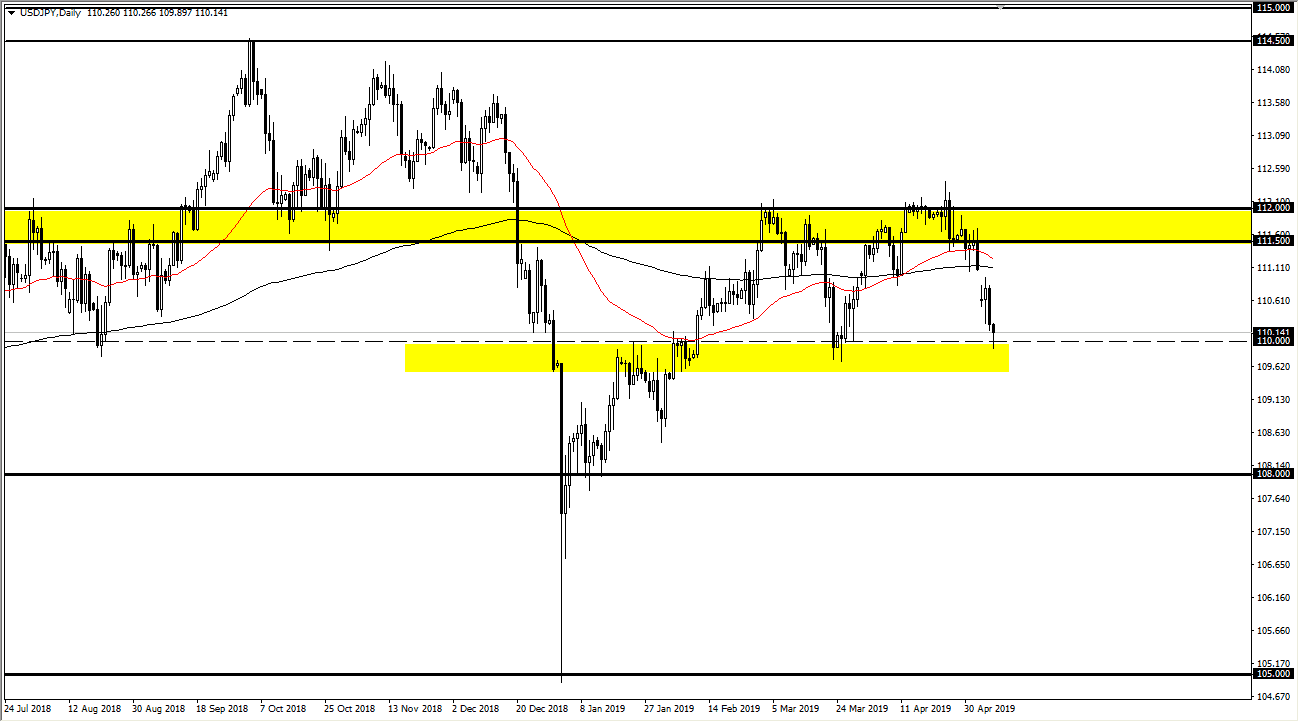

USD/JPY

The US dollar fell a bit during the trading session on Wednesday but found enough support near the ¥110 level II turn things around and form a bit of a hammer. This of course is a very bullish sign and signifies that the area is indeed trying to hold on. The market more than likely will continue to see buyers attracted to it, as it has been rather reliable. A break above the highs of the session should send this market higher to perhaps fill the gap that kicked off the weekend. Remember that this pair does tend to move with the overall attitude of risk appetite in general, so with the S&P 500 showing signs of a bit of recovery, it very well could be assigned that we are ready to go higher from here as well.

The alternate scenario of course is that if we break down below the ¥109.50 level, we could drop towards the ¥108 level. That of course would signify negativity and the overall markets, so keep that in mind.

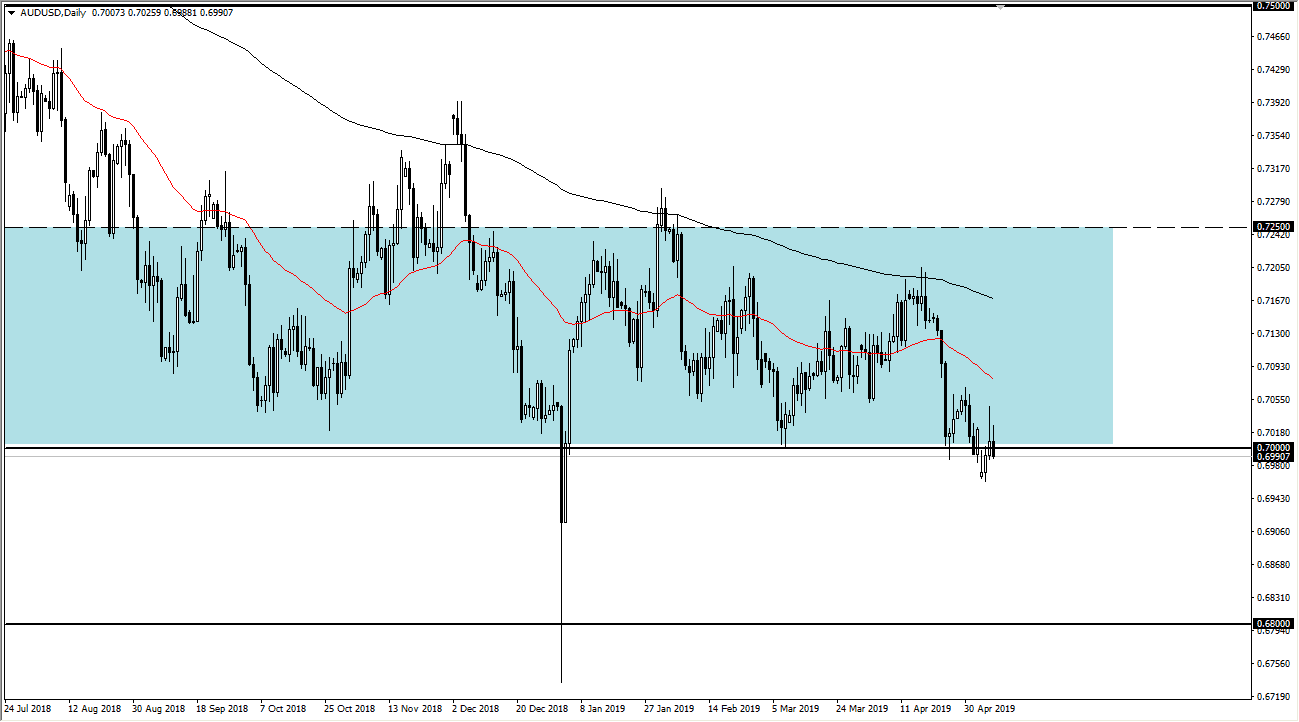

AUD/USD

The Australian dollar continues to struggle for clarity at the 0.70 level, so keep in mind that the level will attract a lot of attention. At this point it’s likely that we are going to see a lot of choppiness as the Australian dollar is so highly levered to the Chinese economy. With the US and China discussing their trade relations over the next several days, it’s very likely that we are going to continue to see a lot of volatility. Simply put, if the Americans and the Chinese can come together in some type of positive turn of events, it’s very likely that we could see a lot of volatility come back into the market to the upside. There is so much support below that extends all the way down to the 0.68 level that I have no interest in shorting.