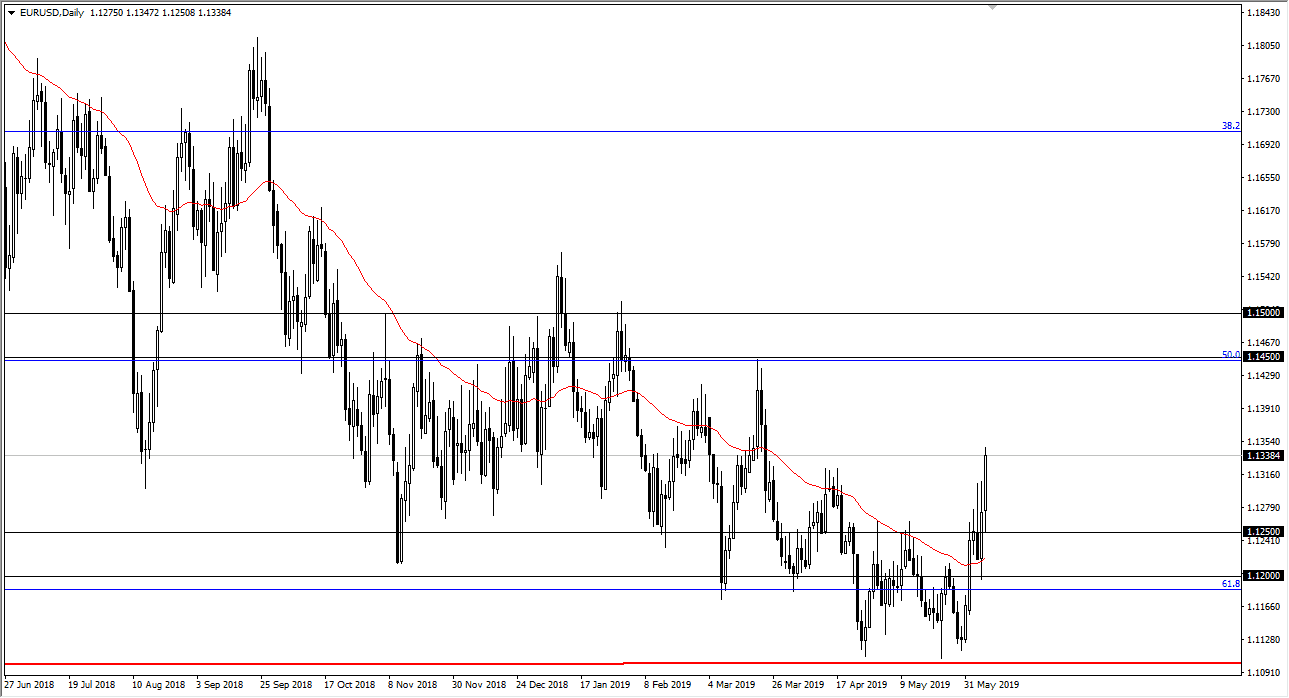

EUR/USD

The Euro initially pulled back during the trading session on Friday, but then found enough support at the 1.1250 level to turn things around and rally significantly. Beyond that, we got a poor jobs report that almost guarantees that the Federal Reserve is going to have to pay attention to the negativity surrounding the United States, and it could send interest rates lower due to the Federal Reserve looking to ease its monetary policy.

Ultimately, we have broken above the 1.13 level, and it looks as if we are ready to go much higher. This being the case, it looks very likely that we will go reaching towards the 1.1450 level above, an area that has been resistance in the past. With the easing coming out of the Federal Reserve, I suspect that pullbacks continue to be buying opportunities.

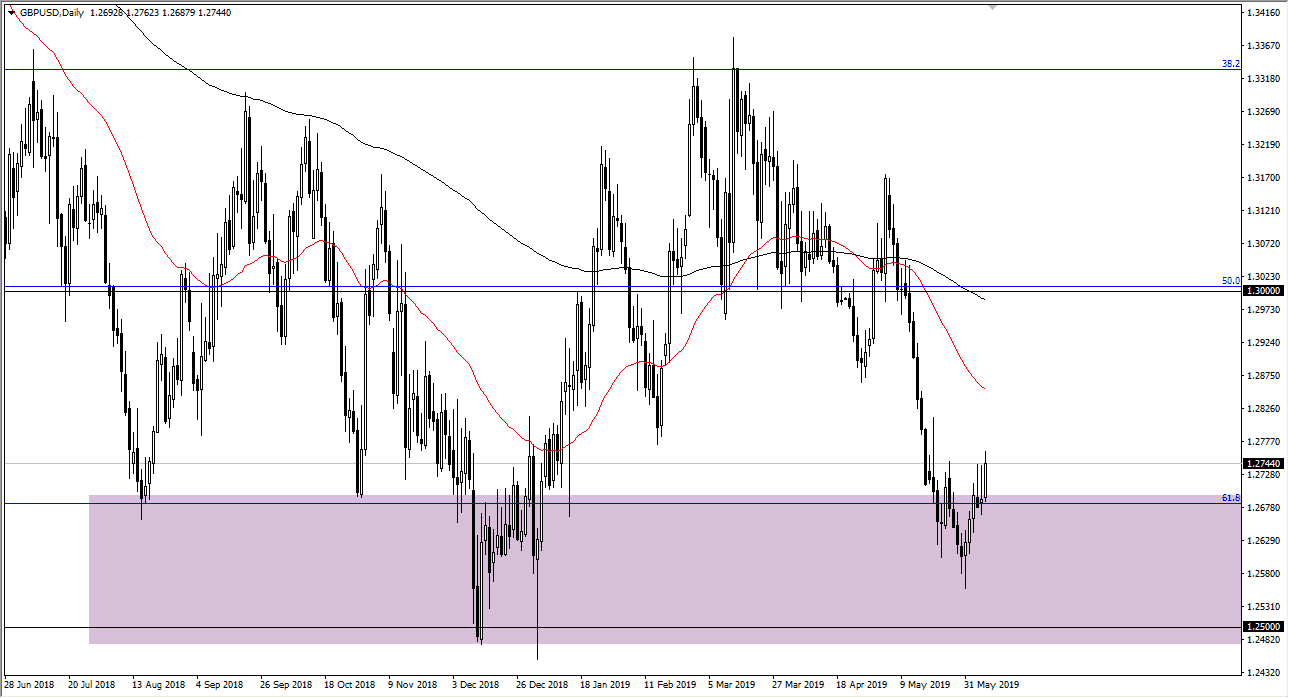

GBP/USD

The British pound rallied a bit during the trading session on Friday, as we continue to see US dollar weakness. While I don’t necessarily think that the British pound is the best currency to own right now, it is historically cheap and it does look like we are trying to break out to the upside. If we can break above the 1.28 level, then we could go to the 1.30 level after that.

Pullbacks at this point should have plenty of interest for value hunters, and the 1.25 level underneath is a massive support level. If we were to turn on a break down through that level, we could see this market fall apart. However, it certainly looks as if traders are starting to focus more the Federal Reserve than the Brexit, so at this point it’s very likely we continue to drift higher. I don’t necessarily think it is going to be a quick move, but a grind it makes more sense.