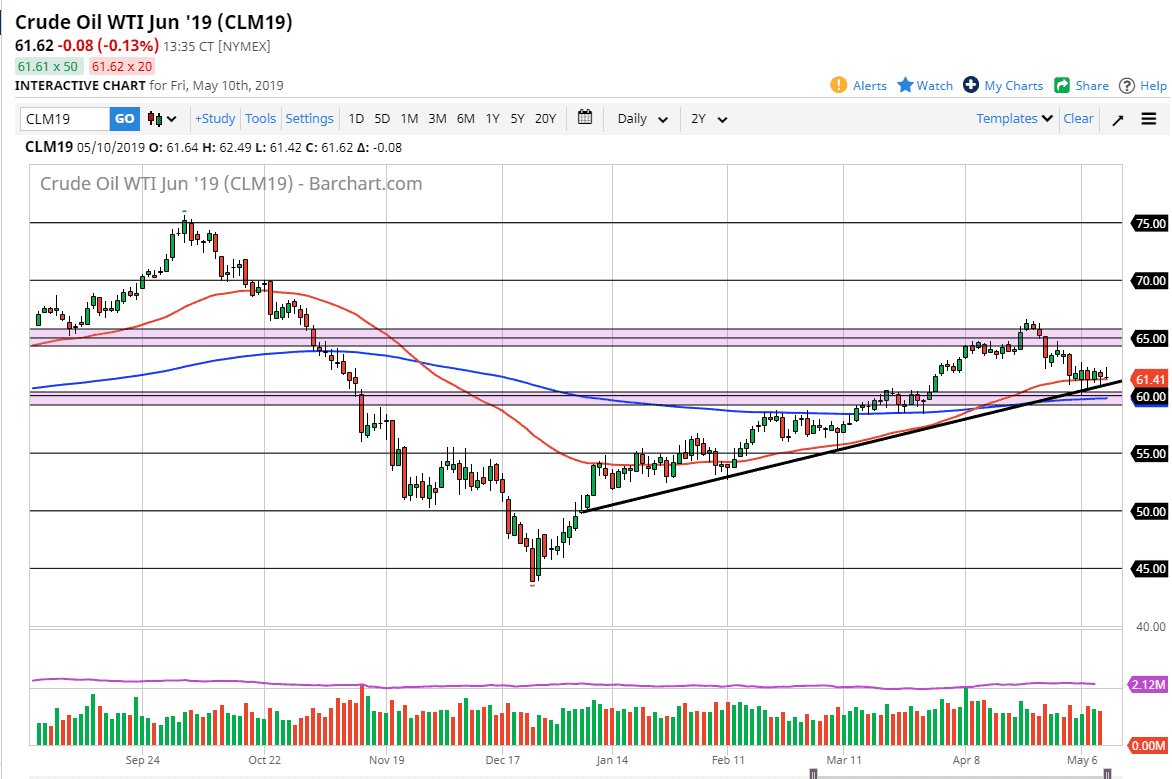

WTI Crude Oil

The WTI Crude Oil market went back and forth during trading on Friday, as we continue to hug at the 50 day EMA in general. Ultimately, this is a market that continues to go sideways as we await the results of the US/China trade relations. As they have agreed to meet later, I think a lot of people are starting to simply sit on the sidelines and wait for the next impulsive candle.

If we can break above the highs of the Friday session, it’s very likely that we will go to the $64 level, followed by the $65 level. If we break down from here we have to deal with the trend line, the $60 level, and the blue 50 day EMA, all of which should be rather supportive. It is because of this that I think there is significant buying pressure underneath, but I do have these levels to pay attention to in order to place a trade.

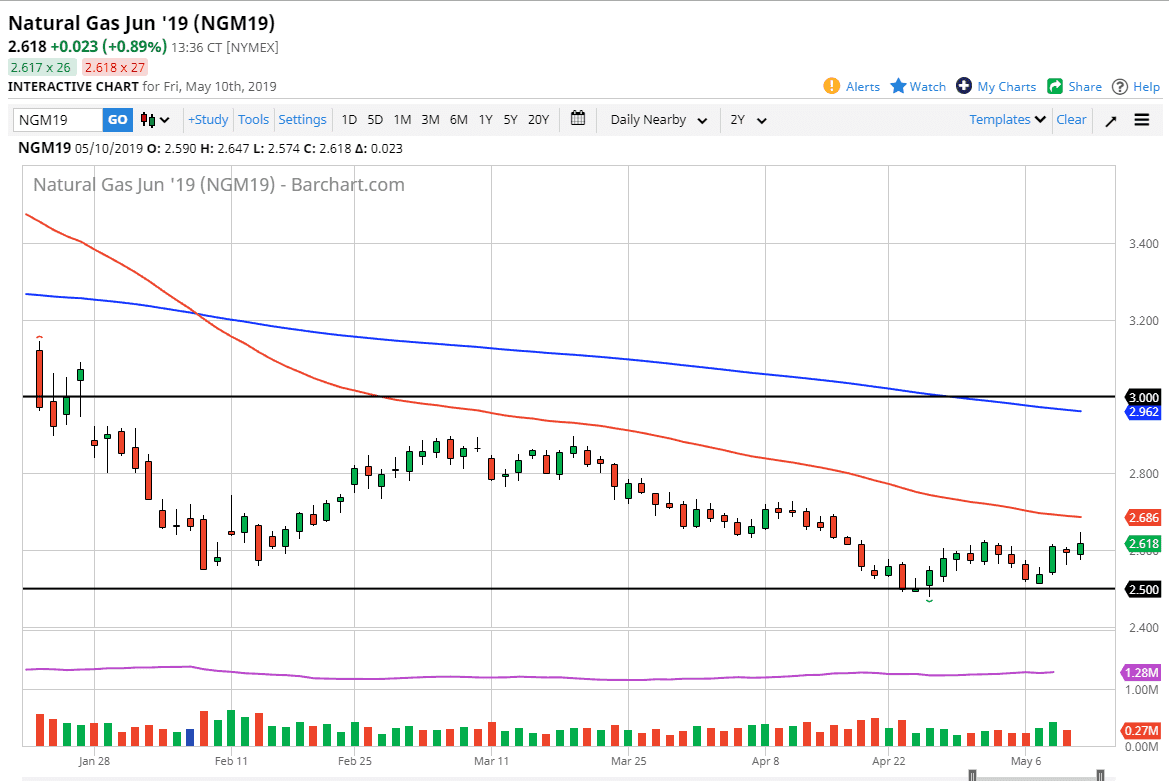

Natural Gas

Natural gas markets had a slightly positive session during the day on Friday, reaching towards the $2.63 level before giving back some of the gains. Nonetheless, we are still bullish in the short term and I think that given enough time we will rally again. That rallies should lead to a selling opportunity though, maybe near the 50 day EMA which is the red moving average just above. The $2.70 level could be a selling opportunity as well. I’m looking for signs of exhaustion to take advantage of and start selling as this is most certainly a very negative market. That being said, we are at extreme lows so it makes sense that we would get a little bit of profit taking in this area.