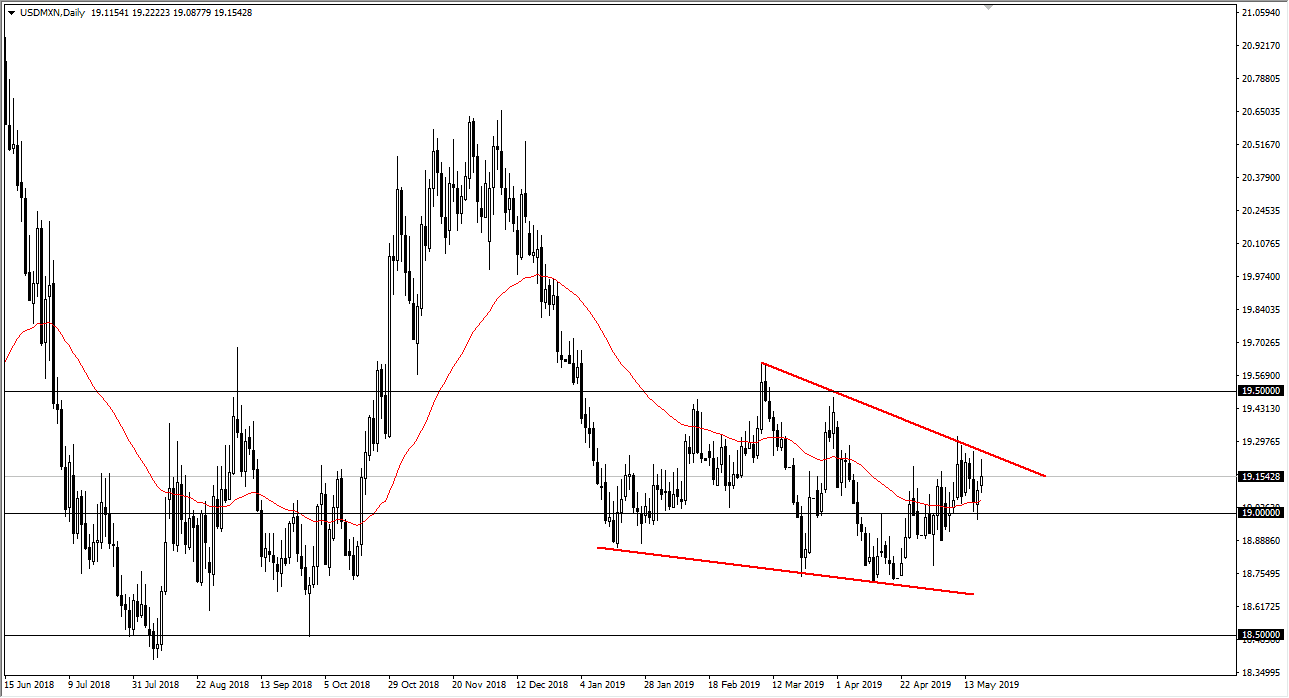

The US dollar has initially tried to rally during the session on Friday, but as you can see has rolled over to form a bit of a shooting star. Looking at the chart, it’s very easy to see that there is a massive downtrend line just above that has held quite nicely, so I think that there is the possibility that we could see this market drift a bit lower. That would make sense, but only in a couple of circumstances.

The initial circumstance of course would be that there’s more of a “risk on” attitude in the financial markets overall. This of course sells off the US dollar as treasuries fall, and people are looking for more of a stronger return, as you can get in emerging markets. If you are going to play Latin America, you have two major choices: Mexico and Brazil. This makes the Mexican peso very crucial for when it comes to that marketplace.

The other circumstance would be crude oil. If crude oil starts to explode to the upside, that would be very bullish for the Mexican peso as Mexico produces so much crude oil. Beyond that, if the crude oil markets rally, it’s quite likely that the US dollar will fall in the same type of situation.

Looking at this chart, we are forming a bit of a shooting star so it looks very likely that we are going to go down to the 19 pesos level. Breaking down below that level could send this market down to the 18.75 pesos level. However, if things turn around and if we break above the downtrend line, then we could go to the 19.50 pesos level. Expect a lot of volatility, but right now it looks as if it favors the downside.