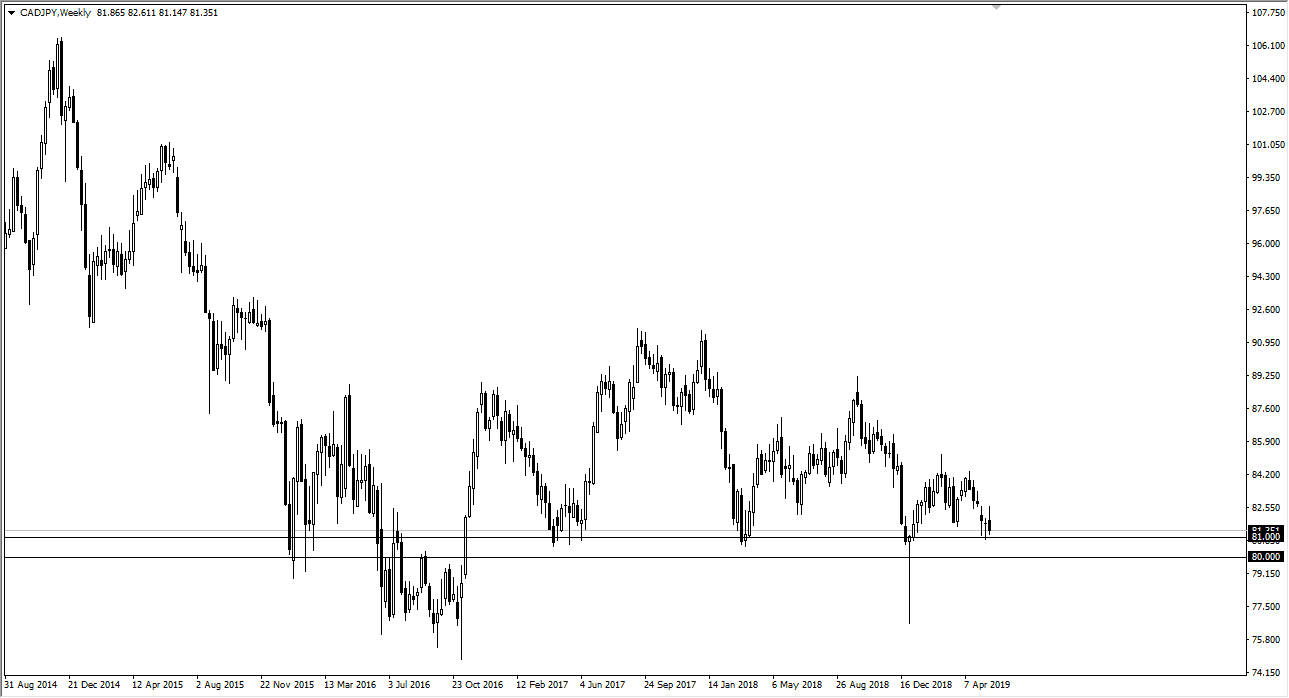

CAD/JPY

The Canadian dollar initially tried to rally against the Japanese yen during the week but has pulled back rather significantly. By forming the candle stick that it has, it looks as if we are trying to break through major support. That support extends from 81 down to the 80 handle. I think if we break down through that level, we could go as low as 77. Keep in mind that this pair tends to follow oil, and oil looks like it’s being threatened at this point. It’s very possible that we break down. To the upside though, I believe that the 83 handle will continue to be major resistance.

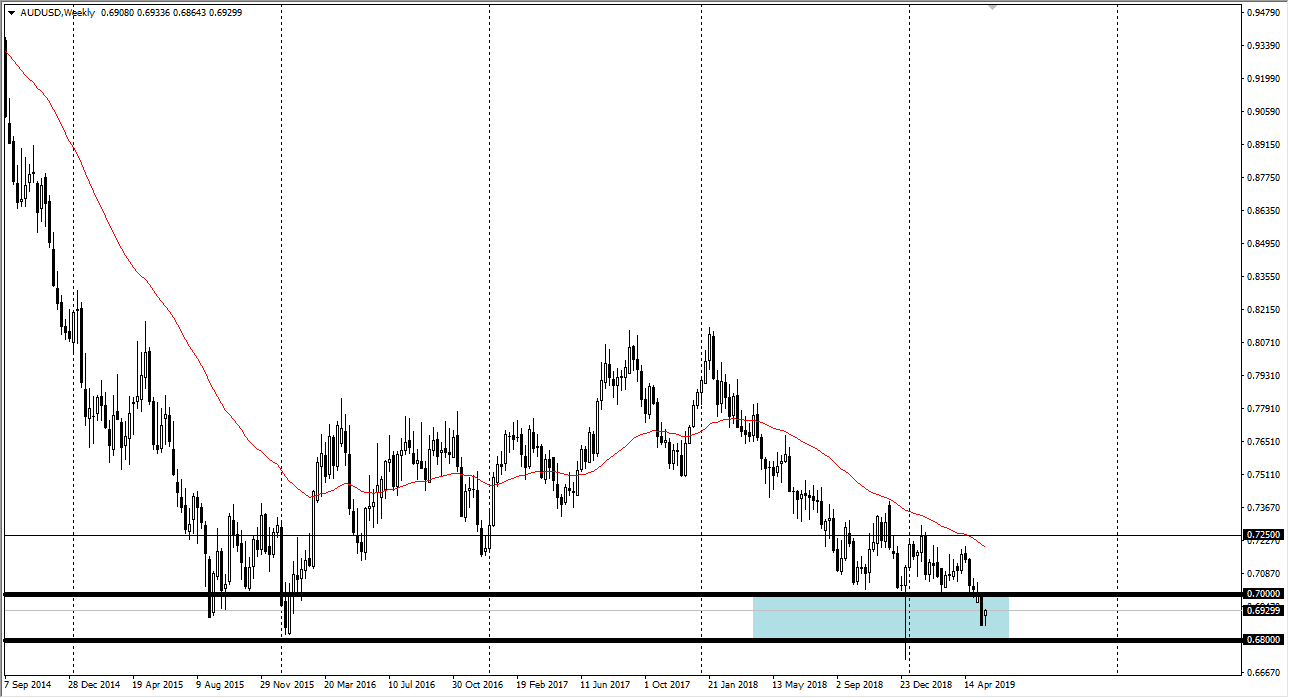

AUD/USD

The Australian dollar gapped higher to kick off the week and then spent most of it going back and forth. However, as we got towards the end of the week, we turned around and gained pretty significantly towards the weekend. The question now is whether or not there was real buying, or was it simply short covering heading into a three day weekend in America with the ability of headlines to cause chaos due to the US/China trade relations? I suspect that’s probably the reality and therefore this week will probably continue to feature back and forth trading within the same range that we have been in for two weeks.

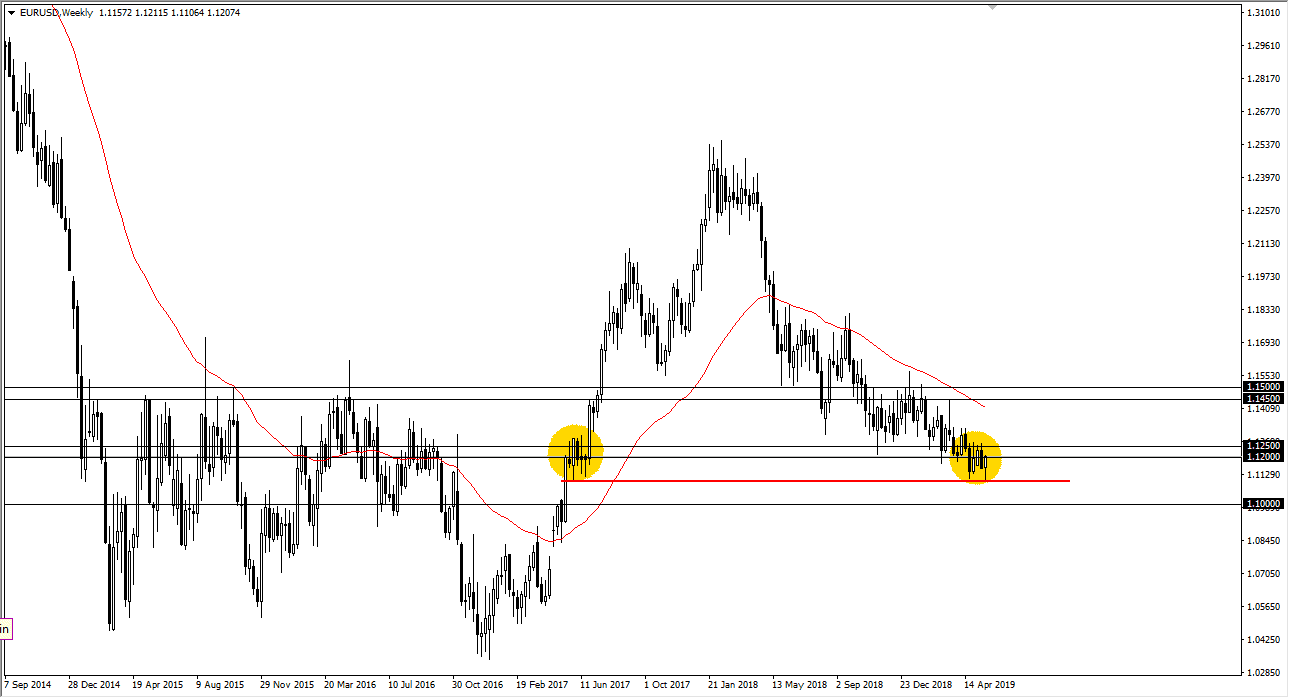

EUR/USD

The Euro had a very strong Friday, capping off a nice-looking hammer for the week. However, there is a significant amount of resistance above at the 1.1250 level. If we can get above there, then the Euro could make a move. In the short term though, I think that we will see a lot of noisy trading, and therefore I suspect that you will probably need to look to short-term charts to pick up small dips for value. If we break down below the 1.11 handle, then it opens the door to the 1.10 level.

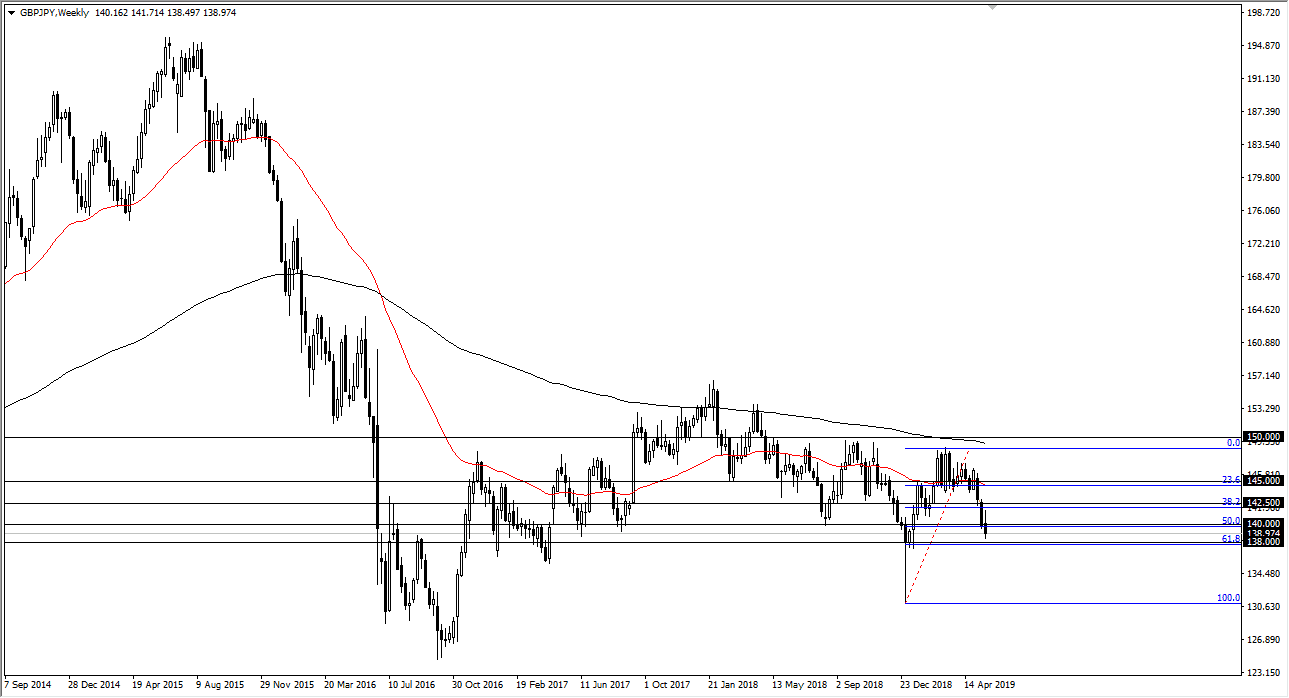

GBP/JPY

The British pound initially rallied during the week but has been repelled by the ¥142 level. By doing so, we have broken significantly lower, finding a bit of support near the ¥138 region. That is the 61.8% Fibonacci retracement level, and I think what we are going to see is a lot of choppiness during the week but if we do break down below the ¥138 level, look out below as we will more than likely drop another 300 pips rather quickly.