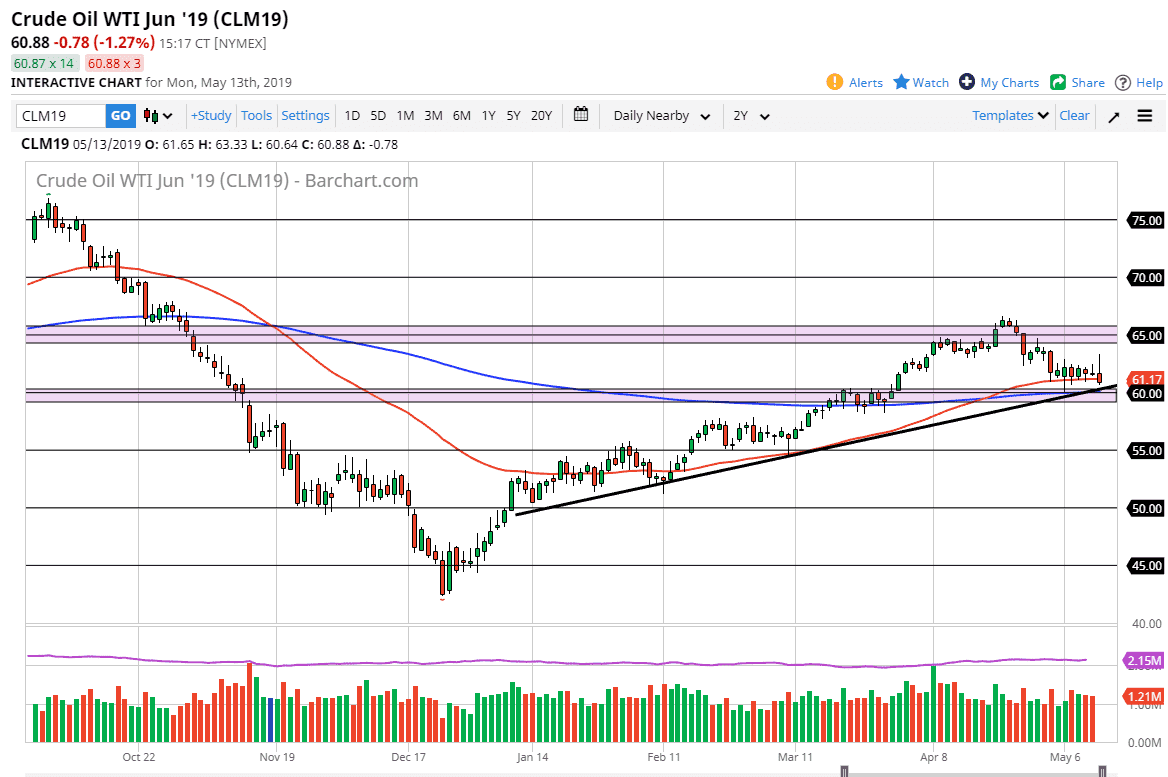

WTI Crude Oil

The WTI Crude Oil market shot higher initially during trading on Monday, but then reversed drastically to form a rather negative candle stick. We are sitting just above a major trendline and of course major pricing, as well as major moving averages. In other words, there is a ton of support underneath but I’d be lying if I didn’t point out that this candlestick doesn’t exactly instill confidence. At this point in time, if the market were to break down below the uptrend line and perhaps even the $59 level, it’s likely that we would find a move to the $55 level happening rather quickly.

On the other hand, if we were to rally from here we could get short-term gains but I think that it’s very likely we would continue to struggle and I think that short-term sellers would probably come back into the market to start selling again. While I’m not ready to short this market quite yet, I don’t know that I’m going to be participating in any short-term rally.

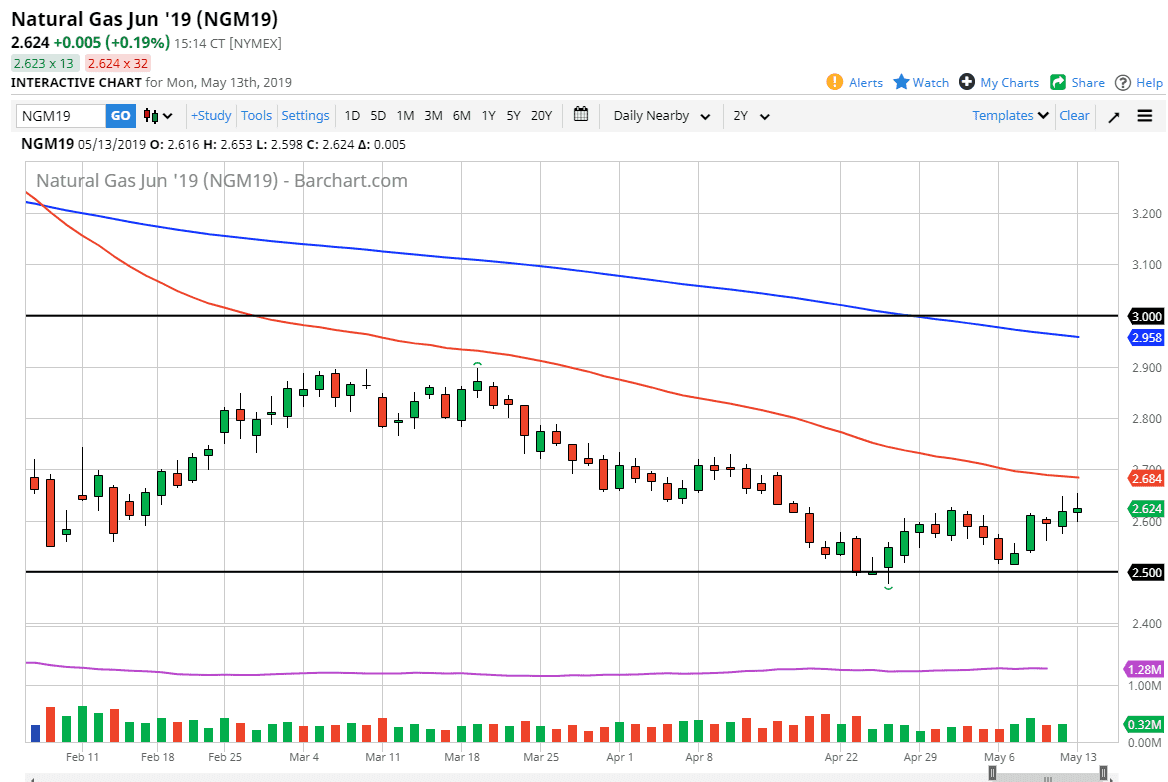

Natural Gas

Natural gas markets continue to go back and forth, with a slight gain being the result. However, we have a lot of resistance above, in not only the $2.70 level, but also the 50 day EMA which is currently just below that level. Because of this, I think signs of exhaustion will continue to be sold, and therefore I think it remains a short-term traders type of situation. Seasonally speaking, we shouldn’t get much in the way of a rally, but if we do it will more than likely be punished right away. Any move above the $2.70 level would be a bit surprising and could bring in fresh buying. At that point, I’d be looking to sell closer to the $2.90 level.