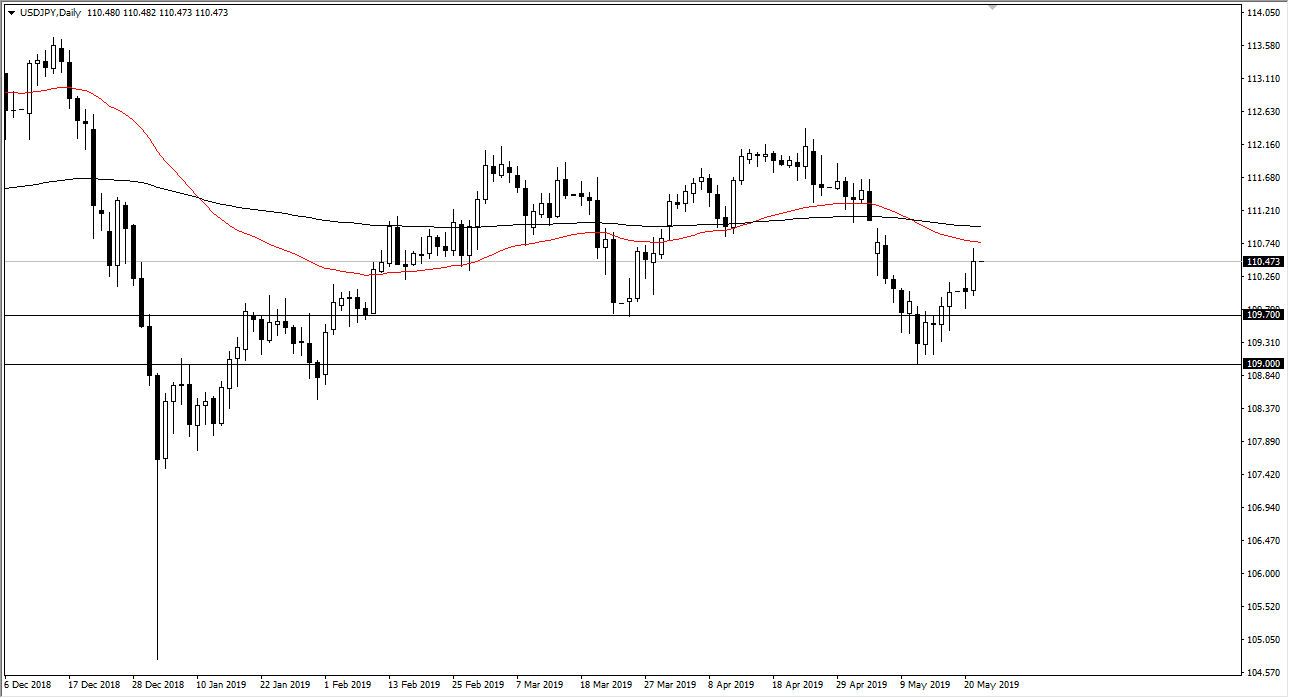

USD/JPY

The US dollar rallied against the Japanese yen during the trading session on Tuesday as we had seen some bullish action in the stock markets in America. With the United States softening its stance on Huawei, at least temporarily, it appears that the “risk on” out of the marketplace has shown itself to selling off of the Japanese yen. The market still has a gap that needs to be filled, so at this point I think it’s only a matter of time before that happens. The ¥111.15 level is an area that will attract a certain amount of selling now, as the 200 day EMA is there right along with the gap.

I believe that the ¥109.70 level underneath is significantly supportive as well, and at this point it’s likely that should be your “floor.” If we were to break down below the ¥109 level, then the market could unwind to the 100 a in level but it would also be a reaction to a very negative economic condition.

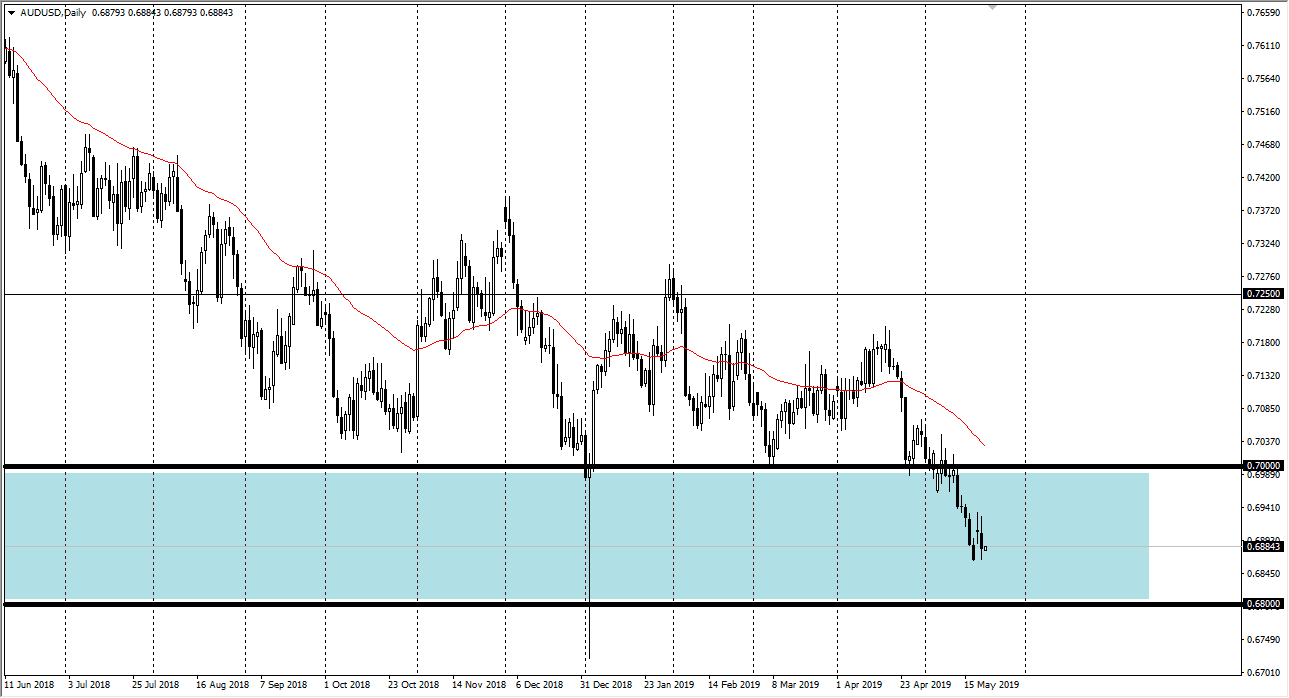

AUD/USD

The Australian dollar tried to rally during the day but then fell towards the bottom of the gap from the beginning of the week. We have recovered a bit, so this point it looks very likely that we could try to bounce from here. We are right in the middle of a major support level, so I think at this point it’s only a matter time before we do get some buyers but if we were to break down below the 0.68 handle, that would be a very negative turn of events, perhaps sending the Australian dollar to extraordinarily low levels. Remember, this pair is slightly sensitive to the US/China trade relations so of course that is another anchor around the neck.