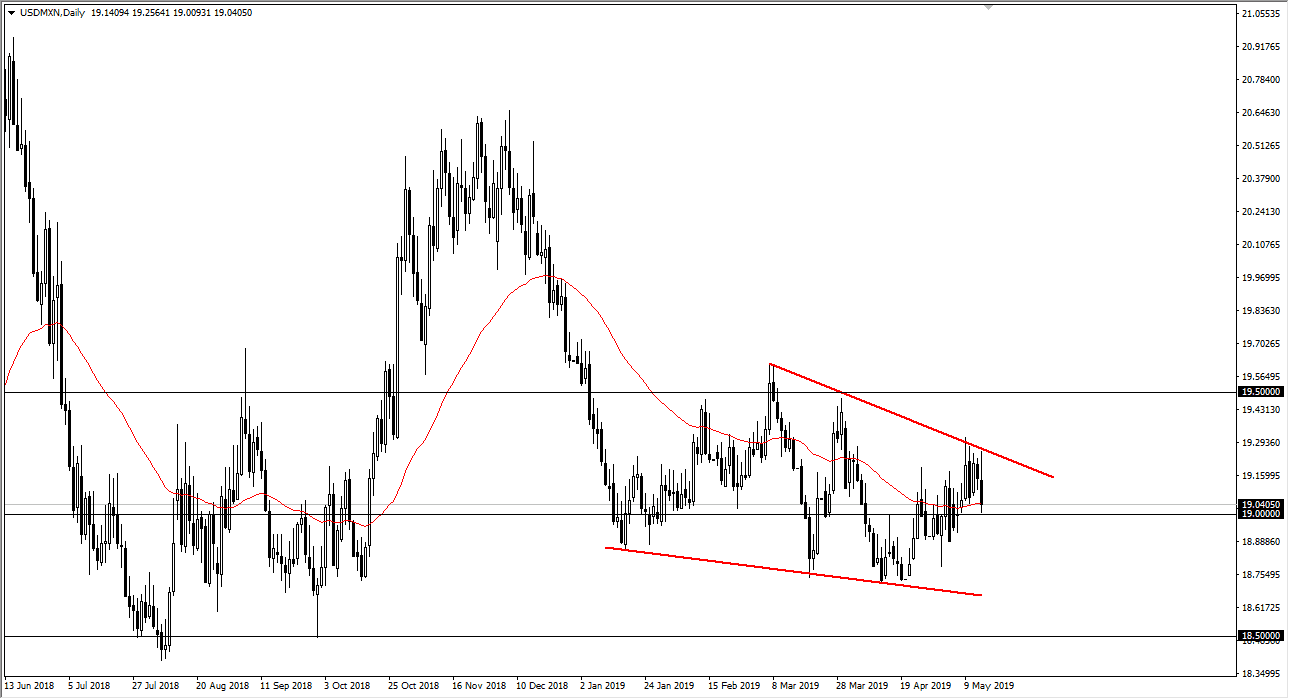

The US dollar initially tried to rally against the Mexican peso but then slammed into a major downtrend line yet again, and yet again we have seen that downtrend line hold. By doing so, the market fell rather significantly, perhaps reaching towards the 15 pesos handle. That is where the 50 day EMA also sits, and therefore it’s not a huge surprise that a lot of interest is being paid to this market.

The 15 pesos level is a large, round, psychologically significant figure, and therefore it would naturally attract a lot of attention. If we break down below the 15 pesos level, then the market probably goes down towards the 18.75 pesos level.

The US dollar has been trying to find its way higher, but at this point it’s obvious that we can’t continue to go higher. This is a market that has been following risk appetite, as the US dollar will rally rather significantly in times of fear, while the Mexican peso will pick up in times of “risk on” trading. With the US stock markets rallying quite nicely during the trading session on Wednesday, it makes sense that money flew towards Latin America where it can pick up a bit of a turbocharge.

The alternate scenario would be a break above the recent highs, where we have been seen the lot of selling pressure near the 19.30 level. A break above that level offers the opportunity for the market to go to the 19.50 pesos level, and then possibly even higher than that. It’s simple, if there is more of a “risk off” scenario, this market will break out to the upside. On the other hand, if we break down here, that will more than likely signify stock markets and other risk appetite markets rallying.