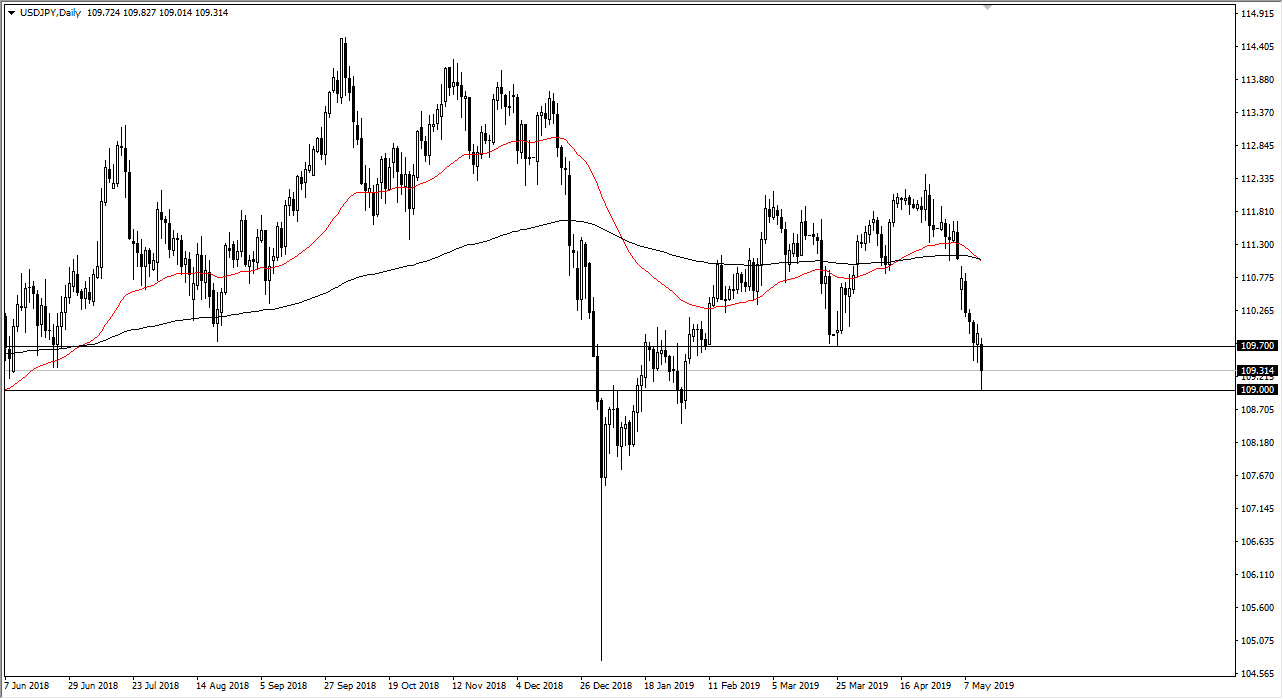

USD/JPY

The US dollar fell significantly during the trading session on Monday as traders freaked out about the Chinese extending the trade war. As a result, we drop down to the ¥109 level, an area that has a significant amount of importance to it being a large, round, psychologically significant figure. However, this candlestick still doesn’t inspire a lot of confidence, so to the upside we are probably somewhat limited. The question now is whether or not we break down below the ¥109 level. If we do, then we are probably going to go looking towards the ¥108 level.

That being said, if we can break above the ¥110 level, then the market is free to go higher and try to fill the gap above. That gap is near the ¥111 level, and therefore could get a bit of traction for the buyers if we can get good news. Remember, this pair tends to move right along with risk appetite and by extension the S&P 500

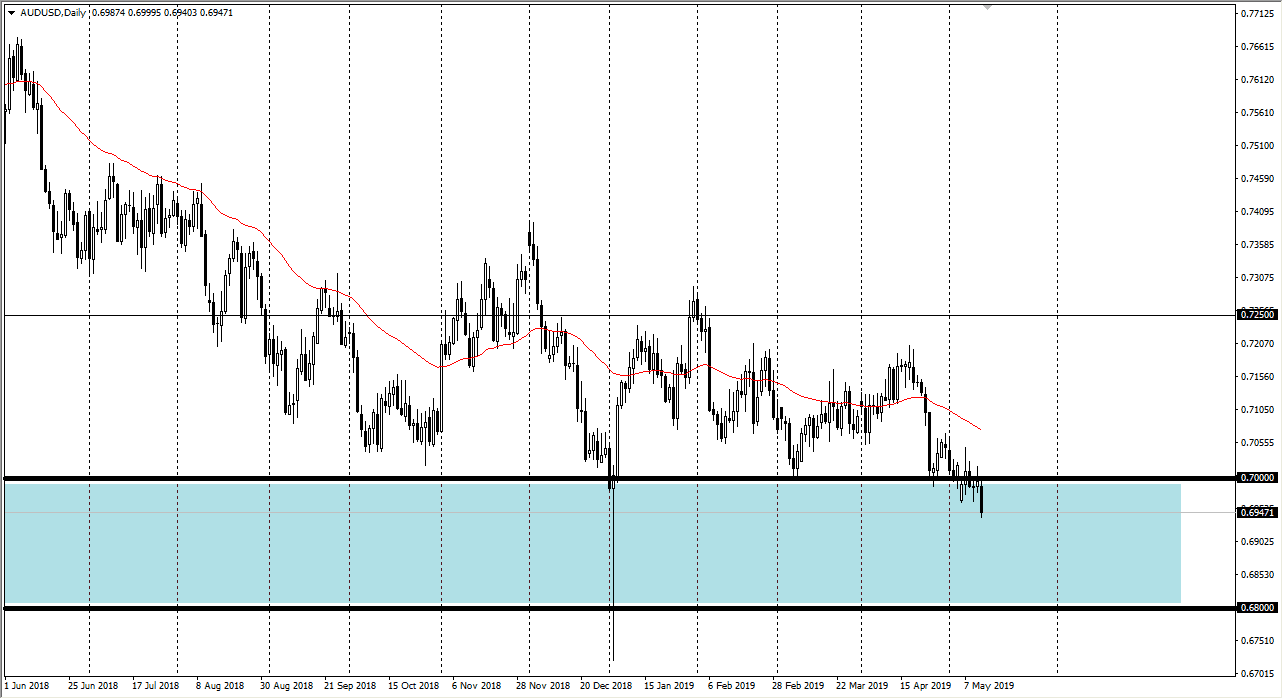

AUD/USD

The Australian dollar broke down a bit during the trading session which shouldn’t be much of a surprise considering that it is so highly levered to the Chinese economy. The fact that we reached towards the 0.6950 level is somewhat telling, but I’m still not willing to sell this pair as I think there are easier ways to buy the US dollar than trying to short the Aussie which is sitting on so much support in this 200 PIP zone. If this pair falls rapidly I’d be much more interested in trying to sell the US dollar against some exotic currencies than the Aussie. (See my USD/ZAR analysis, or perhaps look at other currencies like the Mexican peso, Norwegian krona, etc.) As far as buying is concerned, I’m not willing to do so either. This might be a pair that’s best left alone for the time being.