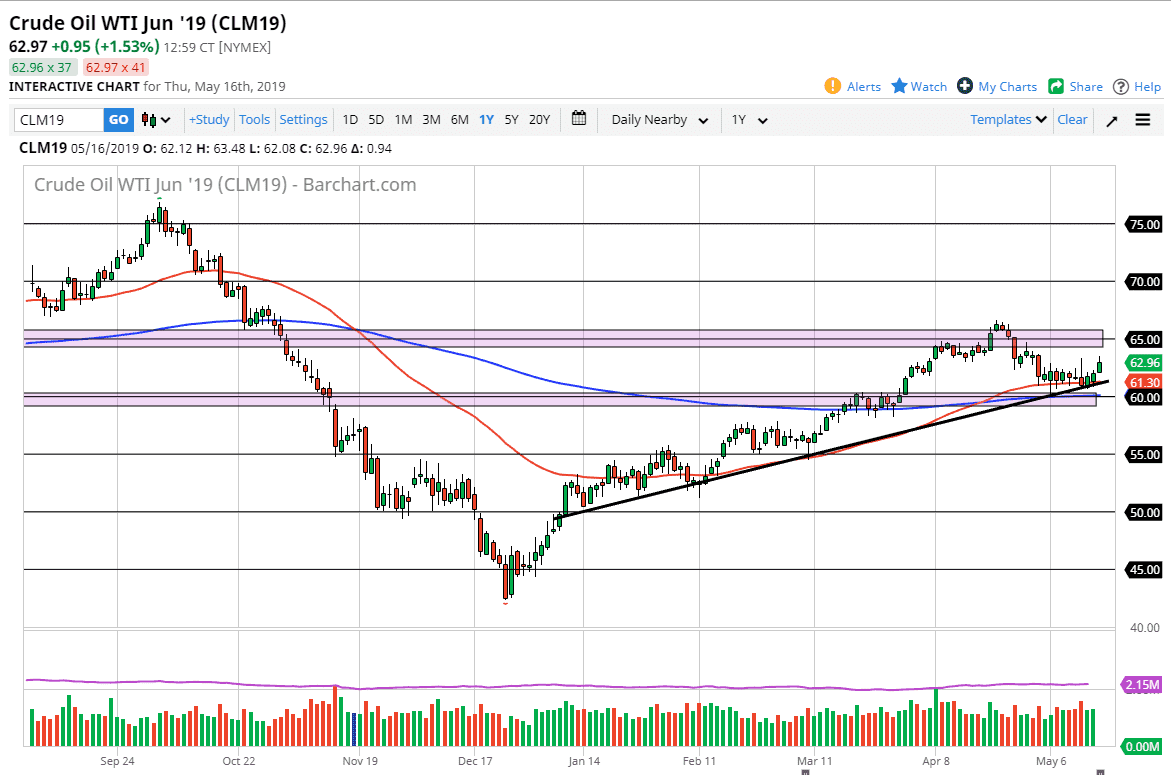

WTI Crude Oil

The WTI Crude Oil market rallied during the trading session on Thursday but did give back some of the gains. However, it does look like we are trying to work our way higher and that of course is a good sign. Short-term pullbacks continue to be value from what I see, and therefore I don’t have any interest or desire to start shorting this market. In fact, I’m not a seller until we break down below the $60 level at this point.

After all, the uptrend line has held and so has the 50 day EMA. That doesn’t mean that the movie higher is going to be easy, and that’s part of why I put in the caveat that I’m a buyer of short-term pullbacks, and not necessarily looking to buy the market right away. The $65 level above is going to be extraordinarily formidable.

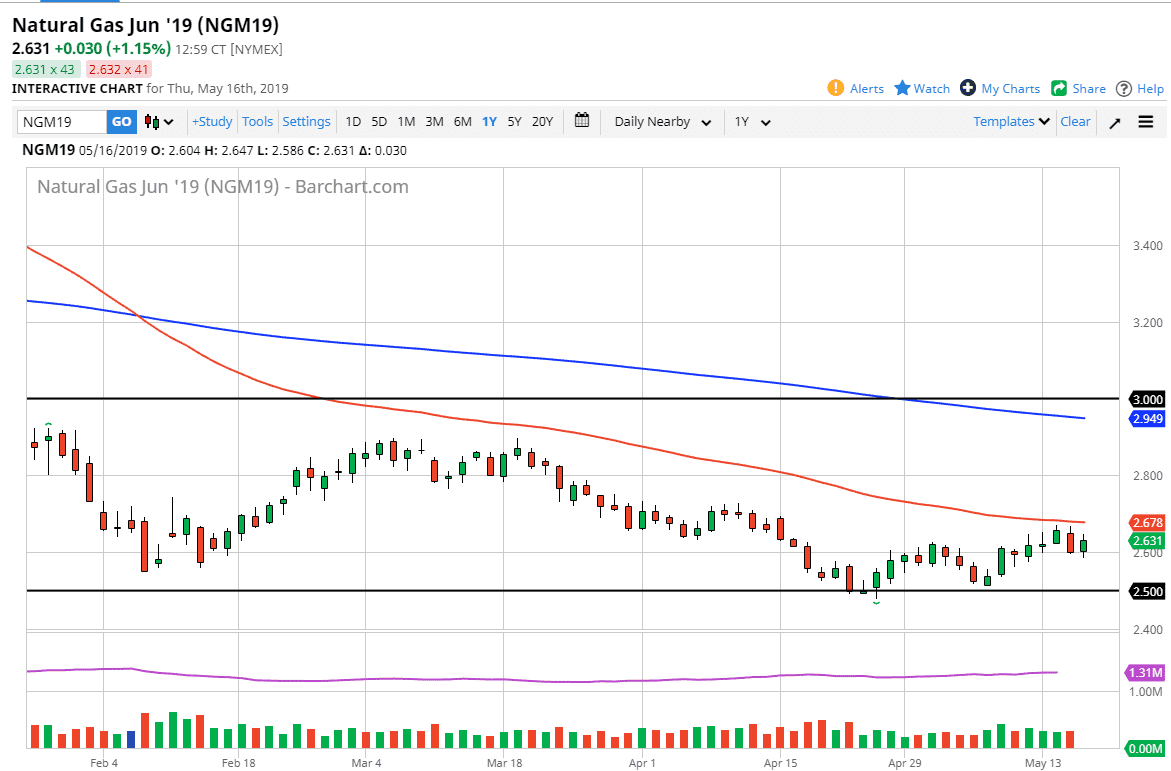

Natural Gas

Natural gas markets rallied during the day as well, using the $2.60 level as a bit of a springboard. The inventory number wasn’t as bad as a lot of people expected, so they gave natural gas a little bit of hope. Ultimately though, this is a market that is in the wrong time of year to expect a lot of strength, as drilling season will fill those stockpiles rather quickly. Short-term rallies are selling opportunities, but this market may move in what is essentially slow-motion at this point.

I believe that the $2.50 level underneath is going to be a massive floor in the market and breaking down below that level would be extraordinarily negative sign. I think in the intermediate term we are looking at selling rallies closer to the 50 day EMA which is pictured in red, and then and $0.10 intervals all the way up to the $3.00 level. I have no scenario in which I am willing to buy this market.