The US dollar continues to be very choppy against some emerging market currencies, and of course the South African Rand will be any different. At this point, it’s very likely that the market continues to see both resistance and support based upon a very unstable global outlook for trading. The South African Rand of course is an emerging market currency, so it’s a place where people will put money when they want to express a “risk on” fashion.

Contrast that with the US dollar that of course is the ultimate safety currency, with maybe the exception of the Japanese yen, so in that environment it’s easy to see which direction we “should be moving in” based upon what other markets are doing. We have seen a lot of choppiness and volatility during the Monday session when it comes to risk appetite, so it makes sense that we have formed a relatively neutral candle.

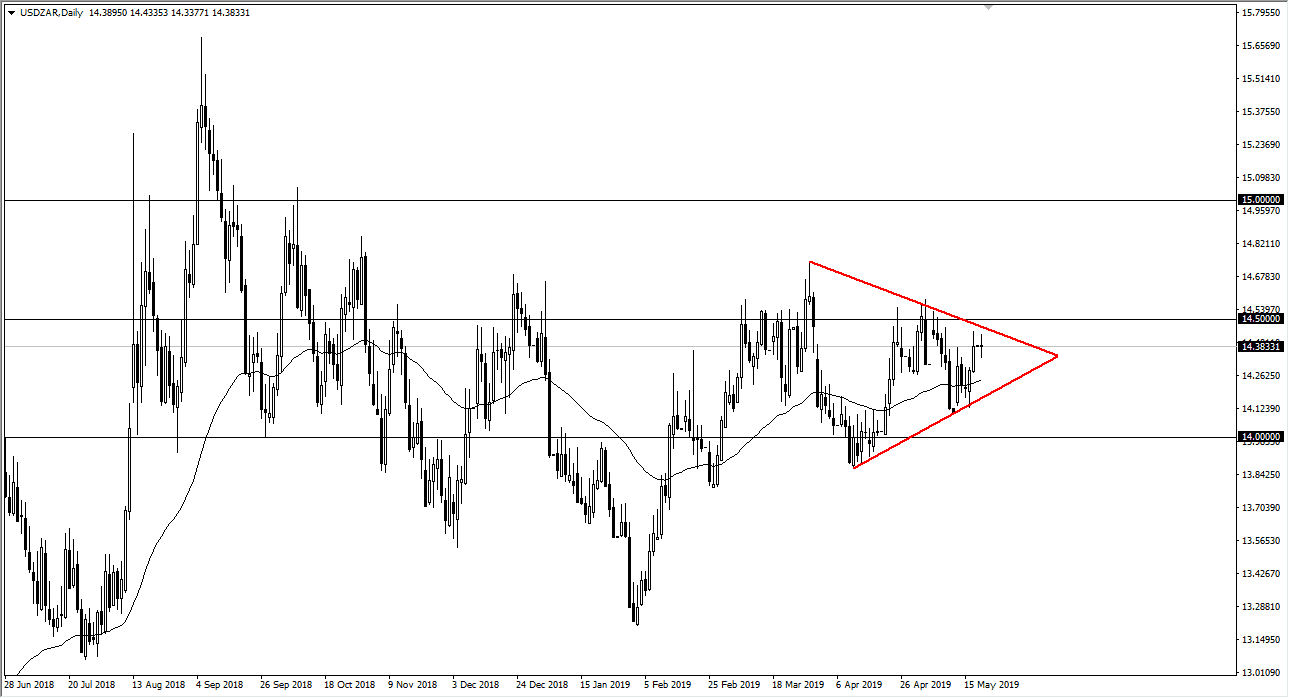

Adding more fuel to the fire of the neutral candle stick is the fact that we are in a symmetrical triangle, so of course it makes sense that the markets would be a bit back and forth as well. I think if we can break above the top of the downtrend line, then the market opens up to the 14.50 Rand level, and then possibly the 14.75 Rand level. On the other side of the coin, if we break down below the lows of the session on Monday, we will probably go looking towards the uptrend line underneath. Obviously, a breakdown below that uptrend line could send this market down to the 14 Rand level. I do believe that the 14 Rand level will be extraordinarily supportive though, so in the short term I think that’s probably what would essentially be the “floor” in the market.