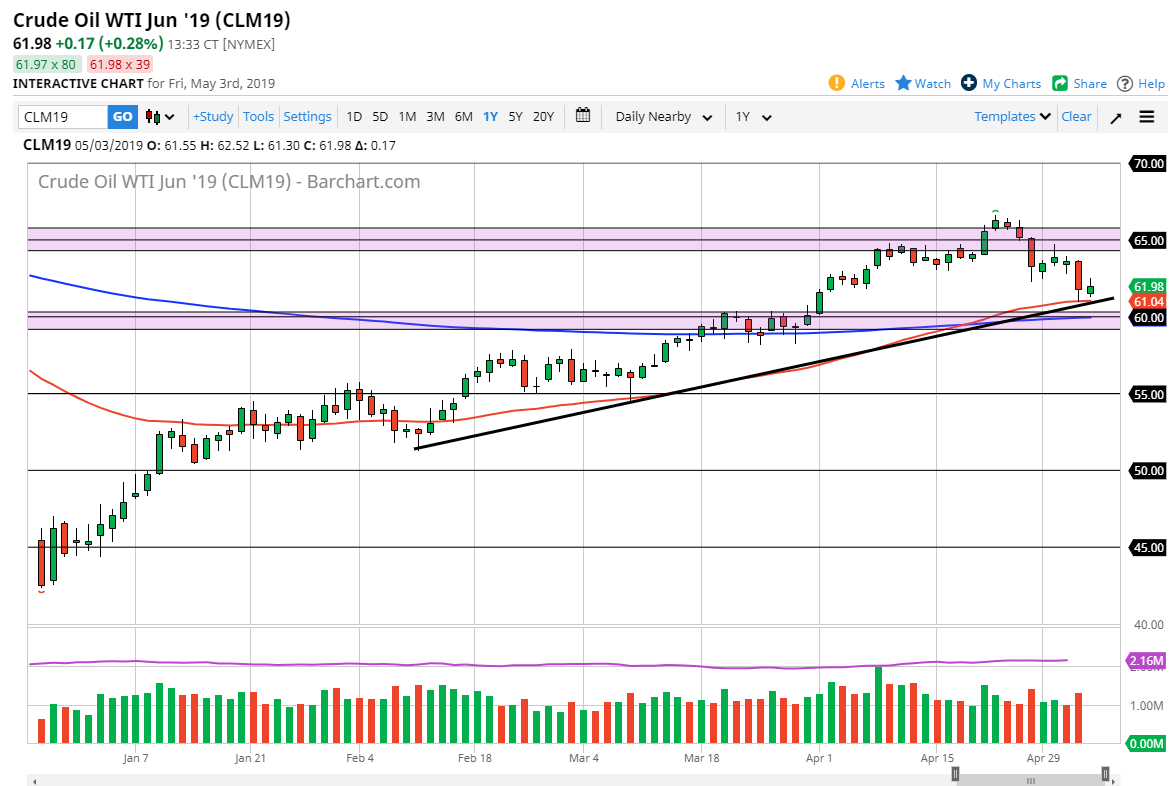

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Friday, as the jobs number came out relatively bullish. With that being the case of the idea of demand of course comes back into play. We also bounced from the 50 day EMA, and of course the trend line that I have marked on the chart. The $60 level underneath of course offers support as well, so at this point I think it’s probably well propped up.

However, there is a lot of resistance above at the $65 level, so I think this leads to an idea of range bound trading. That being said, if we break down below the 200 day EMA which is at the $60 handle, we will go much lower, perhaps down to the $55 level. The $65 level above is massive resistance, so if we were to finally clear above that level, then we could go to the $70. Overall, I think we are at an inflection point, so pay attention for impulsive candles.

Natural Gas

Natural gas markets initially tried to rally during the trading session on Friday but fell back over as we continue to see negativity. The market looks as if it is ready to go back towards the $2.50 level, an area that of course is massive support and has been for some time. If we break down through that level, it could be quick to the downside, perhaps reaching down to the $2.50 level. Overall, markets look likely to see a lot of fading of the rallies, so I like the idea of shorting exhaustive looking candle sticks after short-term rallies. Longer-term, I think that we could eventually rally towards the $2.90 level, but that is more than likely going to be later this year.