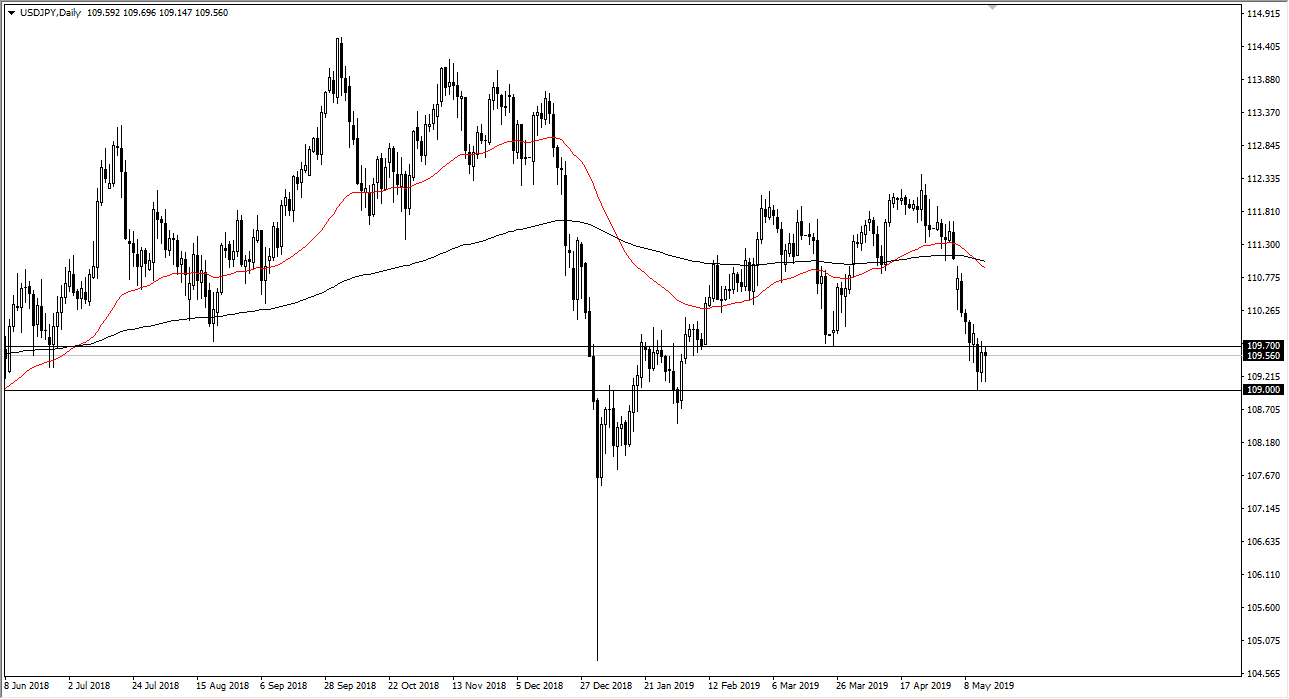

USD/JPY

The US dollar fell initially during the trading session on Wednesday but found enough support underneath to turn things around and form a bit of a hammer. That being the case, it’s very likely that the pair may try to break out above the ¥109.70 level. Once we break above there, the market will probably go looking to fill the gap at the ¥111 level. On the other hand, if we break down below the ¥109 level, then the market will probably unwind down to the ¥108 level.

This is a market that is very sensitive to risk appetite and does tend to move right along with the S&P 500. Ultimately, we will probably fill that gap but we need some type of outside influence to bring risk appetite on.

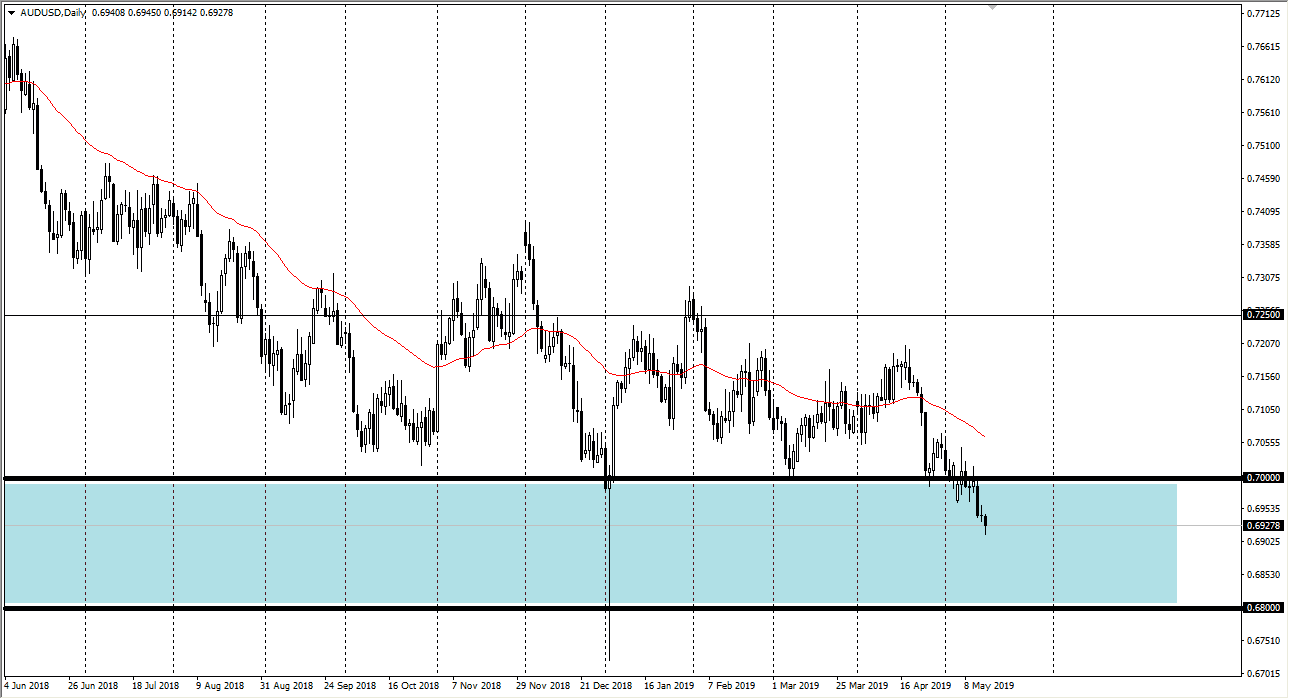

AUD/USD

The Australian dollar fell during the trading session on Wednesday, but the recovers slightly at the end of the session. Ultimately, I do believe that this is a market that is going to continue to see a bit of downward push as the US/China trade talks drag on. If that’s going to be the case, then the Australian dollar will struggle to attract a lot of flow, as Australia’s so highly levered to the Chinese construction and manufacturing economy. With that, I don’t necessarily want to buy this pair. However, selling is going to be all but impossible, because we are in the middle of a major support level that extends down two hundred pips.

It’s simple, if the US dollar starts to fall in more of a “risk on” move, especially if it has to do with the US/China trade relations, I will be putting my money in this pair. If the US dollar continues to strengthen, I have no interest in shorting this pair until we break below the 0.68 handle.