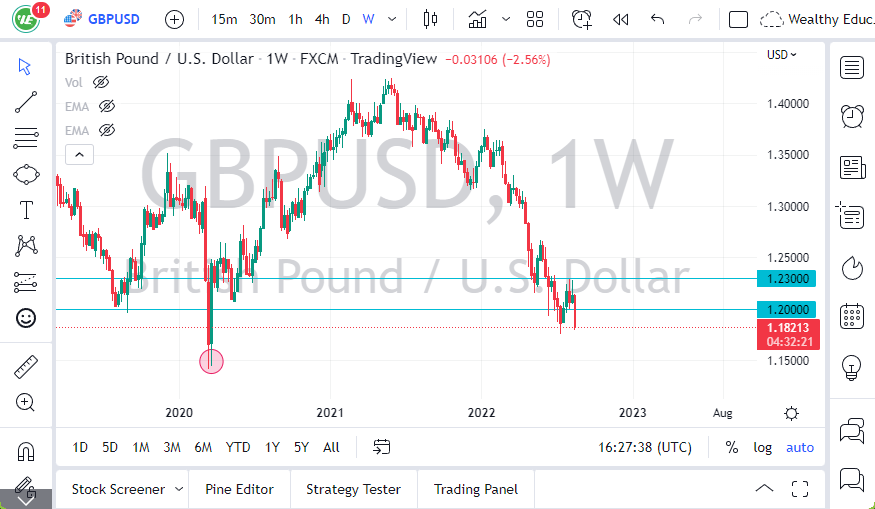

GBP/USD

The British pound had an explosive week to the upside, and it looks as if we are trying to reach towards 1.32 handle. If we can break above the recent highs, from about two months ago, we could see this market continue to go to the upside. As this last week has destroyed a lot of the bearish pressure in the market but we still have some work to do. I suspect that short-term buyers are going to continue to jump into this market after this action. You could make a bit of a slight argument for an inverse head and shoulders.

USD/JPY

The US dollar fell during the week, as we continue to see a lot of volatility. We are basically hanging around the ¥111 level, and I think if we break down a little bit from here will probably go looking towards the ¥110 level. Otherwise, we could go back towards the ¥112 level but it’s very likely to be difficult to break above that level in the short term. Longer-term, will have to wait and see.

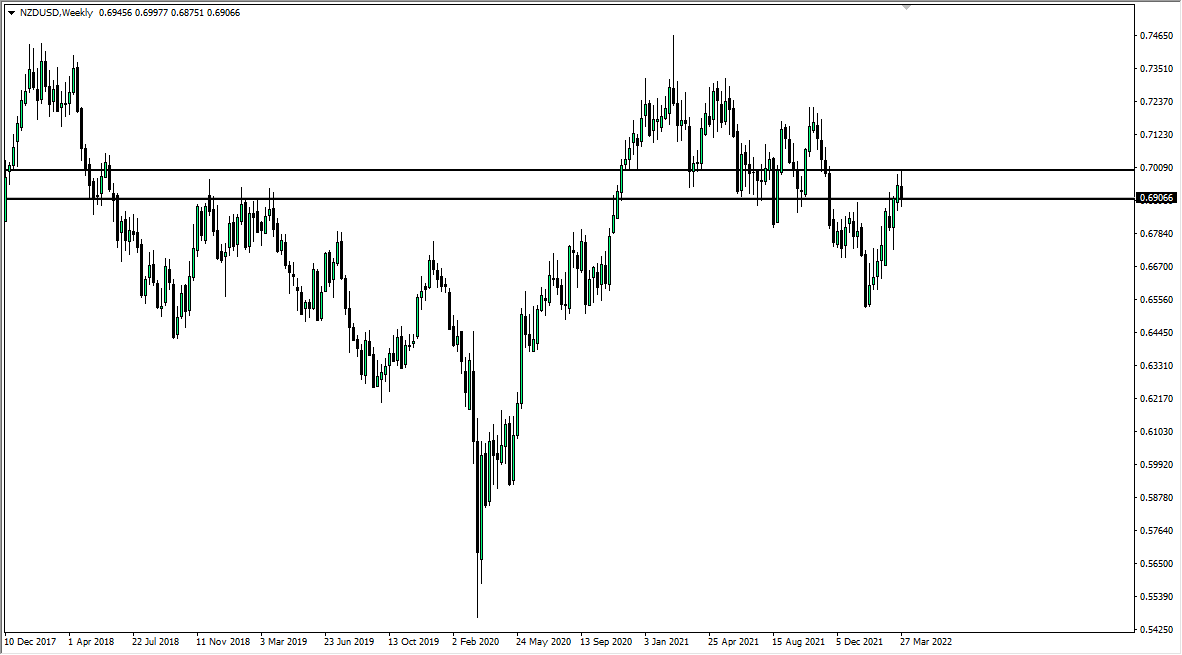

NZD/USD

The New Zealand dollar fell again during the week but continues to find plenty of support at the 0.66 level. At this point it looks very likely that the New Zealand dollar will continue to find buyers so I like the idea of going long at this point. If we break down below the 0.66 handle, then things could change a bit but it certainly looks as if the buyers are starting to show a lot of tenacity, and therefore we could see a bit of a rally from here.

EUR/USD

The Euro rallied a bit during the week but did give back quite a bit of the gains only to turn right back around again. It looks as if the 1.12 level is going to cause a significant amount of resistance, but if we were to break out above the highs of the week, that could make this market looking towards the 1.14 handle. Otherwise, it’s very likely that we drift towards the 1.10 level but it may take several weeks to get there.