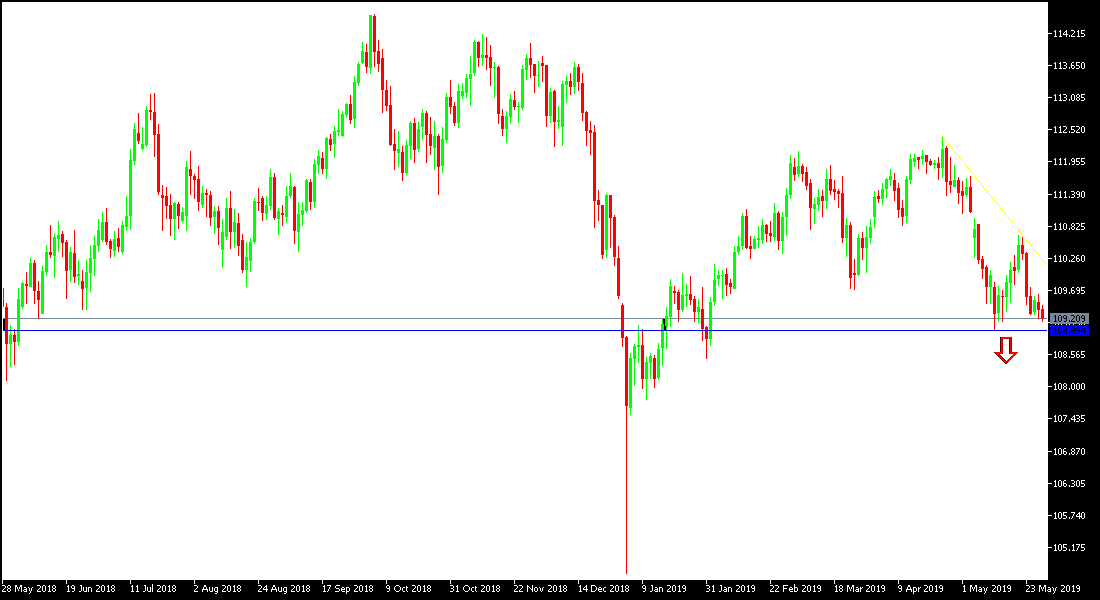

Although US consumer confidence is stronger than expected, buoyed by the US economy, but the USD/JPY is completing the downward move to the support level at 109.14 at the time of writing, and on the daily chart below, breaking through 109.00 level will increase the selling pressure, and the pair will test stronger bearish levels. Overall gains remain stronger for the Japanese Yen as one of the safest safe havens for investors, as the fierce US-China trade war has been brewing recently. The pair has abandoned the resistance level of 110.00, and establishing below it supports the bearish correction while at the same time shows new buying levels, the pair in the long run is still maintaining the bullishness. There are factors that support the US Dollar gains, and the Japanese Yen's recent gains are likely to evaporate at any time with any positive development of the current US-China trade war.

Despite the contents of the latest US Federal Reserve meeting minutes, some members of the bank's policy to raise interest rates, which is positive to the dollar, but the pair declined as the Japanese yen's strong gains returned as a safe haven amid growing investor fears of a widening US trade wars - especially with China after the US sanctions on the Chinese giant Huawei.

The US economy managed to add new jobs more than expected, the unemployment rate fell to its lowest level in 49 years and the average hourly wage rose.

The Federal Reserve Board kept the interest rate unchanged as expected, pointing out that it is unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while at the same time inflation is still unusually low.

We noted in the previous technical analysis that the daily chart clearly shows a new bullish consolidation zone for the pair and that this performance foreshadows the pair's upcoming move towards further gains or bearish correction with the profit-taking operations.

Technically: As we had previously predicted that the stability of the USD / JPY below 110.00 will increase the bearish momentum of the pair and the next support levels may be 109.10, 108.60 and 107.80 respectively, which confirm the strength of the bearish trend. On the upside, the nearest resistance levels are currently at 110.10, 111.00 and 111.75, respectively. We still prefer to buy the pair from every bearish bounce.

On the economic data today: The economic agenda today has no important and influential data from Japan or the US. The pair will watch with caution and interest any renewed global geopolitical concerns and all about Trump's internal and external policies.