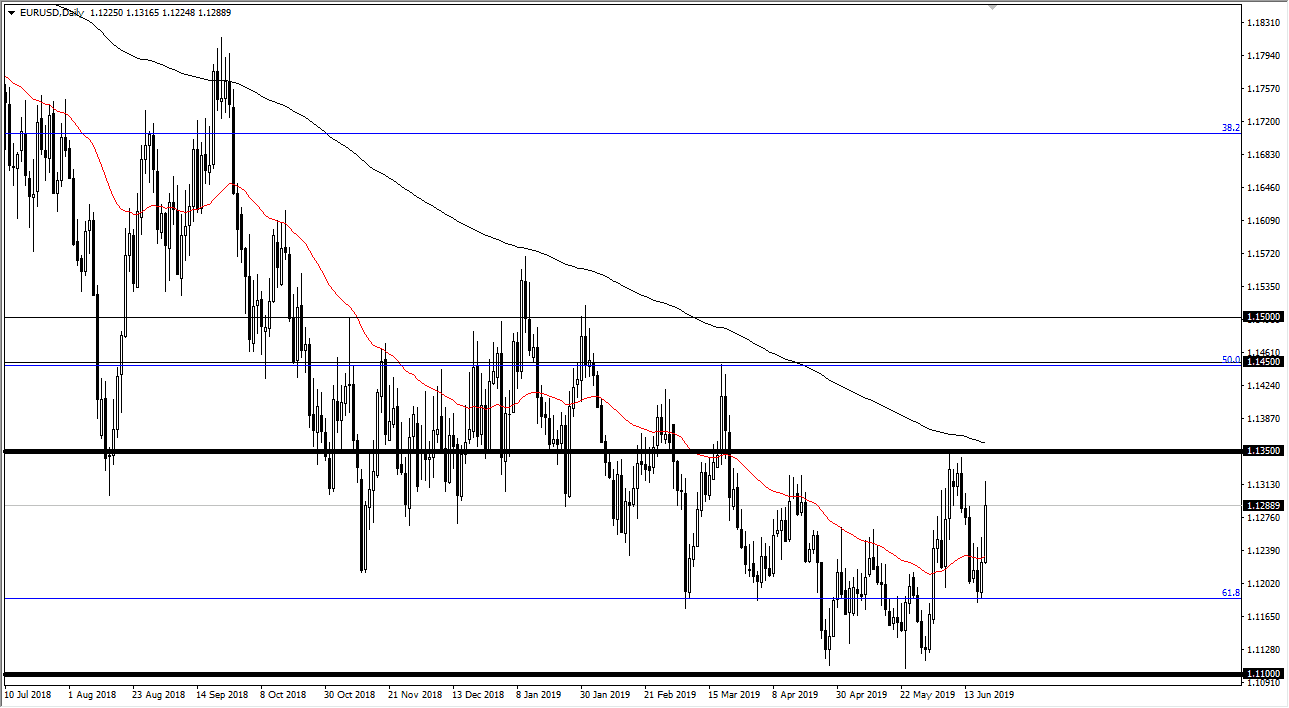

EUR/USD

The Euro shot higher during the trading session on Thursday as we reacted to the Federal Reserve cutting its outlook for interest rate hikes. That being the case, we had seen a bit of a preemptive strike by the ECB suggesting they were also looking at cutting rates. With that, the Euro rallied significantly but it looks as if the 1.1350 level will continue to offer resistance. Above that, we have the 200 day EMA coming into the picture.

That being said I see a lot of support down at the 1.11 handle, and I think we are simply going back and forth trying to build some type of base. Longer-term, I believe that we will turn around to rally to the upside as the US dollar will get pounded by the Federal Reserve and its attitude adjustment, but until we break above the 1.1350 level on a daily close, I think that we are stuck in this range so back and forth trading is probably advised.

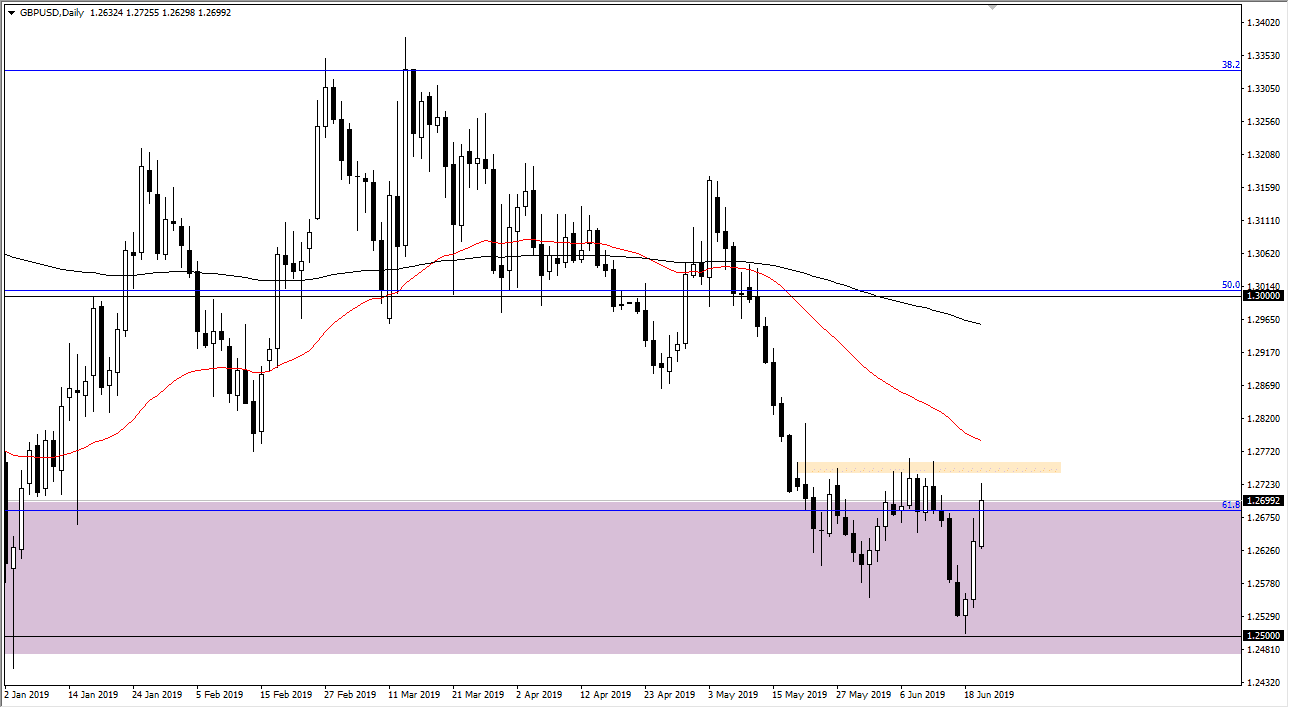

GBP/USD

British pound rallied during the trading session as well, breaking towards the 1.2750 level. That’s an area that looks like it’s going to cause a bit of resistance, so the fact that we give back some of the gains isn’t a huge surprise. If we can break above the 1.28 level on a daily close, then I think we have another 200 pips ago, reaching towards the 1.30 level above. At this point, we have shown signs of exhaustion later in the day, so will have to wait and see whether or not this sticks. That being the case, it’s probably better to wait and see if we can break out before putting money to work. Beyond that, we also have the Brexit to worry about so the British pound should outperform the Euro.