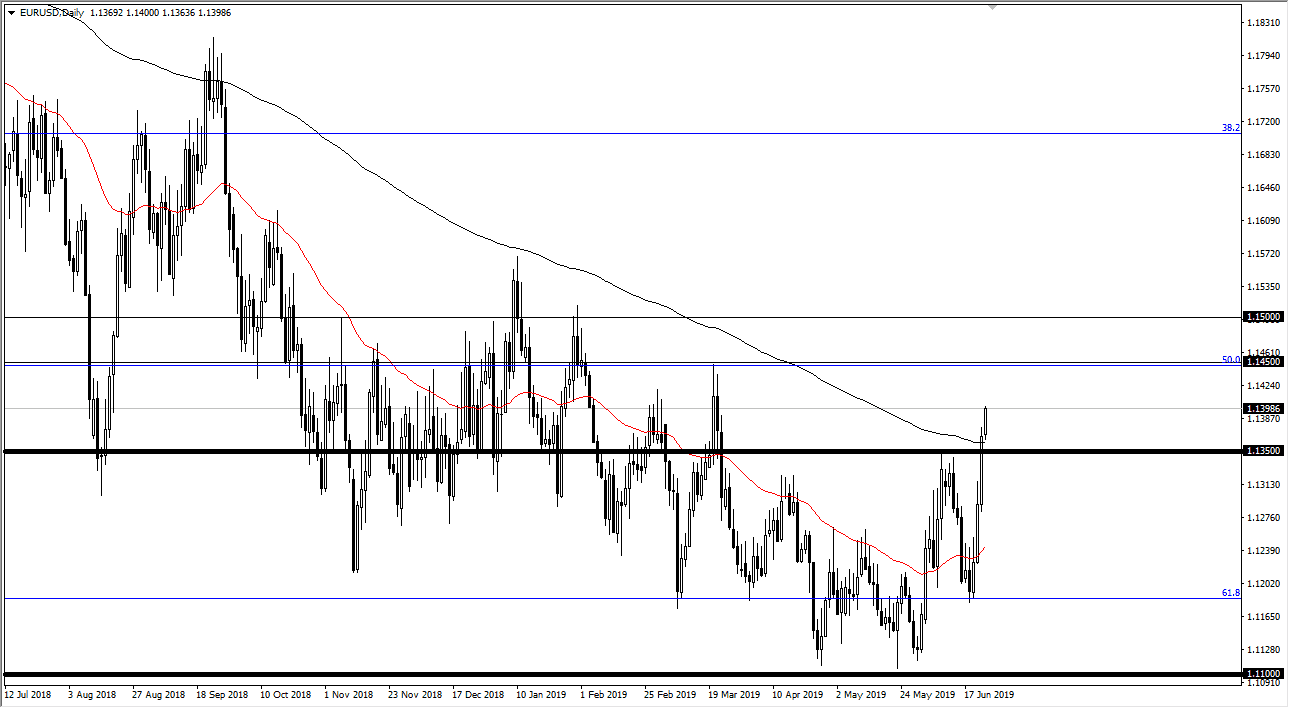

EUR/USD

The EUR/USD pair has rallied a bit during the trading session on Monday to kick off the week, as we extend the run above the 200 day EMA. We have broken above major resistance, and it’s now very likely that we are going to go looking towards 1.1450 level. That being said, it’s very unlikely that the market is going to pull back sooner rather than later, because quite frankly we have gone straight up in the air. However, the pullback should be a buying opportunity for those looking for value. At this point, I’m looking for some type of pullback to offer that value as the United States dollar is probably going to drop in value due to the Federal Reserve stepping away from the hawkish stance that it had been in, and now looks very likely to cut rates. That of course means that the Euro is undervalued.

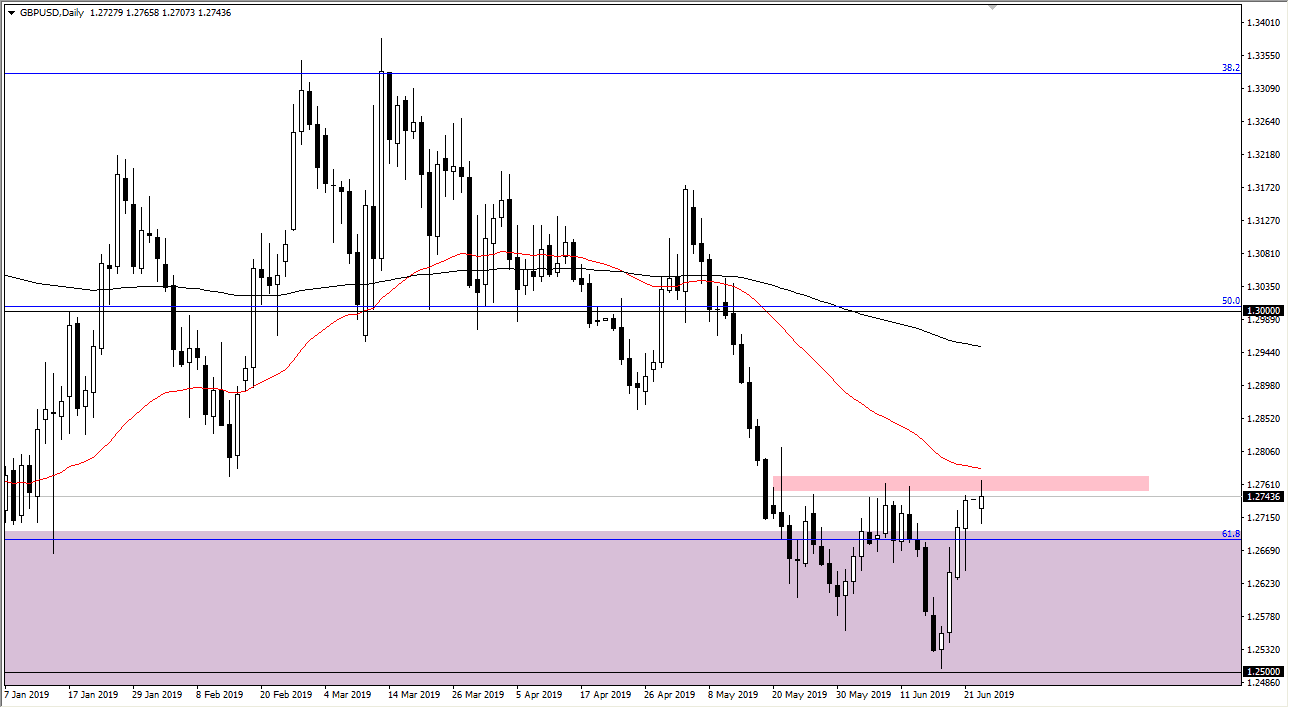

GBP/USD

The British pound has also rallied as of late, but it looks as if it’s going to continue to get stock at the 1.28 handle. If we can break above that level, then the market could very well go towards the 1.30 level but we need some type of daily break out above there on the close to take advantage of. Pullbacks from here could send this market down quite a bit, but if we continue to see US dollar weakness, it’s very likely that the British pound will only fall so far. That being said, the question now is whether or not we get some type of trend reversal, but at the same time we have the Brexit causing quite a bit of heaviness. With that being the case, once the 1.28 handle, or a break down below the bottom of the candle stick for the day on Monday. Overall, even with the US dollar weakness though, I think you’re probably better off buying other currencies against the greenback.