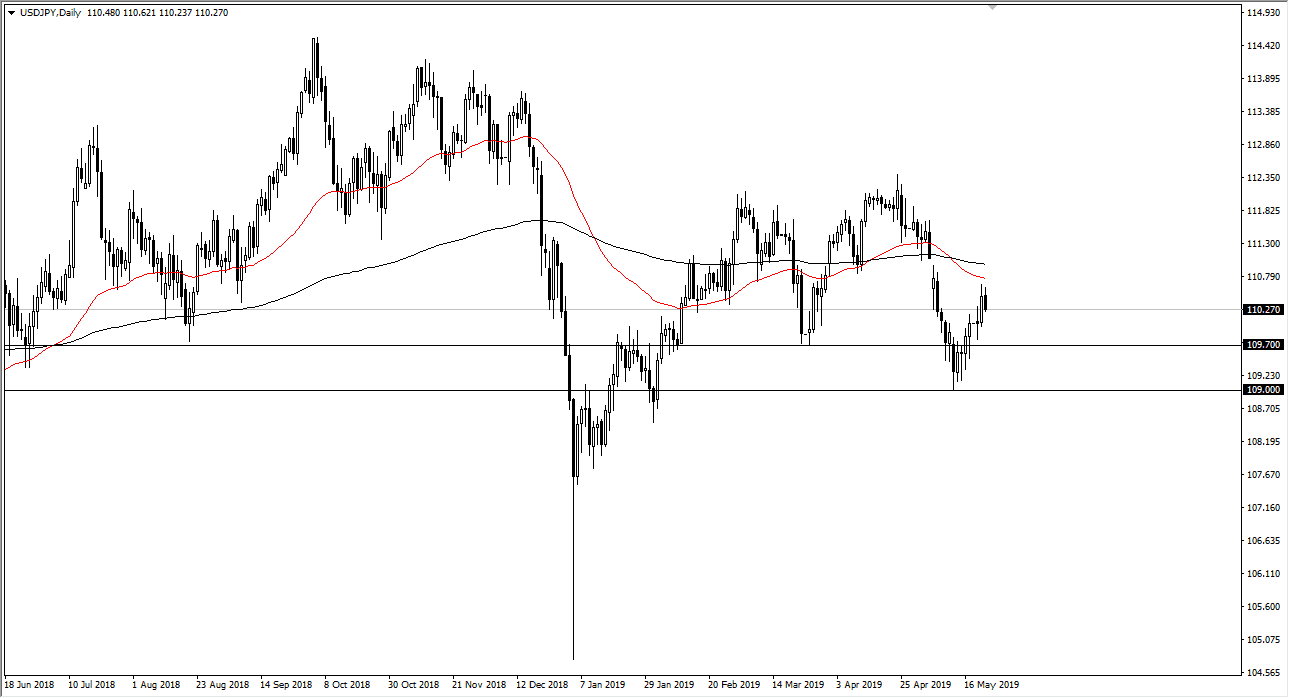

USD/JPY

The US dollar has pulled back a bit against the Japanese yen during trading on Wednesday, as the 50 day EMA has caused a bit of resistance. Beyond that, the stock markets pulled back slightly so it’s more of a “risk off” move. However, we still have a gap above that has yet to be filled, so I think that eventually the buyers will come back and try to make that happen.

I look at the ¥109.70 level as a potential support level that extends all the way down to the ¥109 level. If we were to break down below there then things could get rather ugly. It would more than likely coincide with some type of selloff in stock markets and risk appetite globally. All things being equal I would fully anticipate that some type of pullback should offer value the people are more than willing to take advantage of.

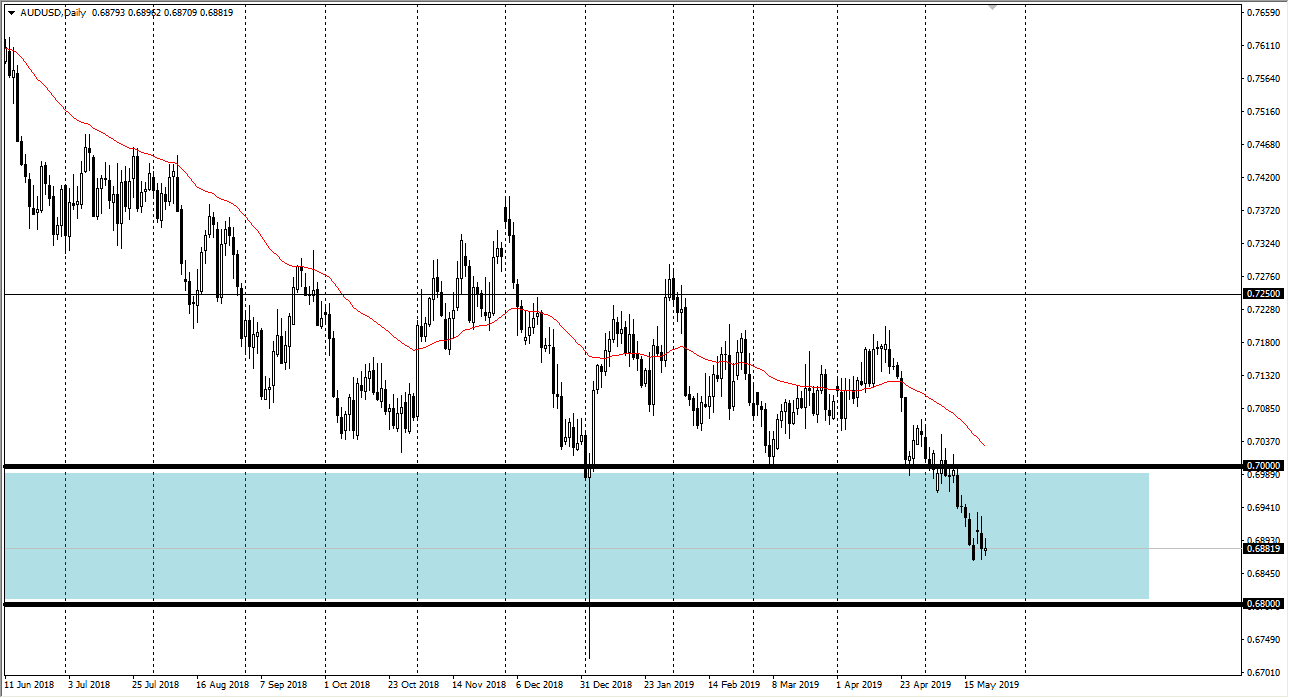

AUD/USD

The Australian dollar has rallied slightly during the trading session on Wednesday, but quite frankly we don’t have much in the way of decisive action to play off of. We are in the middle of a larger consolidation area that should continue to offer value and buying, but we have yet to see enough momentum to get overly concerned. The 0.68 level underneath is the bottom of this range, so if we were to break down below there it would be a very negative sign indeed. At that point, I would anticipate that the market probably goes down to the 0.65 level. In the short term, I think we are simply wandering around aimlessly as the US/China trade talks continue to be a major issue. The 0.70 level above would be your short-term ceiling.