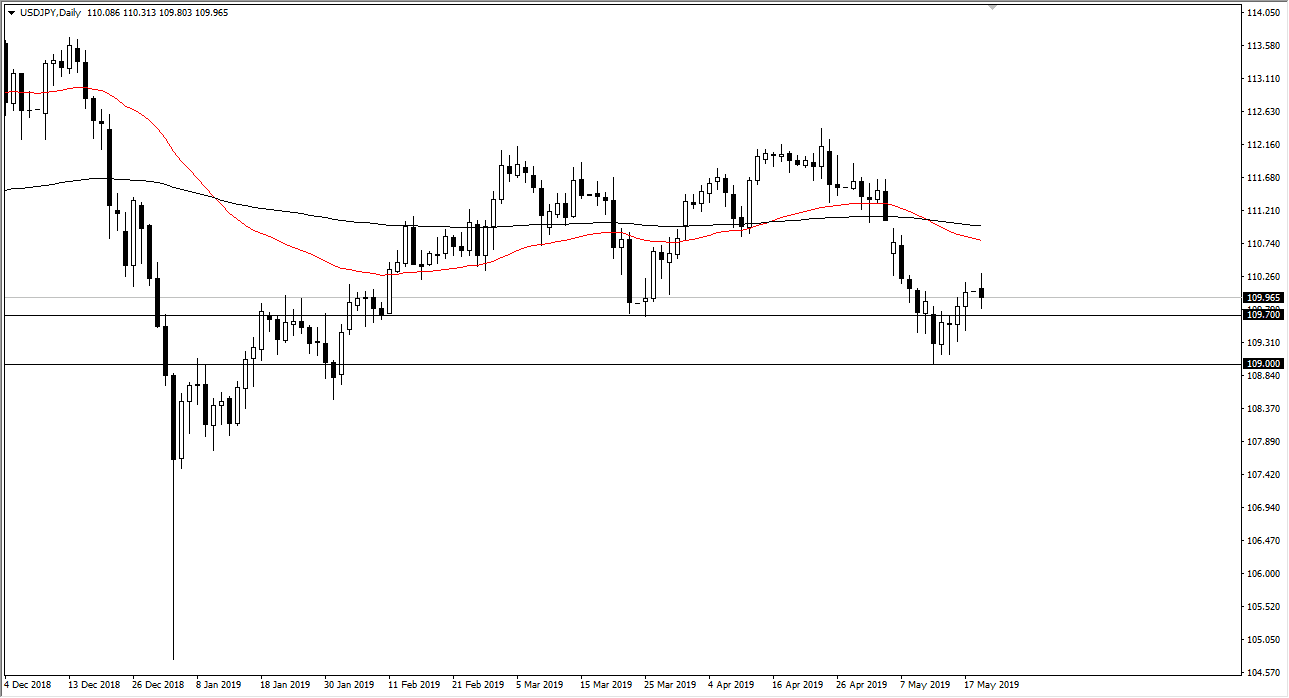

USD/JPY

The US dollar went back and forth during the trading session on Monday, showing indecision. but in the end I think that’s a pretty big victory for the pair, considering that the markets have been all over the place and at this point we continue to find a bit of supportive underneath does tell me that there are most certainly buyers waiting to get involved. I think there is a significant amount of support from the ¥109.70 level that extends down to the ¥109 level. At this point, I think that any drift lower will probably find plenty of buyers.

That being said, I think that we are going to go higher and try to look towards the ¥111 level. That is the scene of a gap above, so I think it makes quite a bit of sense that we will go find it as Forex markets typically do.

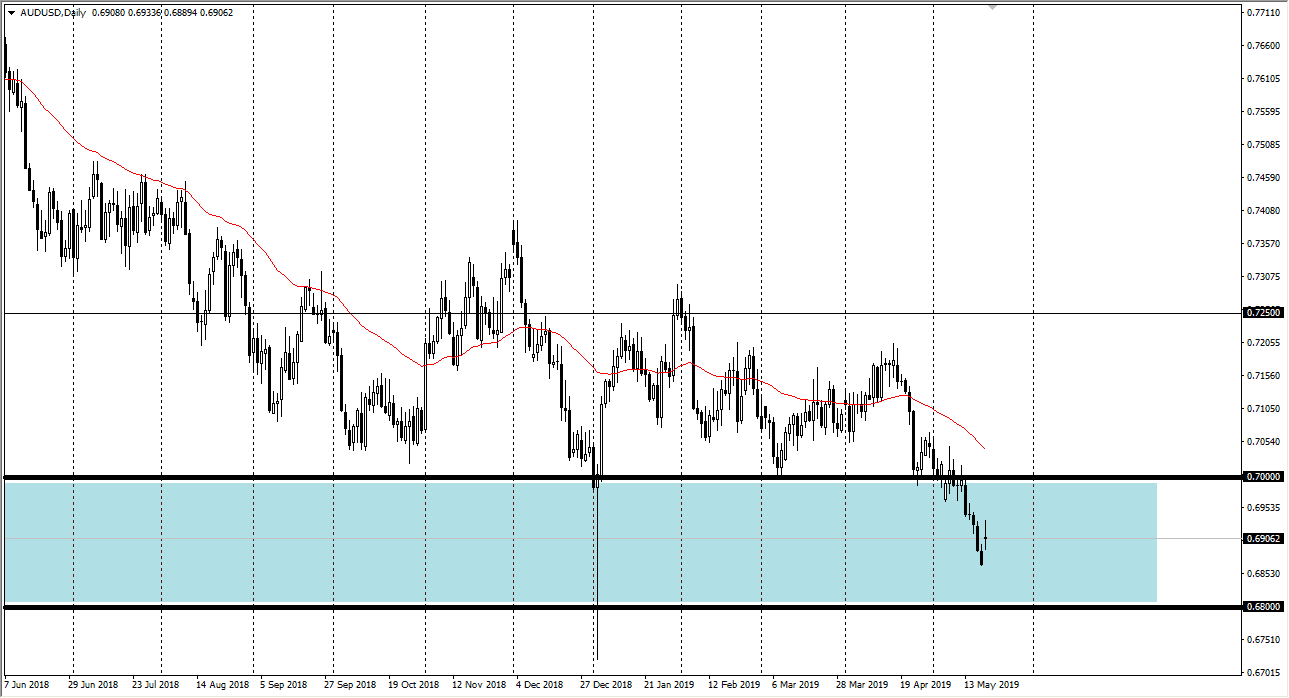

AUD/USD

The Australian dollar gapped higher to kick off the week, as we have seen the conservatives hang on to the prime minister spot, which had buyers coming in to pick up the Aussie dollar as the idea is there will be less spending. Ultimately though, what we really need to pay attention to is the US/China trade relations, which aren’t exactly humming right along. This might be why the initial burst of gains in the Australian dollar has been given up. That being said, we are in the middle of massive support that extends all the way down to the 0.68 handle, so I’m looking for supportive candles to start buying. If we can break above the 0.70 level, then we can continue to go much higher. The alternate scenario is that we break down below the 0.68 handle, which would be extraordinarily negative and could have the market looking towards the 0.65 handle.