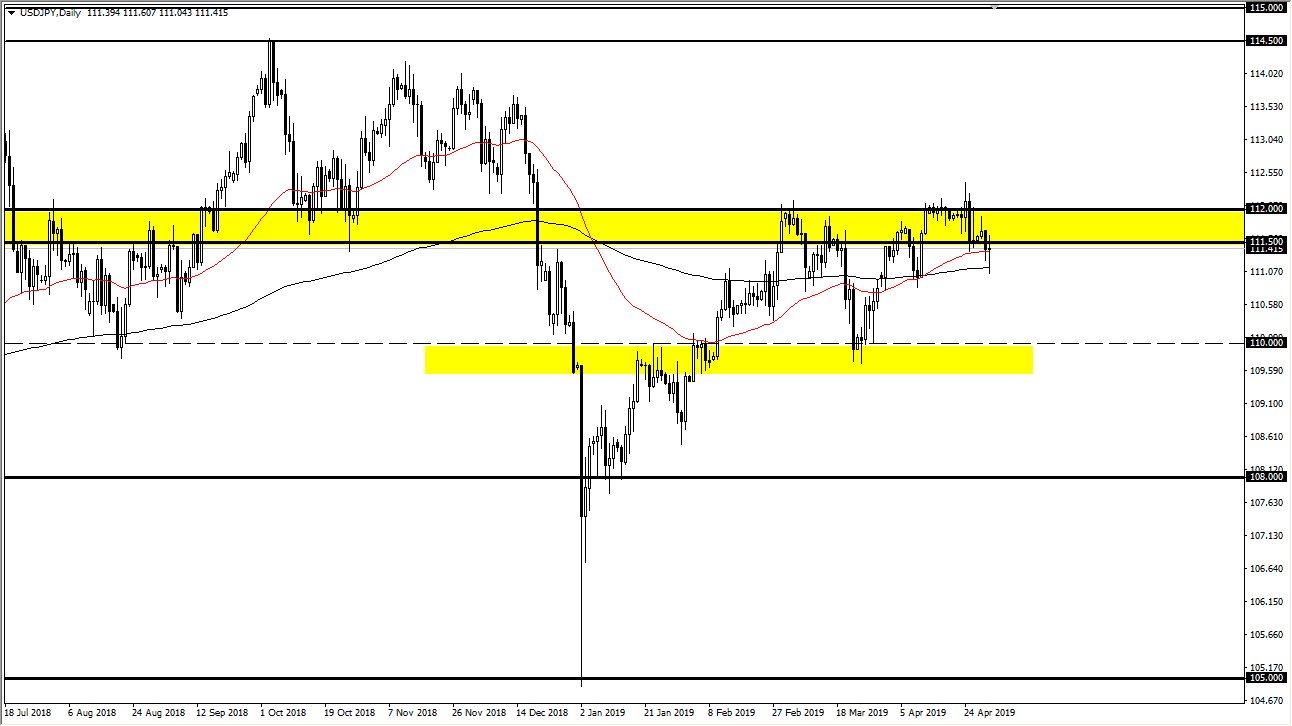

USD/JPY

The US dollar initially fell against the Japanese yen during the trading session but found enough support at the 200 day EMA to turn around and form a hammer. This of course was the end of the two day Federal Reserve meeting, so there was a lot of noise out there due to the press conference. Beyond that, the ISM Manufacturing PMI figure mist drastically, so having said that it’s very likely that there will continue to be volatility. However, if we can break to a fresh, new high, then the market probably goes to the ¥113.50 level. To the downside, if we were to break down below the ¥111 level, then it’s very likely that the ¥110 level will be targeted. All things being equal, it looks as if we may try to continue the uptrend.

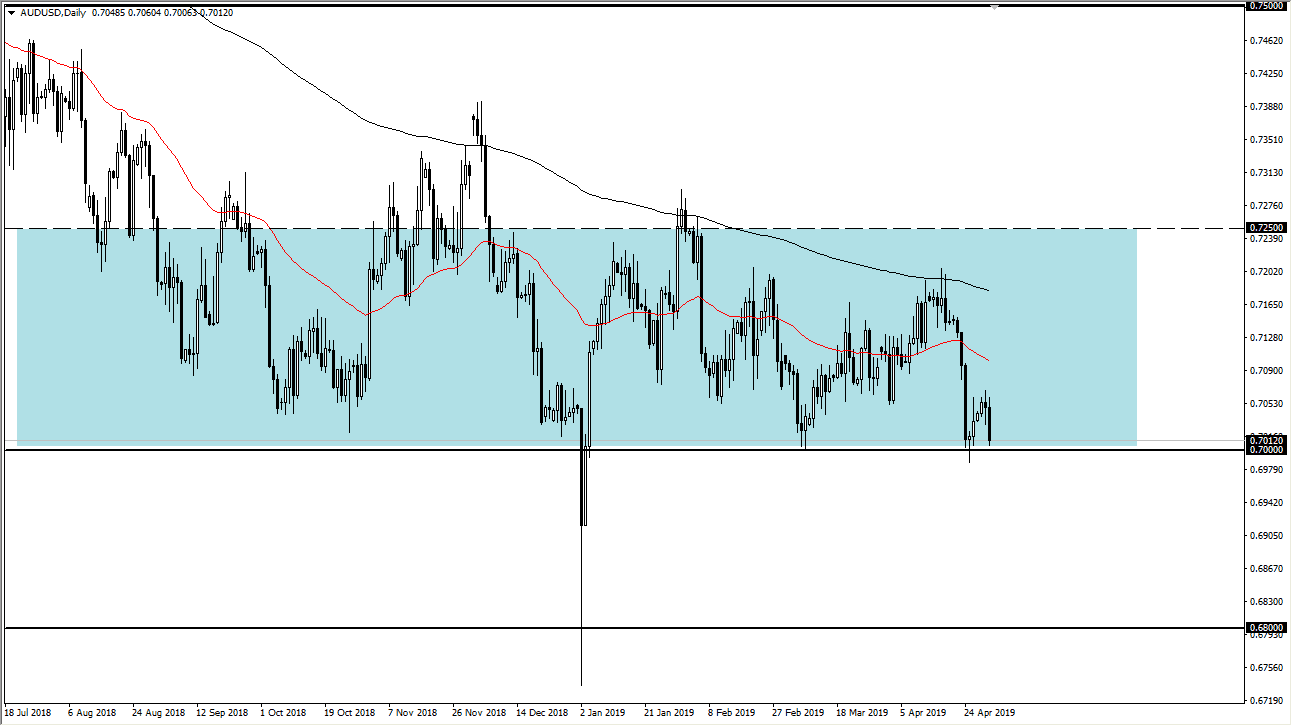

AUD/USD

The Australian dollar initially tried to rally but then slammed into the 0.70 level underneath. That’s an area that has been massive support for quite a while, so after the Federal Reserve gave his press conference, the US dollar strengthened and of course we had seen that in this pair. The 0.70 level is a massive support level that extends down to the 0.68 handle, even on the monthly chart. That being the case, it’s likely that we will continue to see value hunting in this area. With that in mind, if the US dollar strengthens then I will probably ignore this pair. However, if the US dollar rolls over a bit, then it’s likely that the Australian dollar would be a great place to start buying as we are at what I believe is the absolute bottom of the market in general.