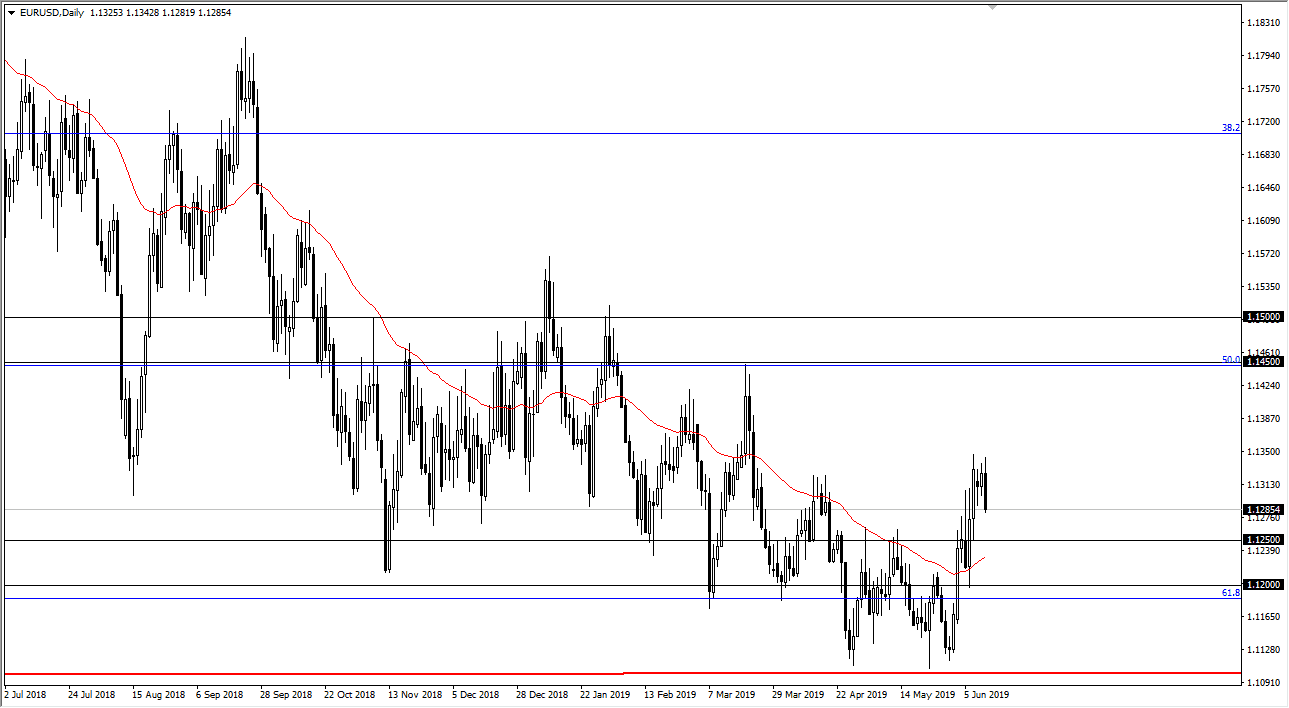

EUR/USD

The Euro initially tried to rally again during the trading session on Wednesday, but then ran into a buzz saw of resistance yet again at the 1.1350 level, which has caused a lot of resistance over the last several sessions. We have since rolled over to show signs of exhaustion, which doesn’t have me shorting this market but rather has me looking at this market as potentially offering a nice buying opportunity.

The red 50 day EMA underneath is just below the 1.1250 level and in the middle of a 50 pip range. I believe that this market may continue to drift a little bit lower from here, reaching towards that area. If we do see some type of bounce from that area, I’m more than willing to jump in and buy this market as it has recently formed a “W pattern.”

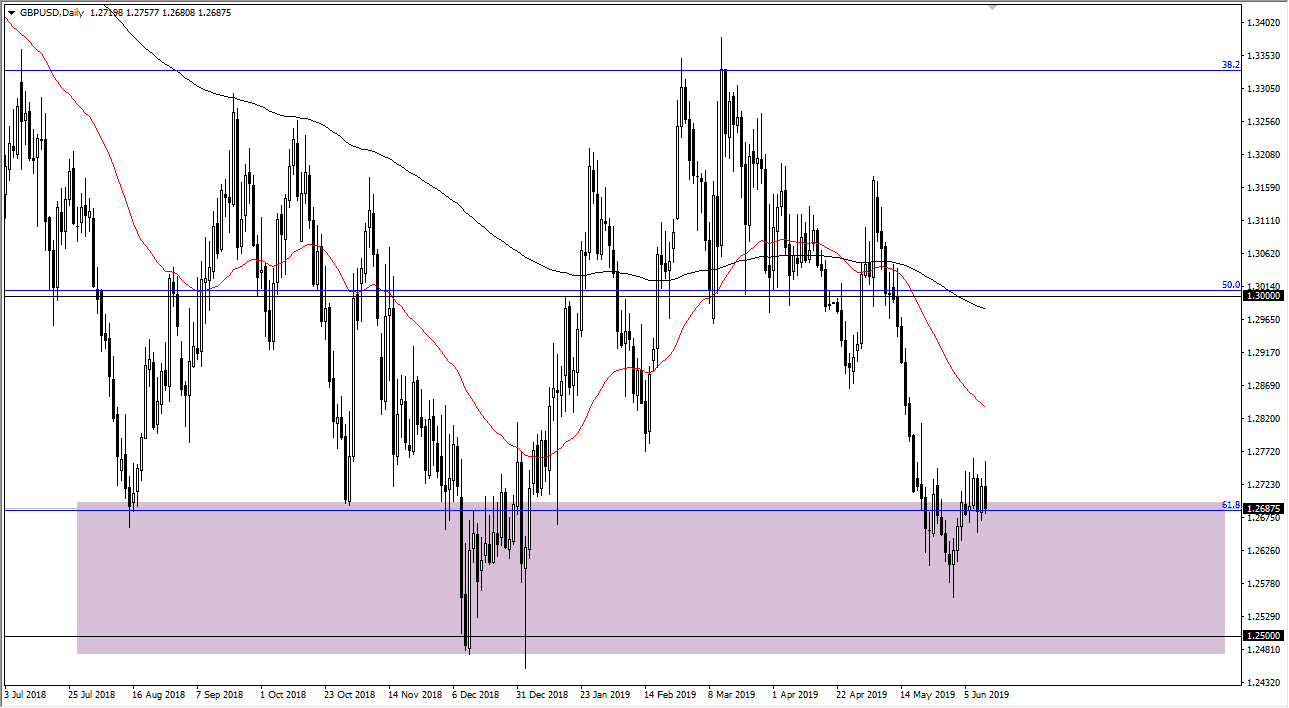

GBP/USD

The British pound try to rally during the day as well, but also pulled back a bit. That being the case, the market looks very likely to try to find support underneath, but at this point the British pound has to worry about the Brexit, which will continue to be a major problem. I see the 1.28 level above as a barrier, but if we were to break above there it’s likely that the market could go to the 1.30 level after that.

In the meantime, I think this market probably pulls back looking for some type of support underneath, as the Federal Reserve has stepped away from an idea of monetary tightening, so that does put a little bit of a floor in what is a historically cheap currency pair. However, I would wait for a pullback to show signs of support before getting involved. I of course will let you know here at Daily Forex when that time comes.