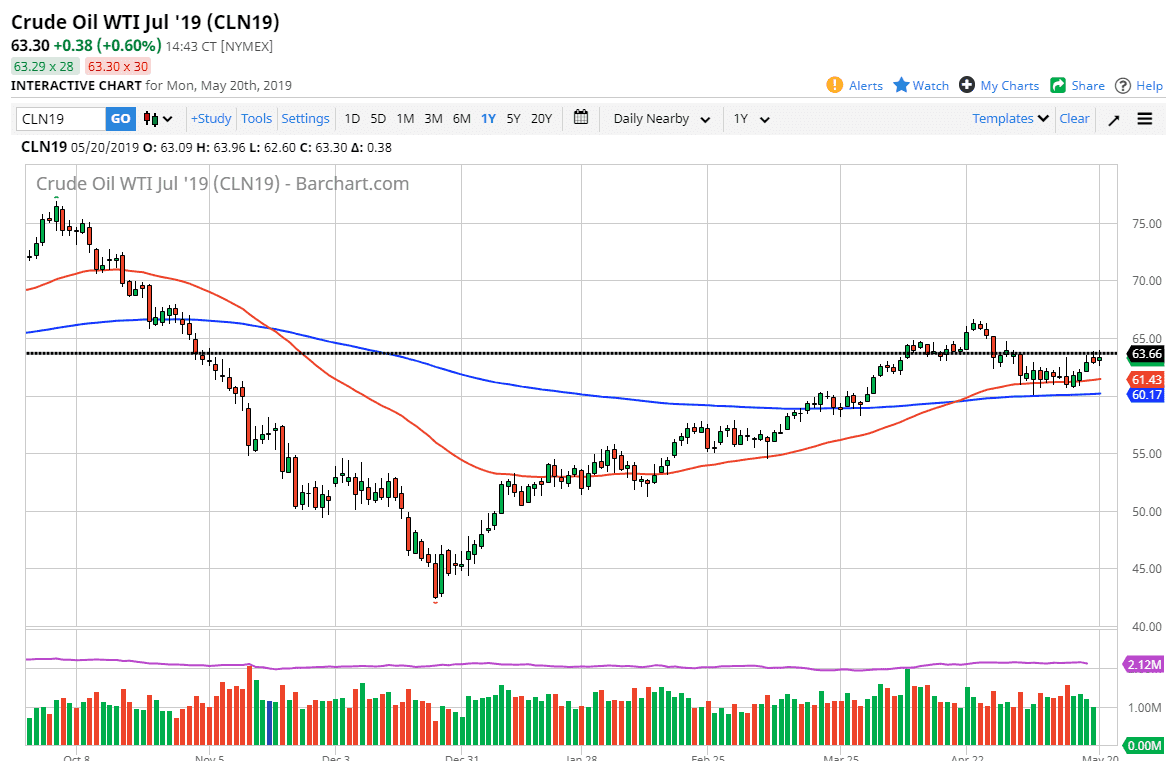

WTI Crude Oil

The WTI Crude Oil market went back and forth during the trading session on Monday, as we continue to see a lot of resistance near the $63.66 level. This is an area that has sold the market off previously, so the fact that we struggle here of course is that much of a surprise. Looking at the $63.66 level you can see that we had broken down a couple of weeks ago and that does mean that we more than likely going to see a lot of order flow in that area. If we can break above there, then it could send the market to the $65 level, possibly even the highs again.

Alternately, if we break down below the bottom of the range on Monday, then it’s likely that we are going to go down to the $61 handle. That is an area that should be supportive, and as long as we can stay above that range there that I think it extends down to the $60 level, it’s probably easier to buy this market more than anything else.

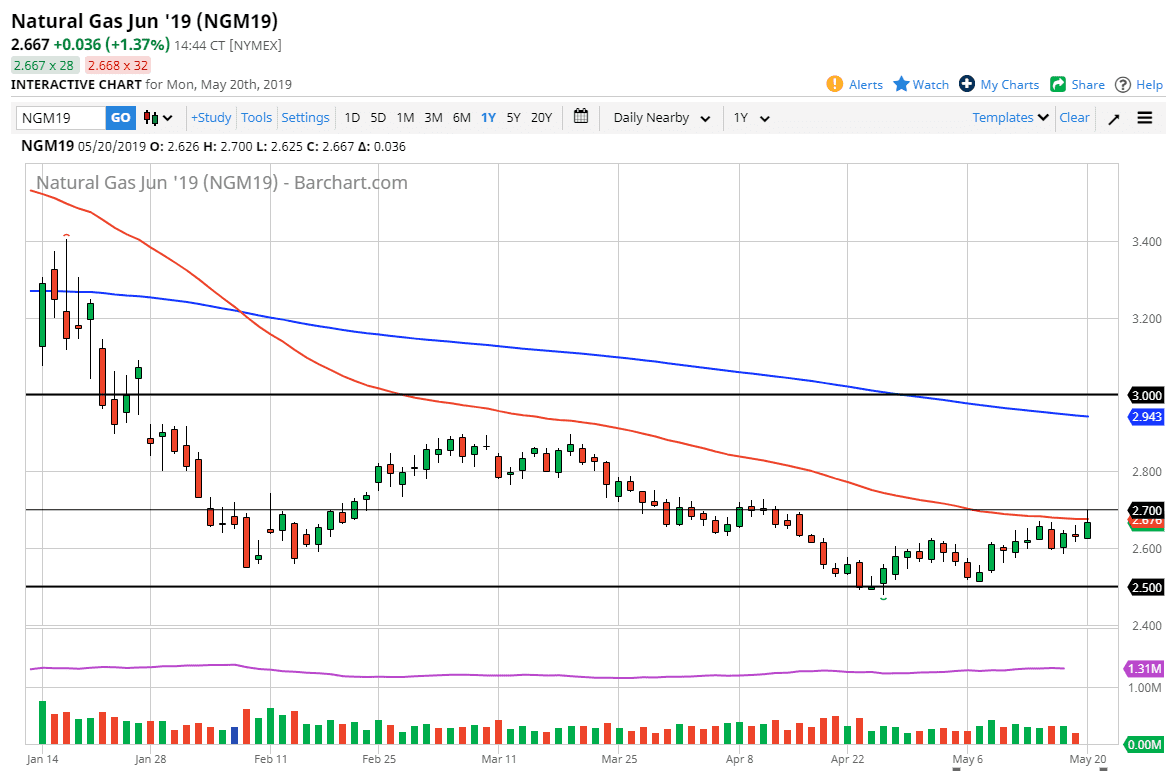

Natural Gas

Natural gas markets shot higher during the trading session on Monday, reaching towards the $2.70 level. This is an area that of course is crucial because the market does tend to move on $0.10 increments. Beyond that, we have the 200 day EMA just above there, so I think it’s only a matter time before the sellers get involved. Signs of exhaustion should be invitations to short this market which of course has been negative for some time. Beyond that, it’s cyclically the wrong time of year for buyers to come in and hang on to the market for a long position. Selling rallies on short-term charts will probably continue to be the best way to trade this market.