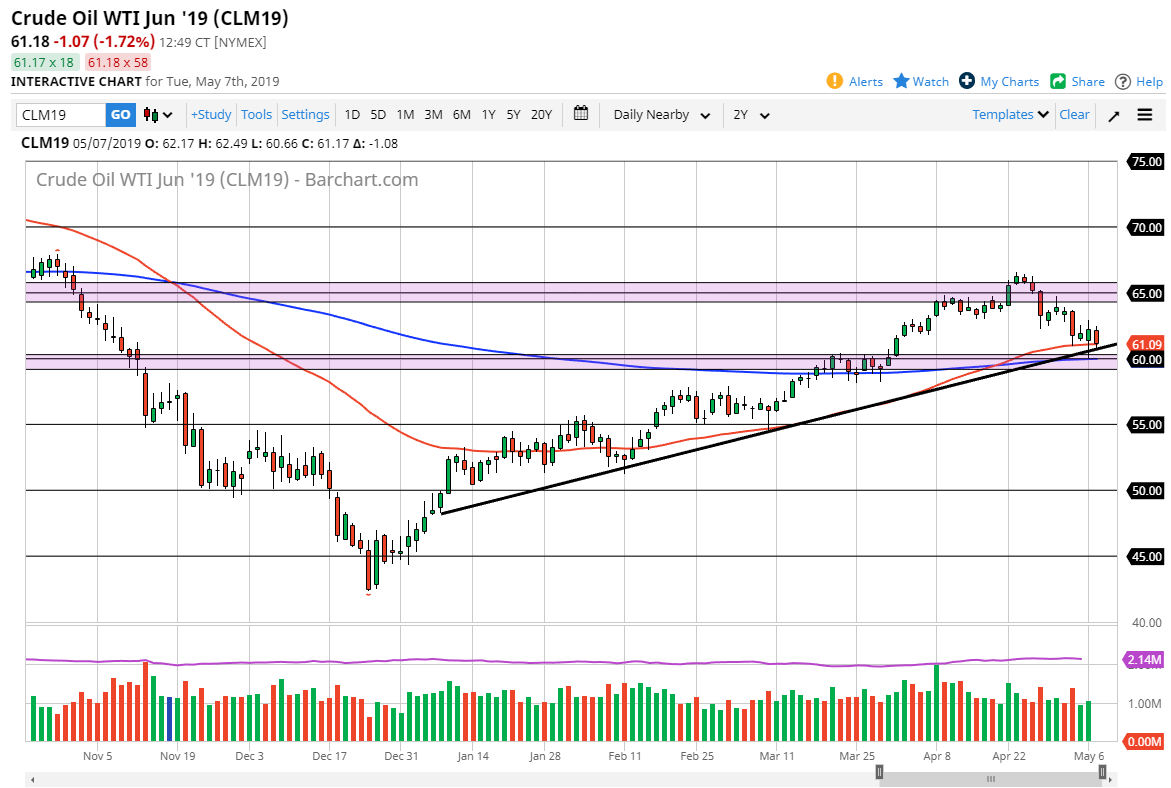

WTI Crude Oil

The WTI Crude Oil market fell during the trading session and a chaotic move formed. We are testing the 50 day EMA, and of course the uptrend line just below. At this point, the market continues to see a lot of support underneath, especially near the $60 level and although the market did break down towards that level on Monday, the Tuesday session wasn’t anywhere near as bearish, although it certainly didn’t seem like that. That being said, we are still very much in and uptrend, so although things were a bit difficult, you should keep in mind that we still have more people interested in buying than selling, at least at the moment. However, if we were to break down below the $59 level, the market could unwind quite drastically, probably down to the $55 level.

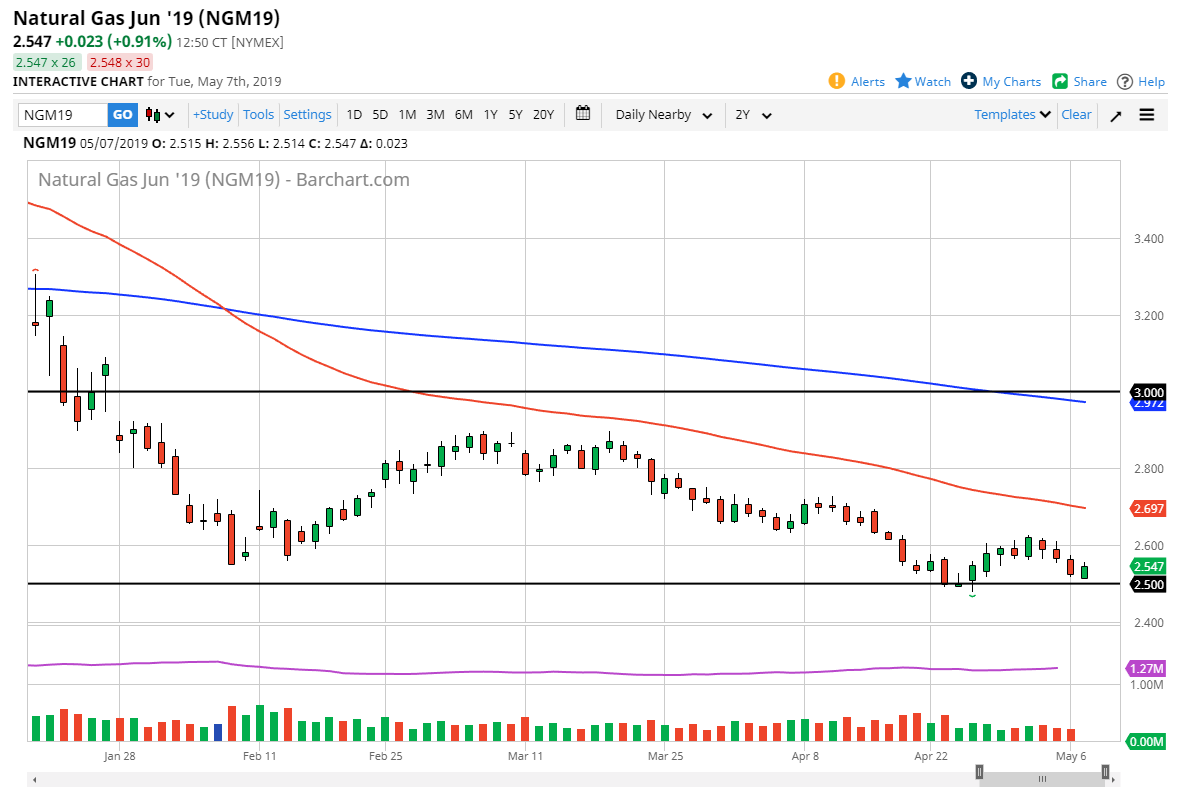

Natural Gas

Natural gas markets rose a bit during the trading session on Tuesday, bouncing from the $2.50 level. Overall, this is a market that is in a major downtrend, so although we are at extreme lows I think the prudent trader will sit on the sidelines and wait for selling opportunities after these bounces. The alternate scenario of course is that we continue to go lower and break down below the lows, perhaps reaching towards the $2.25 level. If we get that going on, that would be an extraordinarily negative sign.

The $2.60 level above is probably the first selling opportunity, so keep that in mind. If we see signs of exhaustion there then I would be a seller. Otherwise, we could go to the $2.50 level which is closer to the 50 day EMA, which is also an area where we probably are going to see sellers. I do not expect natural gas to be bullish for any length of time until November.