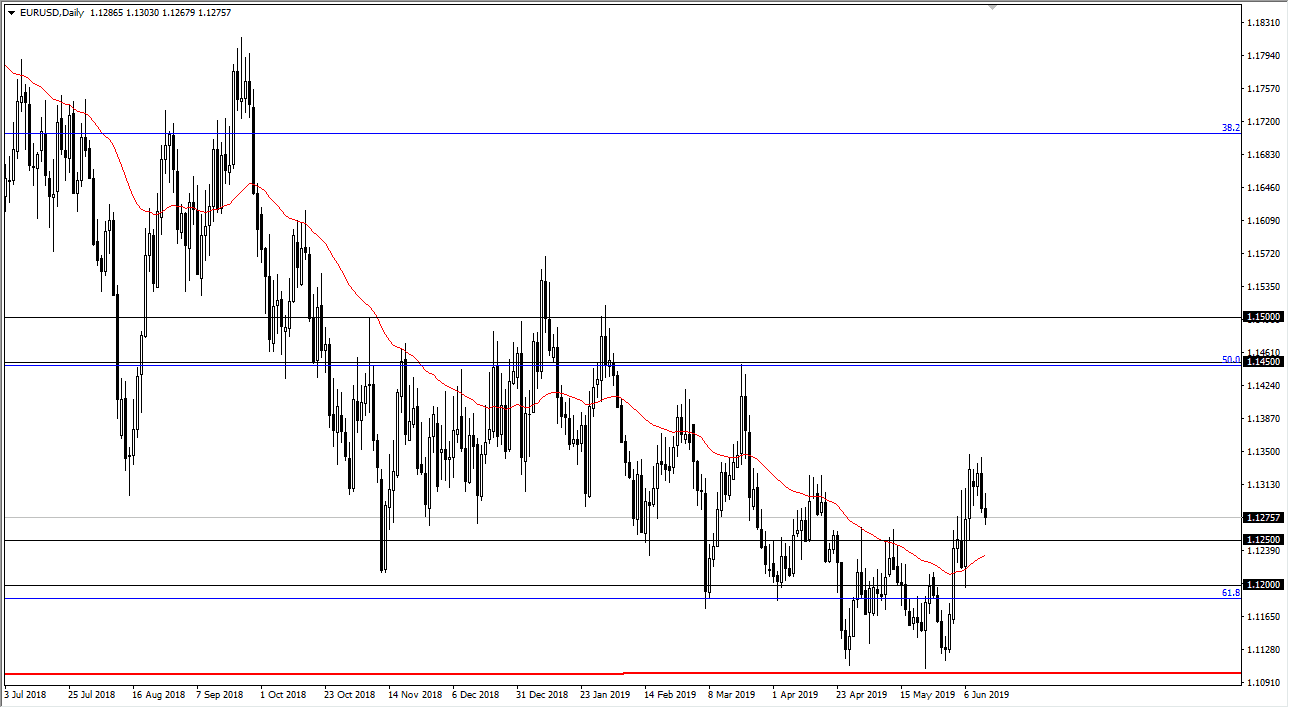

EUR/USD

The Euro initially tried to rally during the trading session on Thursday, but then rolled over a bit. At this point, it looks as if we are going to continue to go lower, and I think that there is a major support area somewhere around the 1.1250 level. In fact, I believe that it extends down to the 1.12 handle after that, so I’m looking for signs of support in that general vicinity using the 50 day EMA as a bit of a proxy. We have recently formed a bit of a “W pattern”, which of course is very bullish in the sign of a bottom trying to be put in. At this point, I am looking to buy this market but I think that I can get better pricing. With the Federal Reserve stepping away from its hawkish stance, it makes sense that we will continue to see a bit of a supportive stance.

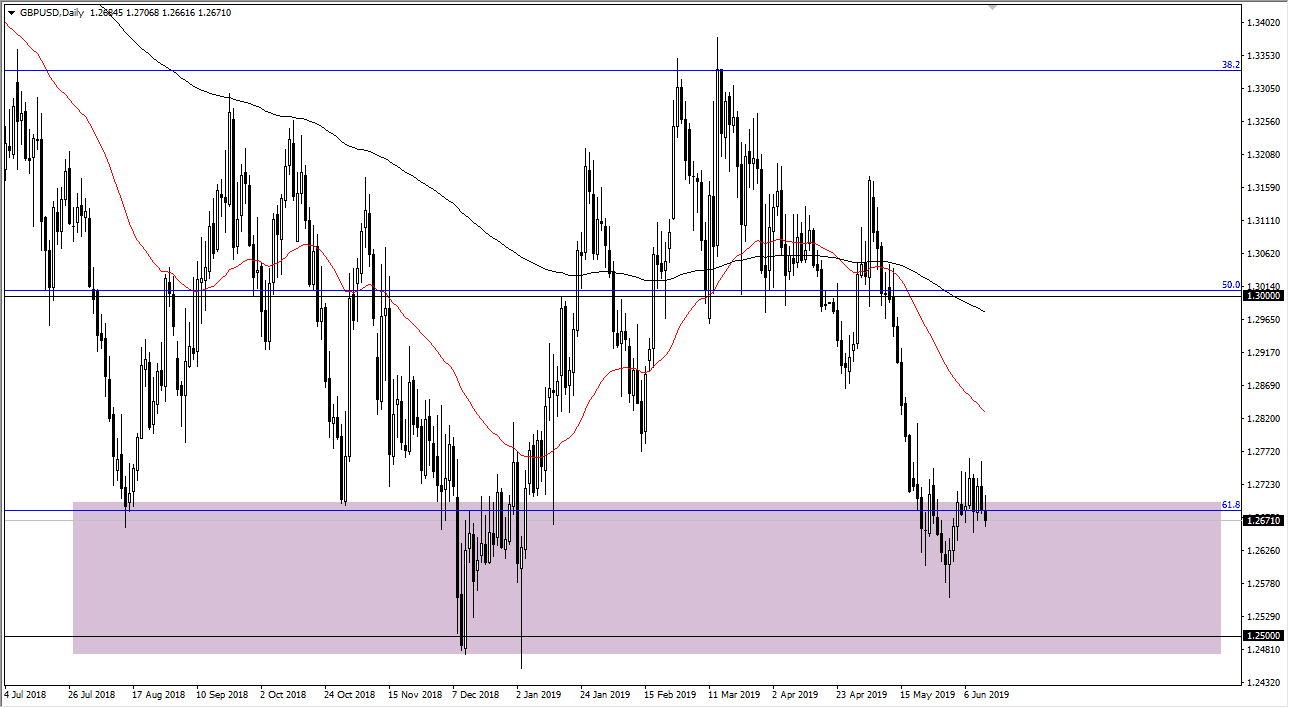

GBP/USD

The British pound tried to rally during the day on Thursday as we continue to form a bit of a bottom down here, but I think this is more about the Federal Reserve than anything else. The British pound has been beaten down significantly, and I think we are trying to form a bit of a base. I believe that as long as we don’t get some type of ridiculous announcement coming out of the Brexit, we could continue to find buyers to grind. That being said, I think you will probably get the occasional pullback that you can take advantage of, as I wouldn’t just jump in right away. The 1.28 level being broken to the upside could send this pair much higher, perhaps as high as the 1.30 level. For me, the absolute “floor” in this market is the 1.25 handle.