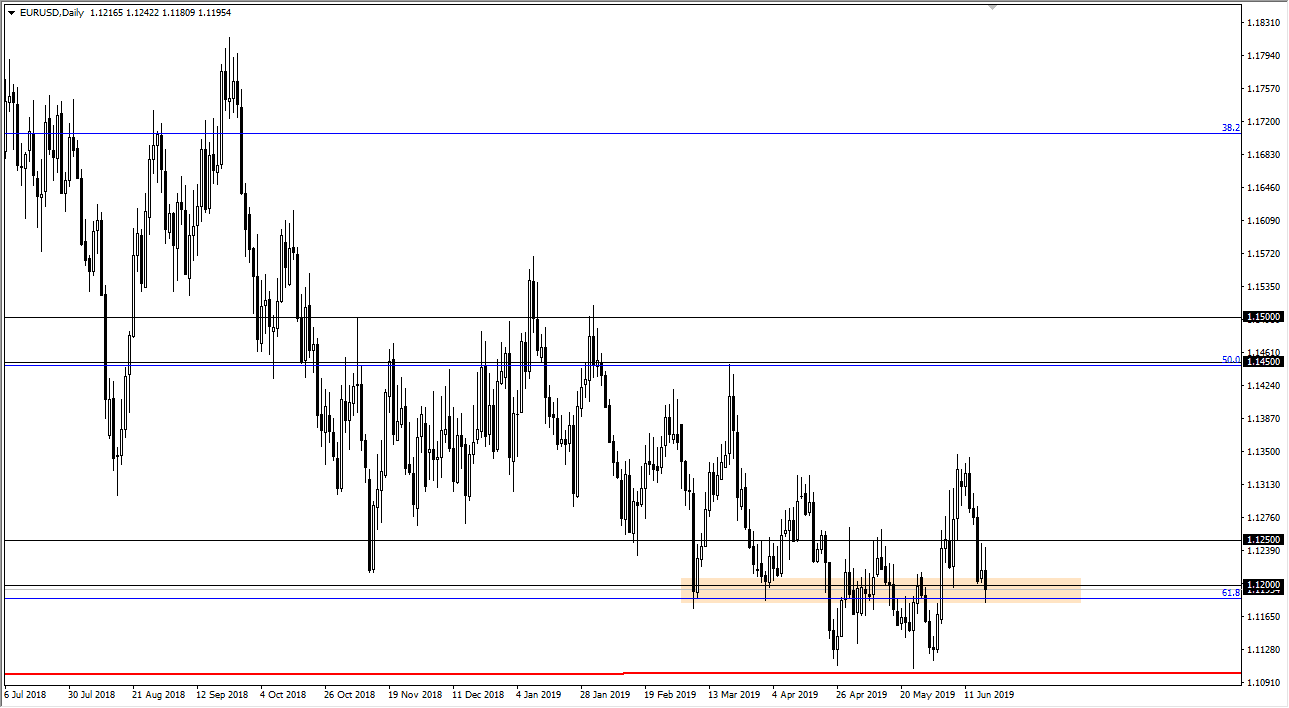

EUR/USD

The Euro showed a lot of volatility during the trading session on Tuesday, as the markets initially tried to rally during the trading session and reach this high as the 1.1250 level. That’s an area where we had seen a lot of pressure of the day before, so the fact that we fell there isn’t a huge surprise. The ECB suggested that perhaps they are willing to ease monetary policy in the near future, so that of course had the Euro selling off.

However, later on in the day we started to see the market bounced back as the 61.8% Fibonacci retracement level has offered support. Beyond that, we reached towards the 1.12 level above, meaning that the market rejected selling off. It makes sense, considering that the FOMC Statement comes out later in the day. The Federal Reserve looks very unlikely to be anything but dovish at this point, keep in this market in the same range we have been in.

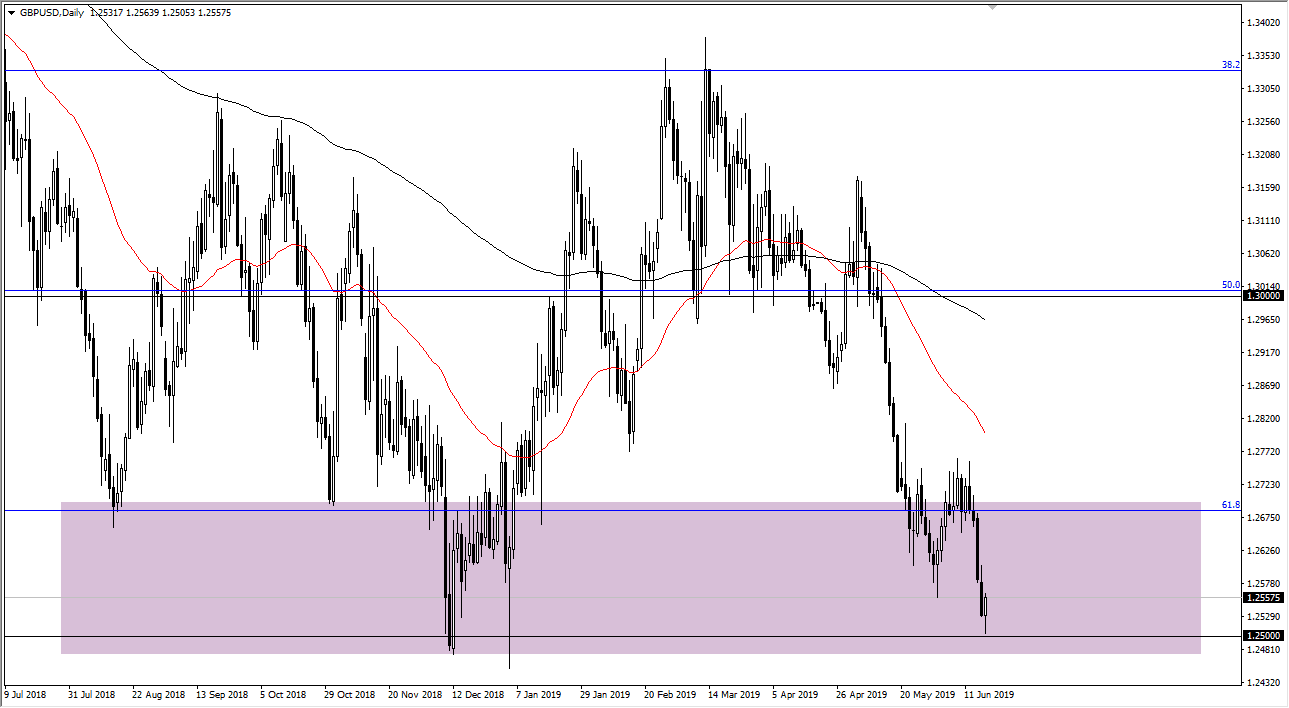

GBP/USD

The British pound broke down during the day initially but found enough support just above the 1.25 level as traders start to pay attention to the Federal Reserve, and we turned around of form a bit of a hammer. That is a very bullish sign, and I think we could get a bit of a bounce from here and try to reach a bit higher. That being said, as long as we can stay above the 1.25 level you have a solid level for a bit of a “floor” in the market, as we should respect the round figure. However, after the Federal Reserve statement we could get a little bit of clarity as to where this market is ready to go. If we go to the upside, the 1.27 level will probably be targeted, but a break down below the 1.25 level could send this market as low as 1.2250 underneath.