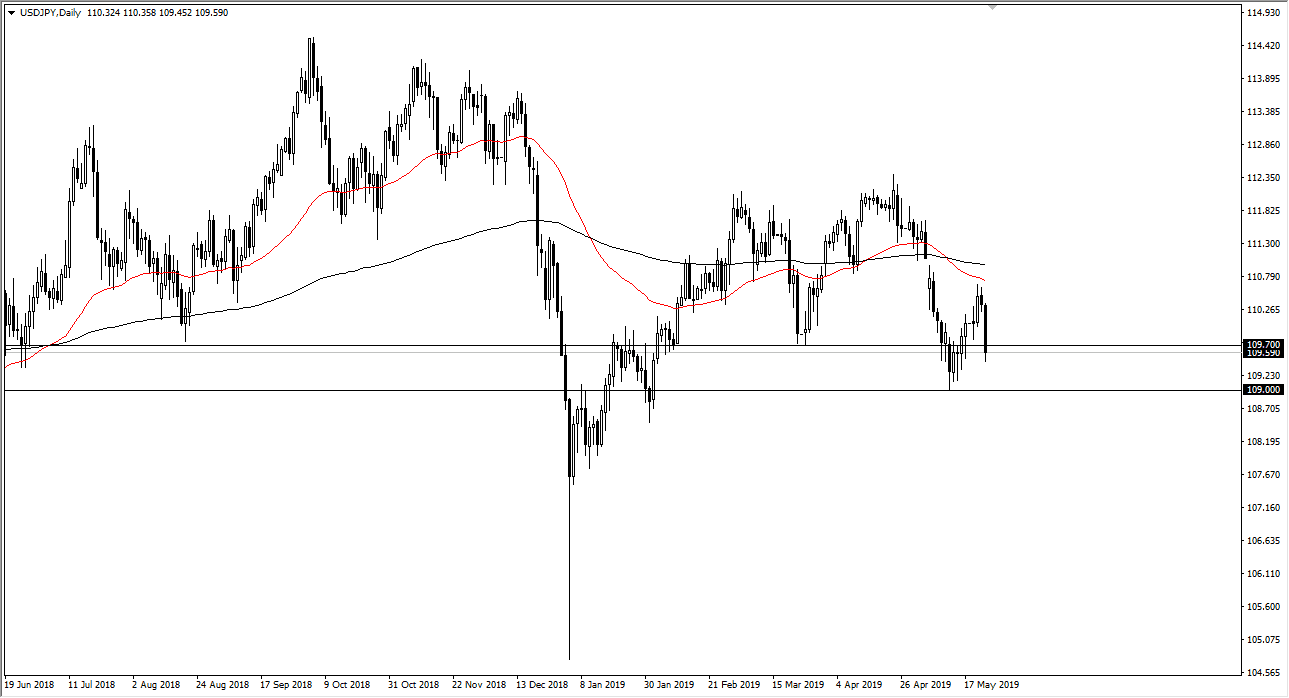

USD/JPY

The US dollar fell rather hard against the Japanese yen during the trading session on Thursday, as there was a major “risk off” move around the world. This of course favors the Japanese yen in general, so it makes sense that this market fell from here. The ¥109.70 level of course is the beginning of significant support that extends down to the ¥109 level. I believe that there are plenty of buyers in this region to continue to turn things around and cause a bit of a bounce, but obviously we need more of a “risk on” feel to markets around the world. One of the best ways to measure this is the S&P 500, so if that recovers, it’s possible that with this market we would see the same thing. The gap above could get filled at that point in time. If we break down below the ¥109 level, the market then could unwind down to the 108 yen level.

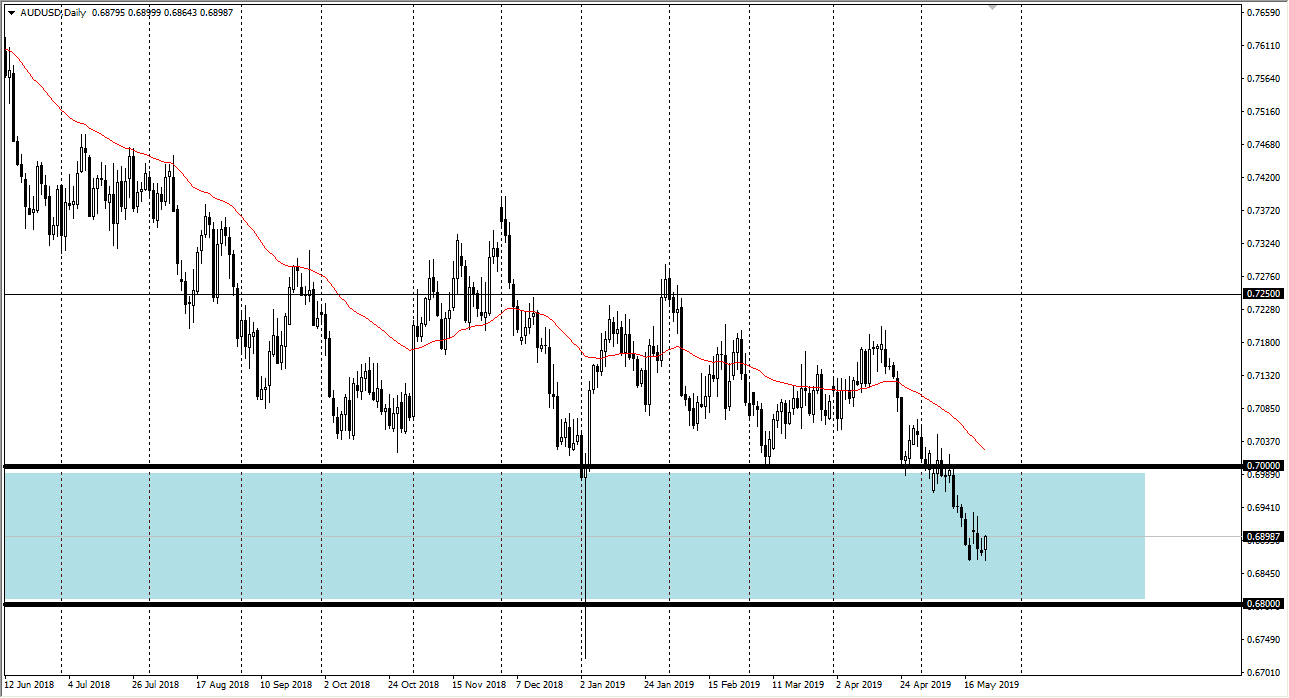

AUD/USD

The Australian dollar initially fell during the trading session but then turned around to show signs of support. By forming the hammer, it’s likely that we could see a bit of a bounce, but this is a market that’s very difficult to trade right now with everything that’s going on between the United States and China.

At this point in time, we are in the middle of the larger consolidation area, so looking at this chart it’s difficult to get excited one way or the other as long as we have all of that drama going on. Looking at the chart, we are also in the middle of a major consolidation area that offered significant support on longer-term charts. With that, I’m on the sidelines.