The US dollar shot higher during the trading session against the Mexican peso as there was a huge “risk off” scenario going on. The US/China trade talks didn’t look particularly bullish at the point, and therefore it’s likely that the US dollar got bought due to a bit of safety concerns. US bonds rallied a bit, and that of course demand US dollars as well. Beyond that though, people will run from exotic currencies and markets when they are not sure about global growth. Obviously, Mexico is a place that you run from when you’re looking for safety.

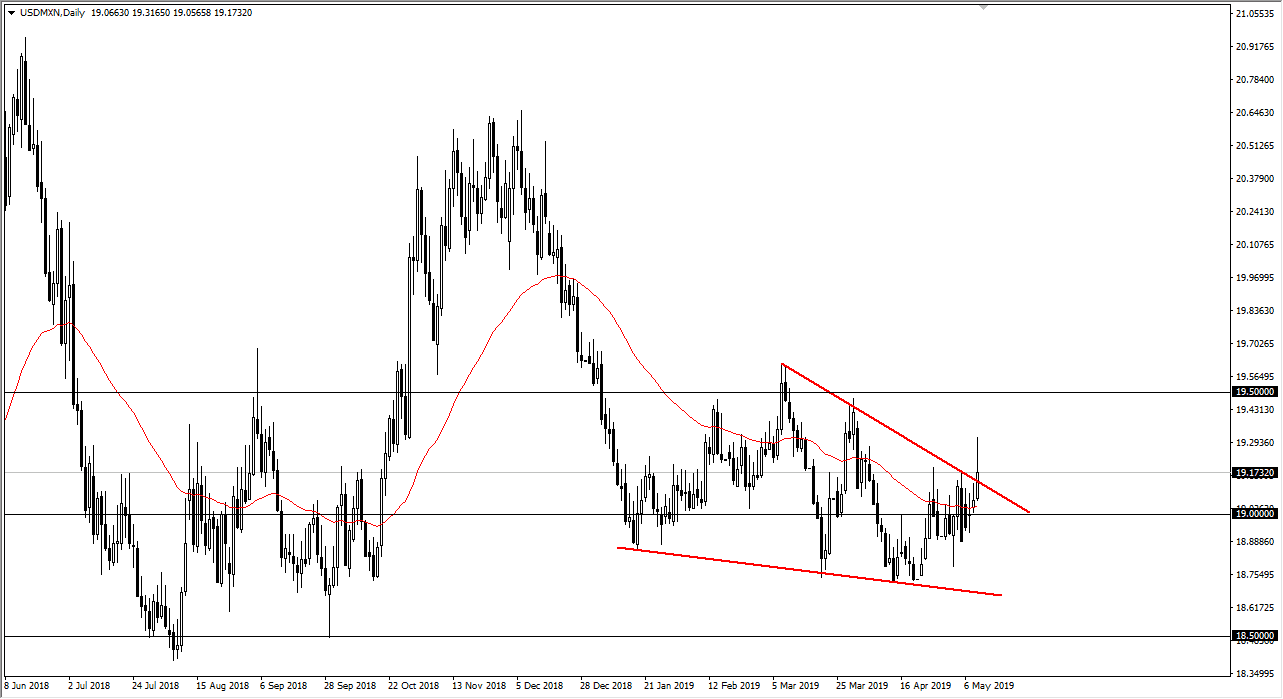

We have also broken through a downtrend line, so you should pay attention to that as well. If we break to the upside, it’s likely that we will go looking towards the 19.50 level given enough time, but we have had a bit of a pushback after Trump tweeted that President Xi had a great alternate plan. That being said, it’s difficult to know exactly what that means. In the short term, if we break above the top of the candle stick for the day on Thursday, then 19.50 would make a lot of sense.

However, if we break down below the 19.00 level, then the market would probably go back towards the lows. That being said, the market did a lot of structural damage to the bearish case during the day on Thursday, and it’s very likely that if the Americans and the Chinese don’t really get things together, it would make a lot of sense that the Mexican peso would get hammered as people worry about supply chains and start buying more US treasuries going forward. That being said, we are also close to major lows, so I am slightly bullish at this point but I recognize Friday can change everything.