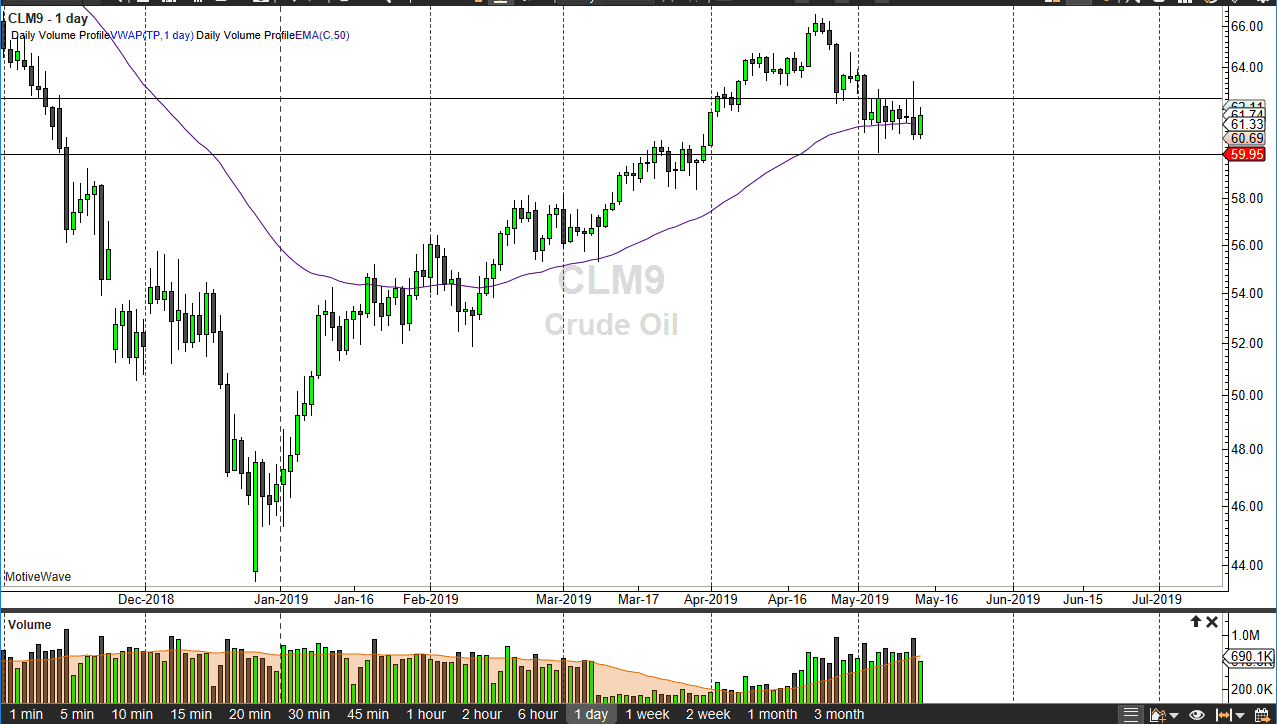

WTI Crude Oil

The WTI Crude Oil market rallied slightly during the trading session on Tuesday, showing signs of resiliency again. Looking at the chart, it appears that we continue to hover around the 50 day EMA, and after the very negative candle stick for the Monday session, this was a bit of a welcome reprieve. However, as you can see the market has been bouncing around in trying to figure out where to go. We are currently stuck in a small trading range, as people worry about the US/China trade relations. All things being equal, if we get good news, then crude oil should go higher. However, as we see saw back and forth, short-term trading is probably the order of the day with the $60 level offering support and the $62.50 level offering resistance. If and when we make a breakout, we’ll know based upon a significantly impulsive and long candle.

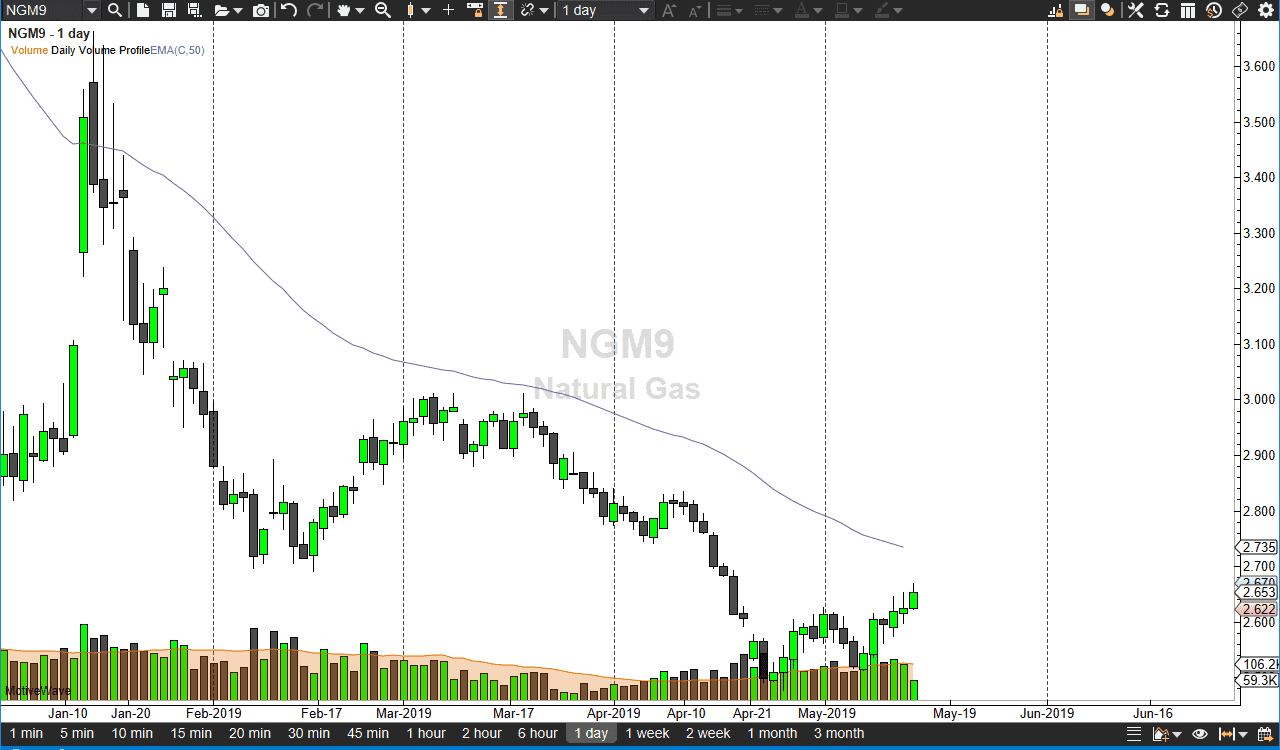

Natural Gas

Natural gas markets continue to drift a little bit higher as perhaps they had gotten oversold. Now that we are at the $2.65 level, it’s very likely that we could drift towards the $2.70 level given enough time. At that point, we should start to run into the 50 day EMA which should offer a bit of technical resistance. It’s not to say that we can’t go higher, it’s just that it’s much easier to short this market this time of year. The demand for natural gas will shrink, as heating is no longer an issue in the northern hemisphere. To the downside, I see the $2.50 level as the “floor” in the market. I’m looking to fade short-term rallies but have not had the opportunity yet.