The future bullishness of the USD/JPY depends on the pair to hold above 110.00 resistance. Any move below it will support the bearish correction that pushed the pair to test 109.90 support at the time of writing the analysis, as Japan's stronger yen rallied amid Trump's threats to raise tariffs on China on Friday, confounding financial markets that had expected to resolve their trade dispute soon as trade negotiations between the two sides continued. These developments have contributed to investors' safe haven behavior led by the Japanese Yen and the abandonment of risk appetite.

The US economy managed to add new jobs more than expected, the unemployment rate fell to its lowest level in 49 years and the average wage per hour rose.

The Federal Reserve Board kept the interest rate unchanged as expected, pointing out that it is unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while, at the same time, inflation is still unusually low. The Bank's policy statement highlighted its continued failure to raise the annual inflation rate to at least 2%. The Fed's preferred inflation index is about 1.5 percent on a year-on-year basis. Referring to a drop in inflation, the statement may have raised expectations that a change in the next federal interest rate is a rate cut to stimulate inflation or growth.

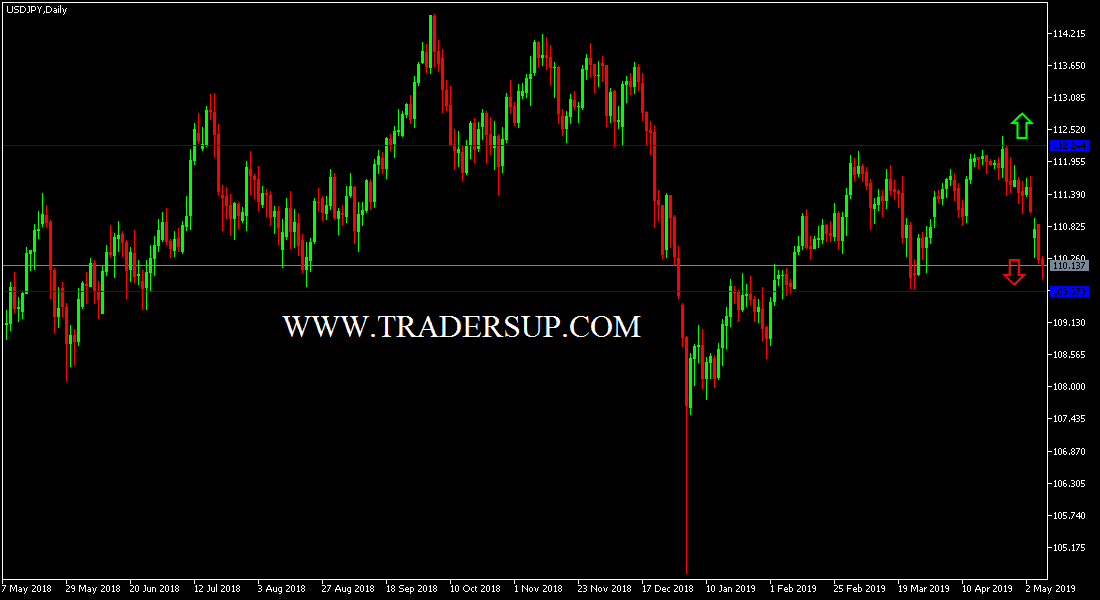

We noted in the previous technical analysis that the daily chart clearly shows a new bullish consolidation zone for the pair and that this performance foreshadows the pair's upcoming move towards further gains or bearish correction with the profit-taking operations. Positive US retail sales and a drop in weekly jobless claims to a 50-year low supported the pair's bullishness.

Technically: As we had previously predicted that the USD/JPY stability above the psychological resistance at 110.00 will increase the bullish momentum. The nearest resistance levels for the pair are currently 111.20, 112.00 and 113.40, respectively. On the downside, the nearest support levels are 110.00, 109.80 and 108.75 respectively. We still prefer to buy the pair from every bearish bounce.

In today's economic data, the economic calendar does not see any significant Japanese or US data. The pair will be watched with caution and interest in renewed global geopolitical concerns. And all about Trump's internal and external policy.