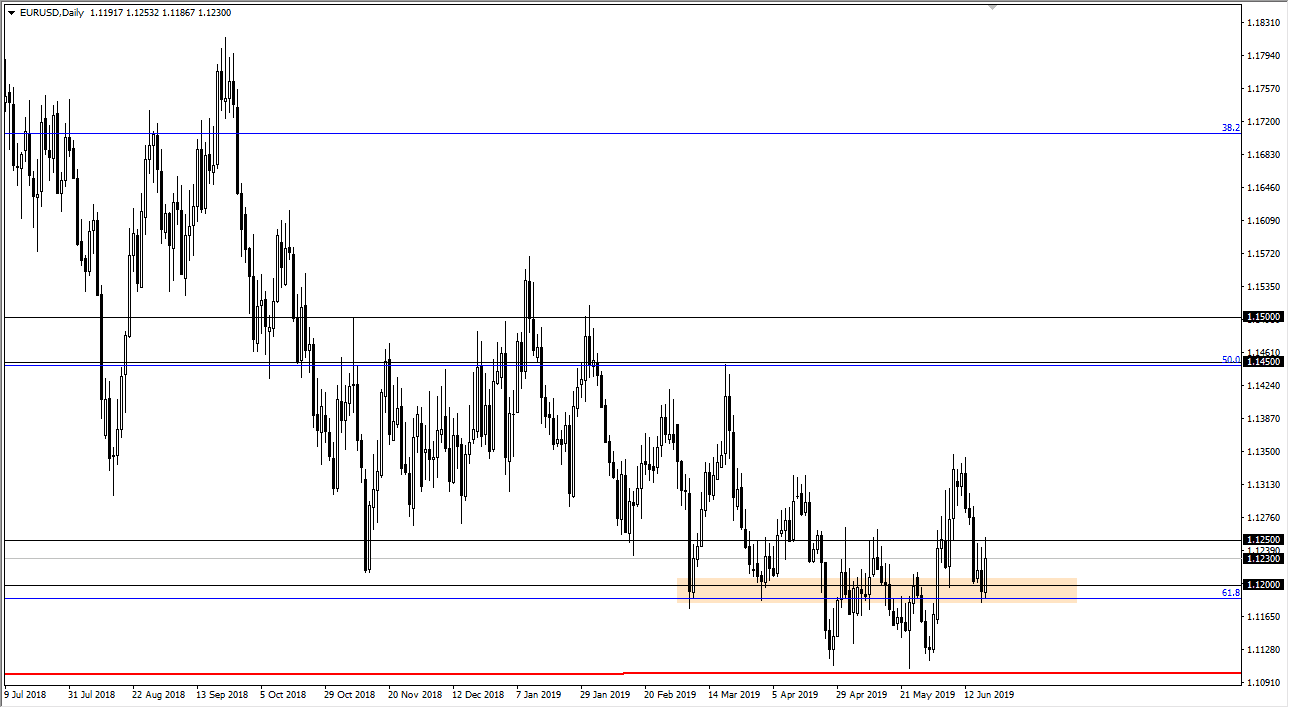

EUR/USD

The Euro shot higher during the trading session on Wednesday as we finally got the Federal Reserve statement. That being said, not much was realized that was new, and with that we have stayed in the same range for some time. The 1.12 level has been supportive in the past, just as the 1.1250 level has been resistance. Overall though, when I look at this market, I recognize that the 1.11 level underneath is massive support, while the 1.1350 level above is resistance. We are essentially in the middle of this area, so it’s difficult to imagine a scenario where we should put a lot of money to work. We are essentially in the “fair value” area, so there’s not much to do in this area right now. It’s very likely that we will continue to hang out in this range for the foreseeable future.

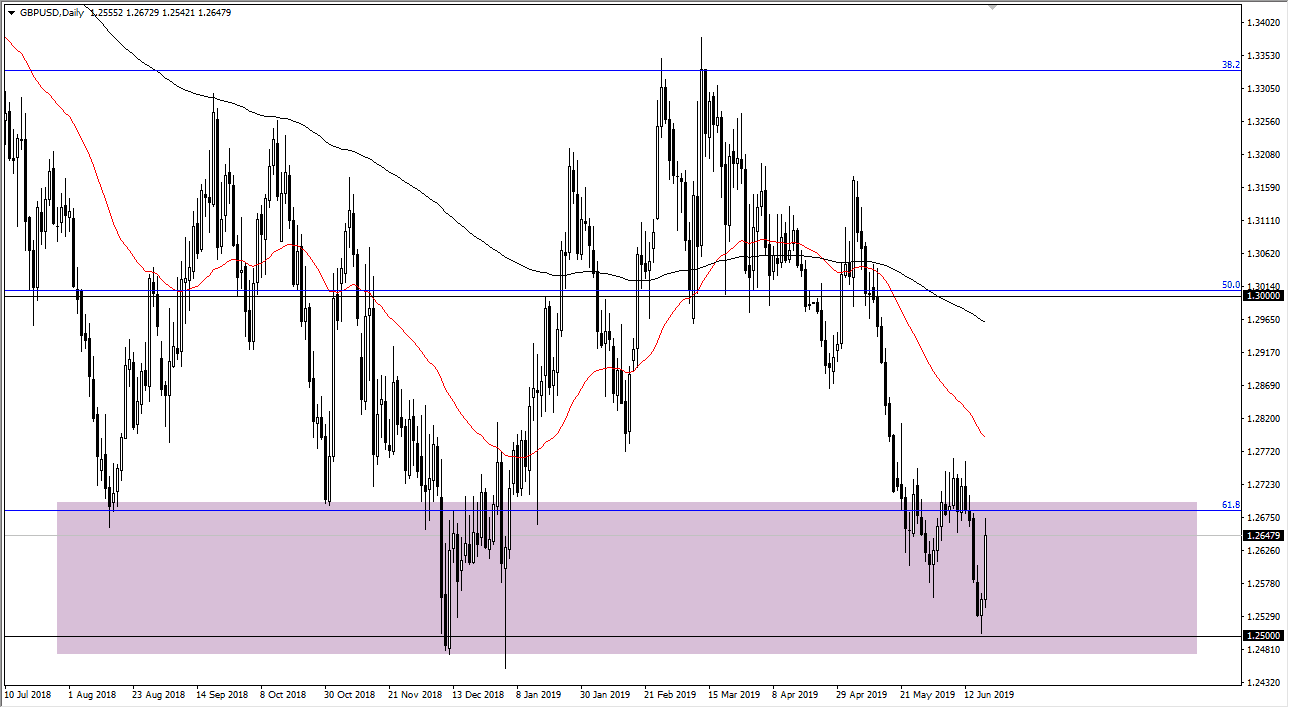

GBP/USD

The British pound has rallied quite nicely, but there is significant resistance above that will continue to cause issues with this market. The 1.2750 level extends resistance to the 1.28 handle. I don’t think we break above there, because although the Federal Reserve has suggested that they could possibly be cutting rates in the near term, the reality is that we already knew it. Beyond that, we also have the Brexit going on and that of course causes major issues as well. Headline risk is at an extreme, so it’s very likely that we will eventually see a reason for this market to rollover and fall significantly. The Brexit is far from being done, so now that the Federal Reserve has essentially told the market what it already knew, it’s perhaps going to shift focus back to the Brexit in this market. Great.