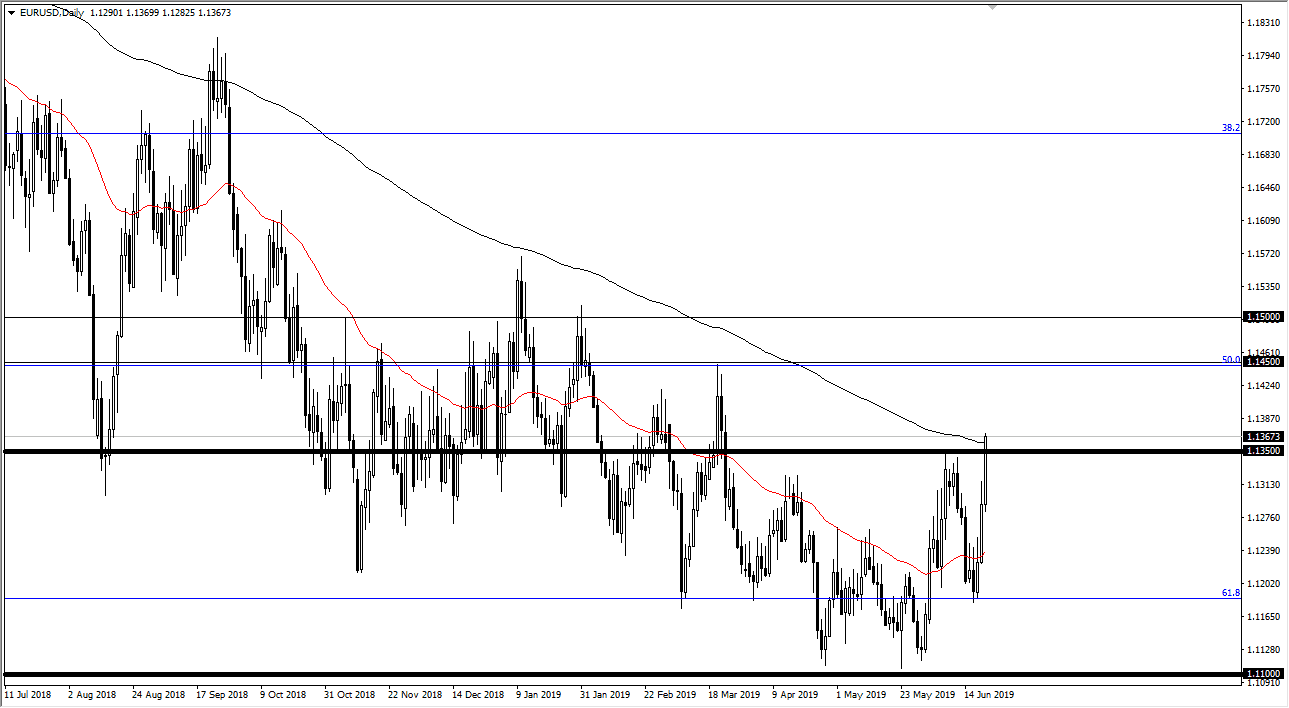

EUR/USD

The Euro broke out late on Friday above the 1.1350 level, clearing the 200 day EMA. However, you should keep in mind that this was late in the day and liquidity would have been almost nonexistent. That doesn’t negate the fact that the market broke out, just that we may have a little bit of pushback initially. Nonetheless, the Federal Reserve is trying to suggest that there are interest rate cuts coming down the road if the situation warrants it. Because of this, the US dollar has been hammered, and now I think we are starting to show significant momentum to the upside, as the longer-term trend is perhaps changing.

The 1.1450 level above extends to the 1.15 handle, and if we can break above there it’s very likely that the trend will continue toward the 1.20 level longer-term. That being said, at that point it would very likely face a bit of resistance. I believe that we are in the midst of a trend change, so I’m a buyer.

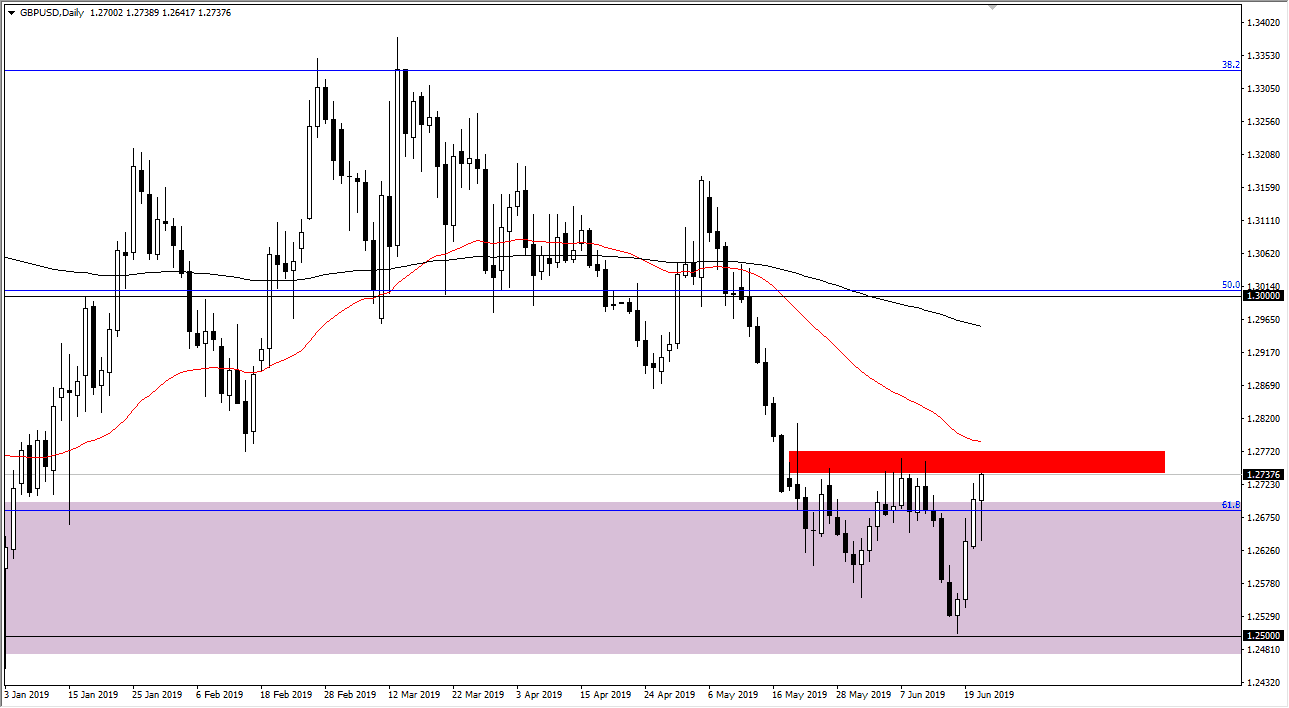

GBP/USD

The British pound has also shot higher during the trading session after initially pulling back, crashing into the 1.2750 level. This is an area that should be rather resistive but if we can break above the 1.28 level, this market could go all the way to the 1.30 level. Alternately, we could pullback but it’s possible that will only offer more value. While I am a bit skittish about the British pound, the reality is that the Federal Reserve is trying to kill the US dollar, or at least bring it down in value, and the Federal Reserve eventually gets what it wants. Yes, the Brexit causes a lot of issues but I do think that a short-term pop may be coming. The real “tell” will be whether or not a pullback forms a “higher low.”